Region:Central and South America

Author(s):Shubham

Product Code:KRAB1066

Pages:100

Published On:October 2025

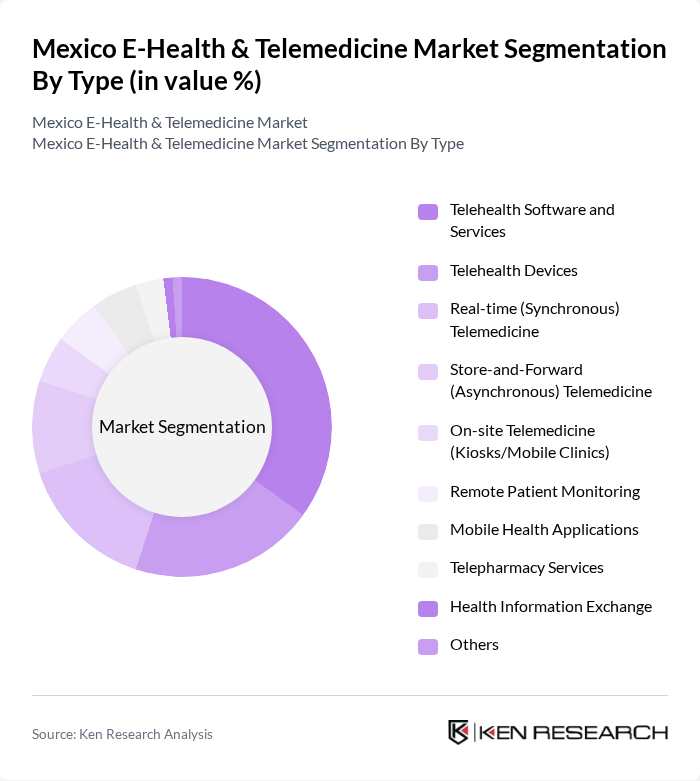

By Type:The market is segmented into various types, including Telehealth Software and Services, Telehealth Devices, Real-time (Synchronous) Telemedicine, Store-and-Forward (Asynchronous) Telemedicine, On-site Telemedicine (Kiosks/Mobile Clinics), Remote Patient Monitoring, Mobile Health Applications, Telepharmacy Services, Health Information Exchange, and Others. Among these,Telehealth Software and Servicesis the leading sub-segment, driven by the increasing demand for integrated healthcare solutions, user-friendly platforms for remote consultations, and the growing integration of telemedicine with electronic health records. The segment is further supported by rising investments in digital health infrastructure and a focus on secure, interoperable platforms .

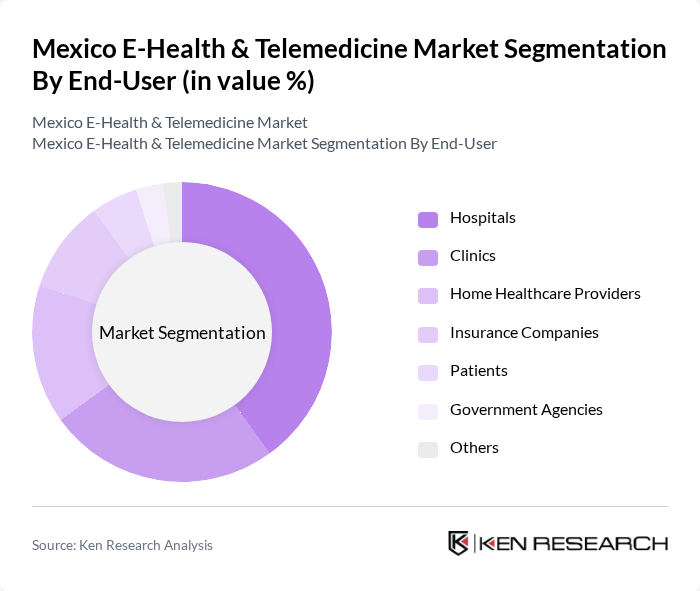

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare Providers, Insurance Companies, Patients, Government Agencies, and Others.Hospitalsare the dominant end-user segment, as they increasingly adopt telemedicine solutions to enhance patient care, streamline operations, and reduce costs associated with in-person visits. Hospitals are also leading in the implementation of remote monitoring and digital health records, while clinics and home healthcare providers are expanding their use of mobile health applications and teleconsultation platforms .

The Mexico E-Health & Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Doc.com, Salud Digna, Farmacias del Ahorro, Medikit, Sofía Salud, Clivi, Clinicas del Azúcar, Farmacias Similares, Teladoc Health, Keralty México, Grupo Ángeles Servicios de Salud, Medtronic México, Siemens Healthineers México, Philips Healthcare México, and 1DOC3 contribute to innovation, geographic expansion, and service delivery in this space. These companies are at the forefront of digital transformation, offering a range of telemedicine, remote monitoring, and health IT solutions tailored to the Mexican healthcare landscape .

The future of the Mexico E-Health and Telemedicine market appears promising, driven by technological advancements and changing consumer preferences. As the healthcare landscape evolves, the integration of artificial intelligence and wearable devices is expected to enhance patient care and monitoring. Furthermore, the increasing focus on preventive healthcare will likely lead to more proactive health management solutions. These trends indicate a shift towards more personalized and efficient healthcare delivery, positioning telemedicine as a vital component of Mexico's healthcare system.

| Segment | Sub-Segments |

|---|---|

| By Type | Telehealth Software and Services Telehealth Devices Real-time (Synchronous) Telemedicine Store-and-Forward (Asynchronous) Telemedicine On-site Telemedicine (Kiosks/Mobile Clinics) Remote Patient Monitoring Mobile Health Applications Telepharmacy Services Health Information Exchange Others |

| By End-User | Hospitals Clinics Home Healthcare Providers Insurance Companies Patients Government Agencies Others |

| By Application | General Consultation Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Services Others |

| By Distribution Channel | Direct-to-Consumer B2B Partnerships Online Platforms Mobile Applications Others |

| By Technology | Video Conferencing Tools Mobile Health Platforms Cloud-Based Solutions AI-Powered Diagnostics Wearable Devices Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers Using Telemedicine | 120 | Doctors, Clinic Administrators |

| Patients Engaging with E-Health Services | 120 | Patients, Caregivers |

| Technology Vendors in Telehealth | 80 | Product Managers, Sales Executives |

| Regulatory Bodies and Health Authorities | 40 | Policy Makers, Health Officials |

| Insurance Providers Offering Telemedicine Coverage | 70 | Underwriters, Claims Managers |

The Mexico E-Health & Telemedicine Market is valued at approximately USD 2.1 billion, reflecting significant growth driven by the adoption of digital health solutions and the need for improved access to medical services, particularly in rural areas.