Region:Central and South America

Author(s):Shubham

Product Code:KRAB2387

Pages:97

Published On:October 2025

By Type:The market can be segmented into various types, includingTeleconsultation Services, Remote Patient Monitoring, Mobile Health Applications, Teletherapy Services, Health Information Systems (including Electronic Health Records), Wearable Health Technology, Digital Diagnostic Platforms, and Others. Each of these subsegments plays a crucial role in enhancing healthcare delivery and patient engagement. Teleconsultation and remote patient monitoring are the most widely adopted, driven by the need for chronic disease management and real-time patient data collection. Mobile health applications and wearable technologies are rapidly gaining traction, particularly among younger, tech-savvy populations seeking proactive health management .

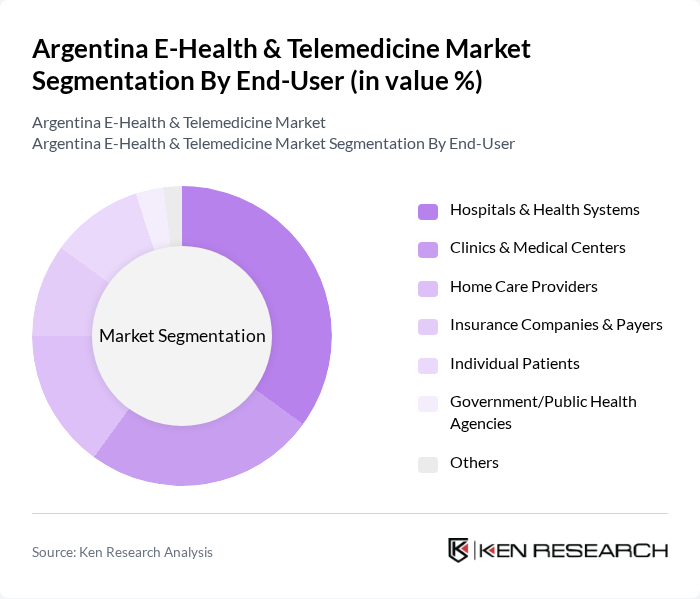

By End-User:The end-user segmentation includesHospitals & Health Systems, Clinics & Medical Centers, Home Care Providers, Insurance Companies & Payers, Individual Patients, Government/Public Health Agencies, and Others. Each segment reflects the diverse applications of e-health and telemedicine across different healthcare settings. Hospitals and clinics are the primary adopters, leveraging telemedicine to expand specialist access and optimize resource allocation. Home care providers and individual patients are increasingly utilizing digital platforms for chronic disease management and remote consultations, while insurance companies integrate telehealth into coverage models to improve service efficiency .

The Argentina E-Health & Telemedicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Sancor Salud, OSDE, Swiss Medical Group, Medicus, Hospital Italiano de Buenos Aires, Telemedicina Argentina, Cuidar Salud, Doctor Online, Salud Virtual, DarioHealth, Axxon Health, Medtronic Argentina, Philips Healthcare Argentina, Siemens Healthineers Argentina, IBM Watson Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Argentina e-health and telemedicine market appears promising, driven by technological advancements and increasing consumer acceptance. The integration of artificial intelligence and machine learning in healthcare is expected to enhance diagnostic accuracy and patient engagement. Additionally, the rise of mobile health applications will further facilitate remote monitoring and consultations, making healthcare more accessible. As the government continues to invest in telehealth infrastructure, the market is poised for significant growth, addressing both urban and rural healthcare needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Teleconsultation Services Remote Patient Monitoring Mobile Health Applications Teletherapy Services Health Information Systems (including Electronic Health Records) Wearable Health Technology Digital Diagnostic Platforms Others |

| By End-User | Hospitals & Health Systems Clinics & Medical Centers Home Care Providers Insurance Companies & Payers Individual Patients Government/Public Health Agencies Others |

| By Application | Chronic Disease Management Mental Health & Telepsychiatry Preventive Healthcare & Wellness Emergency & Acute Care Rehabilitation & Post-Acute Care Pediatrics & Maternal Health Others |

| By Distribution Channel | Direct Sales (B2B) Online Platforms & Marketplaces Partnerships with Healthcare Providers Telehealth Networks & Aggregators Pharmacies & Retail Health Others |

| By Technology | Video Conferencing Tools Mobile Applications Cloud-Based Solutions AI-Powered Platforms IoT & Connected Devices Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Bundled Services Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Providers | 100 | CEOs, Operations Managers |

| Healthcare Professionals Using E-Health | 150 | Doctors, Nurses, Telehealth Coordinators |

| Patients Utilizing Telemedicine | 150 | Patients, Caregivers |

| Health Insurance Companies | 80 | Policy Analysts, Product Managers |

| Technology Providers in E-Health | 70 | Product Developers, IT Managers |

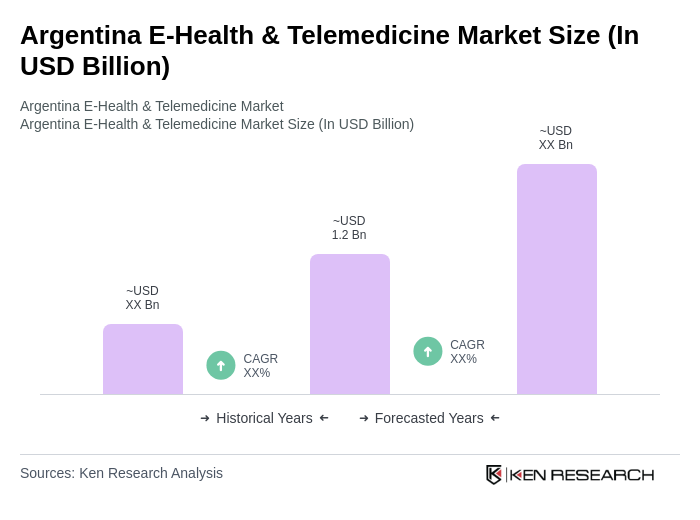

The Argentina E-Health & Telemedicine Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital health solutions and the increasing prevalence of chronic diseases, particularly accelerated by the COVID-19 pandemic.