Region:Central and South America

Author(s):Dev

Product Code:KRAB6487

Pages:85

Published On:October 2025

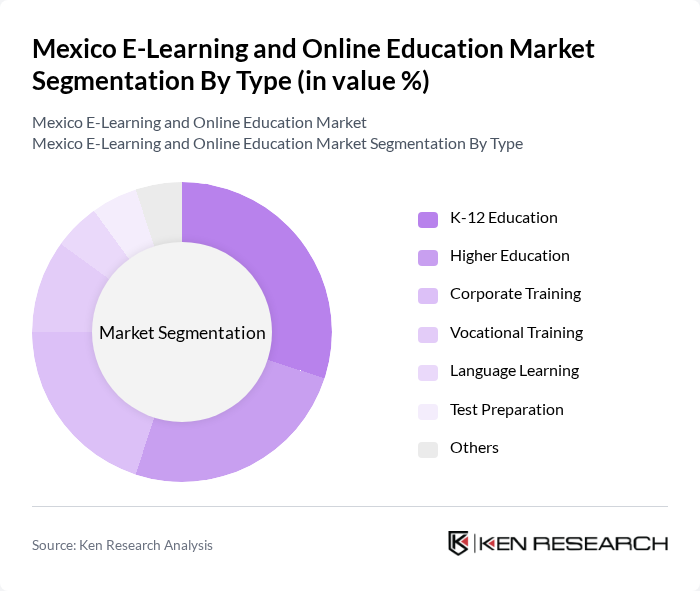

By Type:The market is segmented into various types, including K-12 Education, Higher Education, Corporate Training, Vocational Training, Language Learning, Test Preparation, and Others. Among these, K-12 Education and Higher Education are the most prominent segments, driven by the increasing number of students seeking online learning options and the growing acceptance of digital credentials by educational institutions. The demand for Corporate Training is also rising as companies invest in upskilling their workforce through online platforms.

By End-User:The end-user segmentation includes Students, Educational Institutions, Corporates, and Government Agencies. Students represent the largest segment, as the increasing number of learners seeking flexible and accessible education options drives the demand for e-learning solutions. Educational Institutions are also significant users, adopting online platforms to enhance their curriculum and reach a broader audience. Corporates are increasingly investing in online training programs to upskill employees, while Government Agencies are focusing on digital education initiatives to improve access to learning resources.

The Mexico E-Learning and Online Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera, Udemy, edX, Khan Academy, Platzi, Skillshare, Duolingo, LinkedIn Learning, OpenClassrooms, Teachable, Blackboard, Moodle, Google Classroom, TalentLMS, FutureLearn contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-learning market in Mexico appears promising, driven by technological advancements and changing educational preferences. As institutions increasingly adopt hybrid learning models, the integration of artificial intelligence and personalized learning experiences will likely enhance student engagement and outcomes. Furthermore, the ongoing government support for digital education initiatives will facilitate broader access, particularly in underserved areas, fostering a more inclusive educational landscape that meets the diverse needs of learners across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | K-12 Education Higher Education Corporate Training Vocational Training Language Learning Test Preparation Others |

| By End-User | Students Educational Institutions Corporates Government Agencies |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning |

| By Content Type | Video Lectures Interactive Quizzes E-books and Reading Materials |

| By Subscription Model | Monthly Subscription Annual Subscription Pay-Per-Course |

| By Certification Type | Accredited Certifications Non-Accredited Certifications |

| By Geographic Reach | National Regional International |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Higher Education Institutions | 100 | University Administrators, IT Directors |

| K-12 Schools | 80 | School Principals, Curriculum Coordinators |

| Corporate Training Programs | 70 | HR Managers, Training Coordinators |

| Online Course Providers | 90 | Product Managers, Marketing Directors |

| Students and Learners | 120 | Undergraduate Students, Adult Learners |

The Mexico E-Learning and Online Education Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increased adoption of digital learning platforms and rising internet penetration, particularly accelerated by the COVID-19 pandemic.