Region:Europe

Author(s):Dev

Product Code:KRAA3542

Pages:94

Published On:September 2025

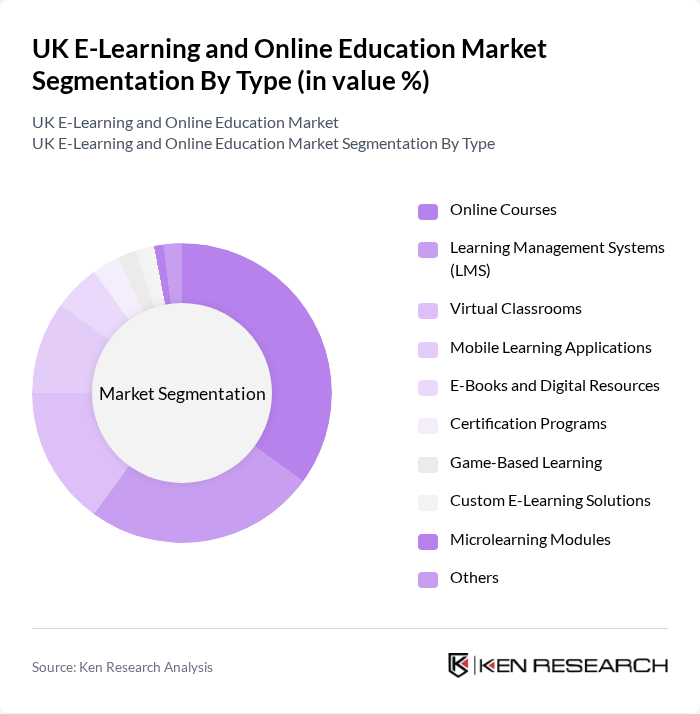

By Type:The market is segmented into various types, including Online Courses, Learning Management Systems (LMS), Virtual Classrooms, Mobile Learning Applications, E-Books and Digital Resources, Certification Programs, Game-Based Learning, Custom E-Learning Solutions, Microlearning Modules, and Others. Among these, Online Courses and Learning Management Systems are particularly prominent, driven by the increasing demand for accessible and flexible learning options. Online Courses have gained traction due to their convenience and variety, while LMS platforms are essential for organizations looking to manage and deliver training efficiently. The market is also witnessing rapid growth in game-based and microlearning modules, reflecting evolving learner preferences for interactive and concise content .

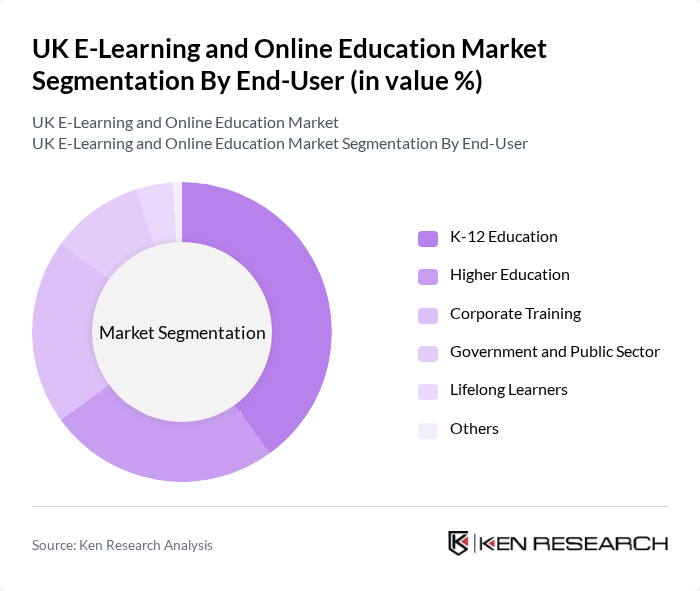

By End-User:The market is segmented by end-users, including K-12 Education, Higher Education, Corporate Training, Government and Public Sector, Lifelong Learners, and Others. The K-12 Education and Corporate Training segments are particularly significant, as schools and businesses increasingly adopt e-learning solutions to enhance educational outcomes and employee skills. The demand for personalized learning experiences and the need for continuous professional development are driving growth in these segments. Corporate training is experiencing robust growth, supported by the need for upskilling and compliance training in the workforce .

The UK E-Learning and Online Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as FutureLearn Ltd., Open University, Pearson Plc, City & Guilds Group, Learning Technologies Group Plc, Learning Pool, Adobe Inc., Cornerstone OnDemand Inc., D2L Inc., Skillsoft Corp., Sponge Group Holdings Ltd., Totara Learning Solutions Ltd., WillowDNA, McGraw Hill LLC, NETEX Knowledge Factory S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The UK e-learning market is poised for continued evolution, driven by technological advancements and changing learner preferences. The integration of artificial intelligence and personalized learning experiences is expected to enhance engagement and retention rates. Additionally, the shift towards hybrid learning models will likely redefine educational delivery, catering to diverse learner needs. As the market matures, platforms that prioritize quality, accreditation, and user experience will emerge as leaders in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Learning Management Systems (LMS) Virtual Classrooms Mobile Learning Applications E-Books and Digital Resources Certification Programs Game-Based Learning Custom E-Learning Solutions Microlearning Modules Others |

| By End-User | K-12 Education Higher Education Corporate Training Government and Public Sector Lifelong Learners Others |

| By Application | Skill Development Professional Certification Academic Learning Compliance Training Language Learning Translation & Localization Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Self-Paced Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model One-Time Payment Others |

| By Content Type | Video Lectures Interactive Quizzes Textual Content Case Studies Animations & Simulations VR/AR Content Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Professional Development Certificates Micro-Credentials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-Learning Adoption | 100 | School Administrators, Teachers, IT Coordinators |

| Higher Education Online Programs | 90 | University Faculty, Program Directors, Student Affairs Officers |

| Corporate Training Solutions | 80 | HR Managers, Training Coordinators, Learning & Development Specialists |

| EdTech Product Development | 50 | Product Managers, UX Designers, Educational Researchers |

| Student Experience in Online Learning | 120 | Current Students, Recent Graduates, Educational Consultants |

The UK E-Learning and Online Education Market is valued at approximately USD 11.8 billion, reflecting significant growth driven by the increasing adoption of digital learning solutions and the demand for flexible, personalized education options.