Region:Central and South America

Author(s):Shubham

Product Code:KRAA4744

Pages:91

Published On:September 2025

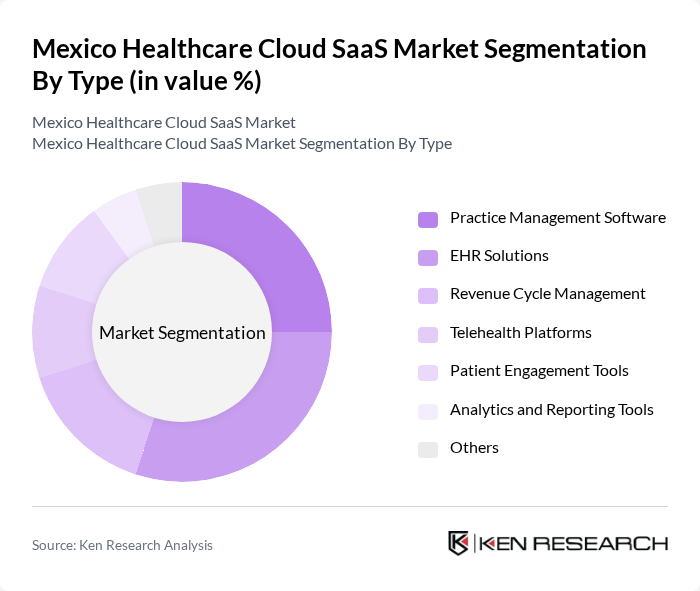

By Type:The market is segmented into various types, including Practice Management Software, EHR Solutions, Revenue Cycle Management, Telehealth Platforms, Patient Engagement Tools, Analytics and Reporting Tools, and Others. Each of these sub-segments plays a crucial role in enhancing healthcare delivery and operational efficiency.

The EHR Solutions sub-segment is currently dominating the market due to the increasing need for efficient patient data management and regulatory compliance. Healthcare providers are increasingly adopting EHR systems to streamline operations, improve patient care, and enhance data accessibility. The growing trend of interoperability among healthcare systems further supports the demand for EHR solutions, making it a critical component of the healthcare cloud SaaS market.

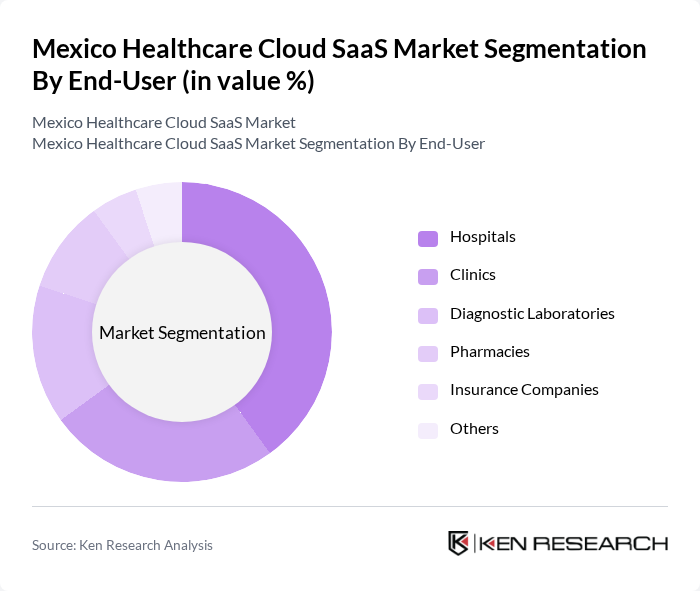

By End-User:The market is segmented by end-users, including Hospitals, Clinics, Diagnostic Laboratories, Pharmacies, Insurance Companies, and Others. Each end-user category has unique requirements and contributes differently to the overall market dynamics.

Hospitals are the leading end-user segment, driven by the need for comprehensive healthcare management solutions. The increasing patient volume and the complexity of healthcare services necessitate the adoption of cloud-based solutions for better data management, operational efficiency, and improved patient outcomes. Hospitals are also investing in technology to enhance their service delivery and meet regulatory requirements, further solidifying their position in the market.

The Mexico Healthcare Cloud SaaS Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teladoc Health, Cerner Corporation, Allscripts Healthcare Solutions, McKesson Corporation, Epic Systems Corporation, Athenahealth, Inc., Meditech, NextGen Healthcare, eClinicalWorks, Infor Healthcare, Philips Healthcare, IBM Watson Health, Oracle Health Sciences, Siemens Healthineers, GE Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico Healthcare Cloud SaaS market is poised for significant growth, driven by technological advancements and increasing healthcare demands. In future, the integration of AI and machine learning into healthcare applications is expected to enhance patient care and operational efficiency. Additionally, the expansion of telehealth services will continue to reshape healthcare delivery, making it more accessible. As healthcare providers increasingly embrace digital transformation, the market will likely witness a surge in innovative solutions tailored to meet evolving patient needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Practice Management Software EHR Solutions Revenue Cycle Management Telehealth Platforms Patient Engagement Tools Analytics and Reporting Tools Others |

| By End-User | Hospitals Clinics Diagnostic Laboratories Pharmacies Insurance Companies Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Application | Clinical Management Financial Management Operational Management Others |

| By Sales Channel | Direct Sales Online Sales Distributors Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Region | Northern Mexico Central Mexico Southern Mexico Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Healthcare Institutions | 100 | IT Directors, Healthcare Administrators |

| Private Hospitals and Clinics | 80 | Chief Financial Officers, IT Managers |

| Health Insurance Providers | 60 | Product Managers, IT Strategy Leads |

| Telemedicine Service Providers | 50 | Operations Managers, Technology Officers |

| Healthcare IT Consultants | 70 | Consultants, Market Analysts |

The Mexico Healthcare Cloud SaaS Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital health solutions, efficient healthcare management systems, and increased demand for telehealth services.