Region:Asia

Author(s):Rebecca

Product Code:KRAD6123

Pages:82

Published On:December 2025

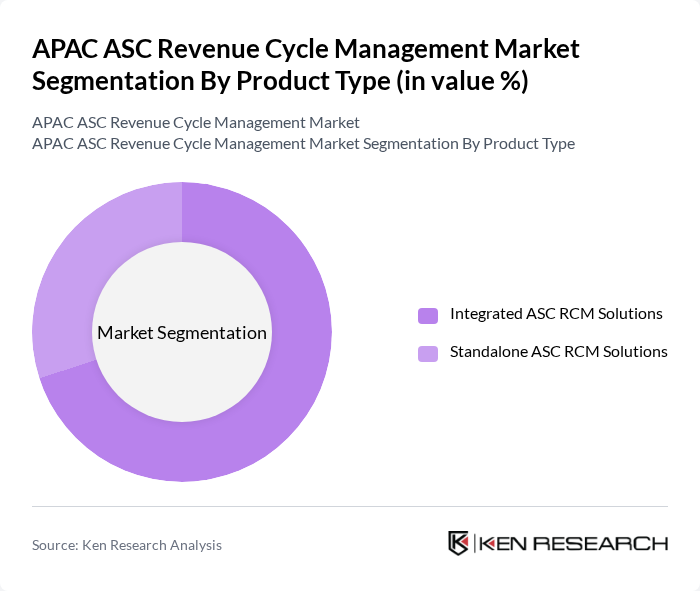

By Product Type:The product type segmentation includes Integrated ASC RCM Solutions and Standalone ASC RCM Solutions. Integrated solutions are gaining traction due to their ability to provide a comprehensive approach to revenue cycle management, allowing for seamless data flow and improved efficiency by integrating functions such as billing, scheduling, coding, and collections into a single platform that streamlines operations and reduces errors. Standalone solutions, while still relevant, are often chosen by smaller facilities that require specific functionalities without the need for a full suite of services.

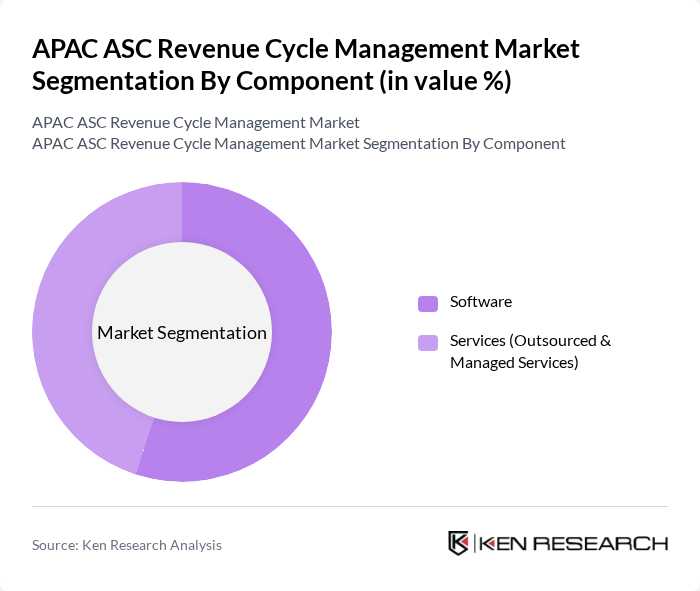

By Component:The component segmentation consists of Software and Services (Outsourced & Managed Services). Software solutions are increasingly preferred due to their ability to automate processes and enhance accuracy in billing and coding. Services, particularly outsourced options, are also in demand as healthcare facilities seek to reduce operational costs and focus on core competencies while ensuring compliance and efficiency in revenue management.

The APAC ASC Revenue Cycle Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optum (UnitedHealth Group), R1 RCM Inc., Oracle Health (formerly Cerner Corporation), McKesson Corporation, Change Healthcare (UnitedHealth Group), nThrive (Aviant Health), GeBBS Healthcare Solutions, Conifer Health Solutions, MedAssist (Firstsource Solutions Ltd.), Omega Healthcare, AGS Health, Access Healthcare, Cognizant Technology Solutions, Wipro Limited, TCS (Tata Consultancy Services) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC ASC revenue cycle management market is poised for significant evolution, driven by the increasing adoption of technology and a shift towards value-based care models. As ASCs prioritize patient engagement and satisfaction, the integration of advanced analytics and reporting capabilities will become essential. Furthermore, the expansion of telehealth services is expected to enhance patient access and streamline billing processes, creating a more efficient revenue cycle. These trends will shape the future landscape of RCM in the region, fostering innovation and improved financial performance.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Integrated ASC RCM Solutions Standalone ASC RCM Solutions |

| By Component | Software Services (Outsourced & Managed Services) |

| By Delivery / Deployment Mode | Cloud-Based Web-Based On-Premise |

| By RCM Stage | Front-Office (Patient Access & Pre-Authorization) Mid-Office (Clinical Documentation & Coding) Back-Office (Billing, Collections & Denial Management) |

| By End-User | Independent Ambulatory Surgical Centers Hospital-Owned / Health System–Affiliated ASCs ASC Management Companies |

| By Country | China Japan India South Korea Australia & New Zealand ASEAN (Indonesia, Thailand, Malaysia, Singapore, Vietnam, Others) Rest of Asia Pacific |

| By Technology Enablement | AI-Enabled & Automation-Driven RCM Analytics & Business Intelligence–Enabled RCM Traditional / Rules-Based RCM Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Revenue Cycle Management | 120 | CFOs, Revenue Cycle Directors |

| Ambulatory Care RCM Services | 100 | Practice Managers, Billing Specialists |

| Health Insurance Claims Processing | 80 | Claims Managers, Underwriting Officers |

| Telehealth Revenue Management | 70 | Telehealth Coordinators, IT Managers |

| Long-term Care RCM Solutions | 60 | Facility Administrators, Financial Officers |

The APAC ASC Revenue Cycle Management Market is valued at approximately USD 4.8 billion, driven by the increasing demand for efficient healthcare services, outpatient surgeries, and advancements in healthcare IT solutions.