Region:Central and South America

Author(s):Rebecca

Product Code:KRAA3329

Pages:80

Published On:September 2025

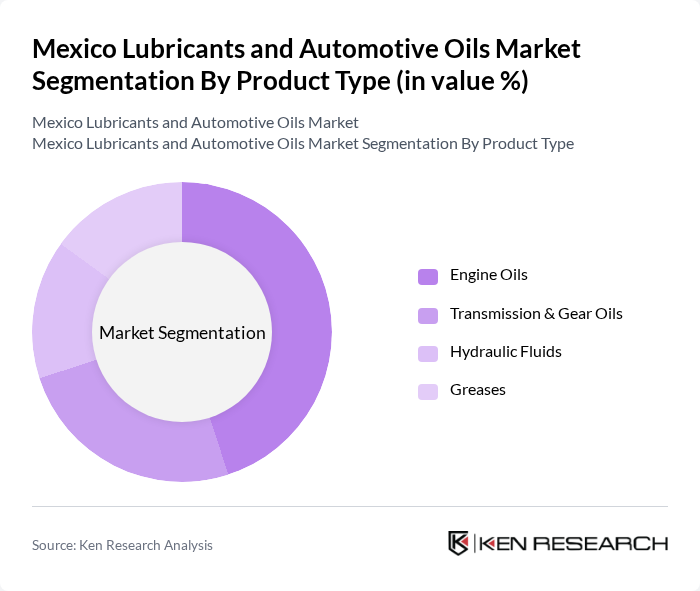

By Product Type:The product type segmentation includes Engine Oils, Transmission & Gear Oils, Hydraulic Fluids, and Greases. Among these, Engine Oils dominate the market due to their essential role in vehicle performance and maintenance. The increasing number of vehicles on the road and the growing trend towards synthetic and high-performance engine oils are driving this segment's growth. Consumers are increasingly opting for premium engine oils that offer better protection and efficiency, leading to a significant market share for this sub-segment.

By Vehicle Type:The vehicle type segmentation includes Commercial Vehicles, Passenger Vehicles, and Motorcycles. The Passenger Vehicles segment holds the largest market share, driven by the increasing number of personal vehicles and the growing trend of vehicle ownership among the middle class. Additionally, the rise in urbanization and the demand for mobility solutions contribute to the growth of this segment. Consumers are also becoming more aware of the importance of using quality lubricants to enhance vehicle performance and longevity.

The Mexico Lubricants and Automotive Oils Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation (Mobil), BP PLC (Castrol), Shell Mexico, TotalEnergies, Chevron Corporation, Repsol, Fuchs Petrolub SE, Valvoline Inc., Bardahl Manufacturing Corporation, Gulf Oil International, Liqui Moly GmbH, Motul, Petronas Lubricants International, Kluber Lubrication, Pemex (Petróleos Mexicanos) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico lubricants and automotive oils market appears promising, driven by technological advancements and a growing focus on sustainability. As consumers become more environmentally conscious, the demand for bio-based and synthetic lubricants is expected to rise. Additionally, the integration of smart technologies in automotive maintenance will create new opportunities for lubricant manufacturers to innovate and differentiate their products, ensuring they meet evolving consumer needs and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Engine Oils Transmission & Gear Oils Hydraulic Fluids Greases |

| By Vehicle Type | Commercial Vehicles Passenger Vehicles Motorcycles |

| By Oil Type | Synthetic Oils Semi-Synthetic Oils Mineral-Based Oils |

| By Distribution Channel | Retail Outlets Online Sales Distributors Direct Sales Others |

| By Brand Type | OEM Brands Aftermarket Brands Private Labels Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Lubricant Retailers | 120 | Store Managers, Sales Representatives |

| Automotive Service Centers | 100 | Service Managers, Technicians |

| Lubricant Manufacturers | 60 | Product Development Managers, Marketing Directors |

| Fleet Operators | 70 | Fleet Managers, Procurement Officers |

| Industry Experts and Analysts | 50 | Consultants, Market Researchers |

The Mexico lubricants and automotive oils market is valued at approximately USD 2 billion, driven by increasing automotive production, sales, and the demand for high-performance lubricants across various sectors, including automotive and industrial applications.