Region:Africa

Author(s):Geetanshi

Product Code:KRAA3234

Pages:88

Published On:September 2025

By Type:The market is segmented into various types of lubricants and automotive oils, including engine oils, transmission fluids, hydraulic fluids, greases, gear oils, brake fluids, coolants, industrial oils, marine oils, and others. Among these,engine oilsare the most dominant segment due to their essential role in vehicle performance and maintenance. The increasing number of vehicles on the road and the growing awareness of the importance of regular oil changes drive the demand for high-quality engine oils. Advancements in synthetic and semi-synthetic oil technology, as well as the adoption of lubricants designed for extended drain intervals and fuel efficiency, further boost their popularity .

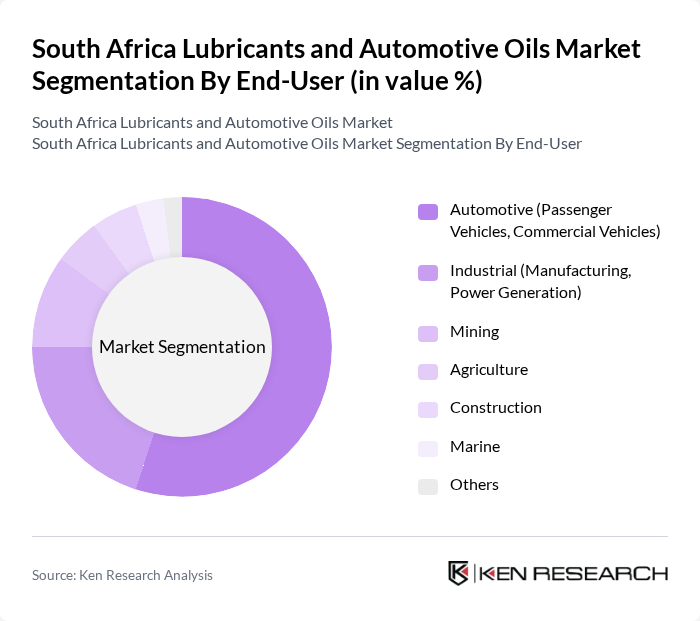

By End-User:The end-user segmentation includes automotive (passenger vehicles and commercial vehicles), industrial (manufacturing and power generation), mining, agriculture, construction, marine, and others. Theautomotive sectoris the largest end-user, driven by the increasing number of vehicles and the need for regular maintenance. The rise in commercial vehicle usage for logistics and transportation further fuels this segment. The industrial sector’s demand for lubricants in machinery and equipment maintenance, as well as the mining sector’s requirements for heavy-duty lubricants, also contribute significantly to market growth .

The South Africa Lubricants and Automotive Oils Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sasol Limited, TotalEnergies South Africa, Engen Petroleum Ltd., BP Southern Africa (Castrol), Astron Energy Pty Ltd, Shell South Africa, Fuchs Lubricants South Africa, Klüber Lubrication South Africa, Lubrication Engineers South Africa, Petronas Lubricants South Africa, Motul South Africa, Valvoline South Africa, Repsol South Africa, Gulf Oil South Africa, Caltex South Africa contribute to innovation, geographic expansion, and service delivery in this space.

The South African lubricants and automotive oils market is poised for significant transformation driven by technological advancements and sustainability initiatives. As the automotive industry shifts towards electric vehicles, the demand for specialized lubricants will evolve. Additionally, the increasing focus on eco-friendly products will encourage manufacturers to innovate and develop bio-based lubricants. These trends, combined with the expansion of the mining sector, will create a dynamic market landscape, fostering growth and new opportunities for industry players in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Oils Transmission Fluids Hydraulic Fluids Greases Gear Oils Brake Fluids Coolants Industrial Oils Marine Oils Others |

| By End-User | Automotive (Passenger Vehicles, Commercial Vehicles) Industrial (Manufacturing, Power Generation) Mining Agriculture Construction Marine Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors Service Stations Others |

| By Packaging Type | Bulk Packaging Retail Packaging Industrial Packaging |

| By Application | Automotive Applications Industrial Applications Marine Applications Agricultural Applications Mining Applications |

| By Price Range | Economy Mid-Range Premium |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Lubricant Retailers | 60 | Store Managers, Sales Representatives |

| Automotive Service Centers | 50 | Service Managers, Technicians |

| Fleet Operators | 40 | Fleet Managers, Maintenance Supervisors |

| Lubricant Manufacturers | 40 | Product Development Managers, Marketing Directors |

| End-User Consumers | 80 | Car Owners, DIY Enthusiasts |

The South Africa Lubricants and Automotive Oils Market is valued at approximately USD 420 million, driven by increasing vehicle ownership, automotive maintenance needs, and industrial demand for high-performance lubricants.