Region:Europe

Author(s):Rebecca

Product Code:KRAA6345

Pages:95

Published On:September 2025

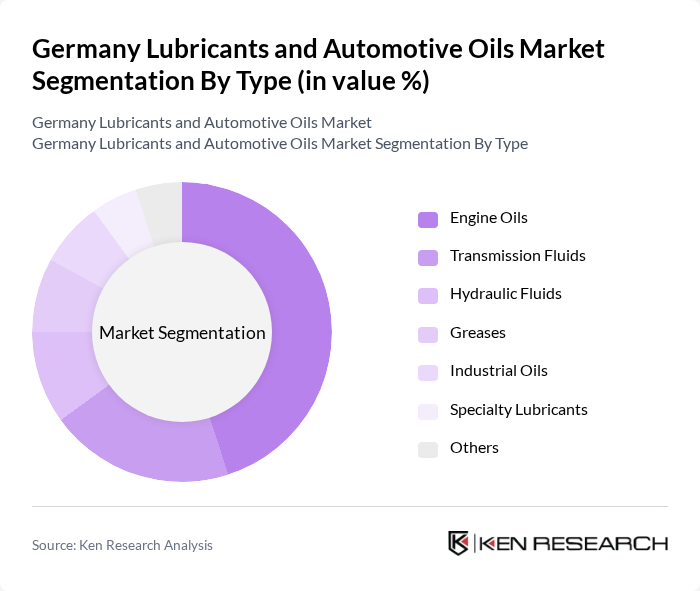

By Type:The market is segmented into various types of lubricants and automotive oils, including engine oils, transmission fluids, hydraulic fluids, greases, industrial oils, specialty lubricants, and others. Among these, engine oils are the most dominant segment due to their essential role in vehicle performance and engine protection. The increasing number of vehicles on the road and the growing trend towards longer oil change intervals are driving the demand for high-quality engine oils. Additionally, advancements in engine technology are leading to the development of specialized engine oils that cater to specific vehicle requirements.

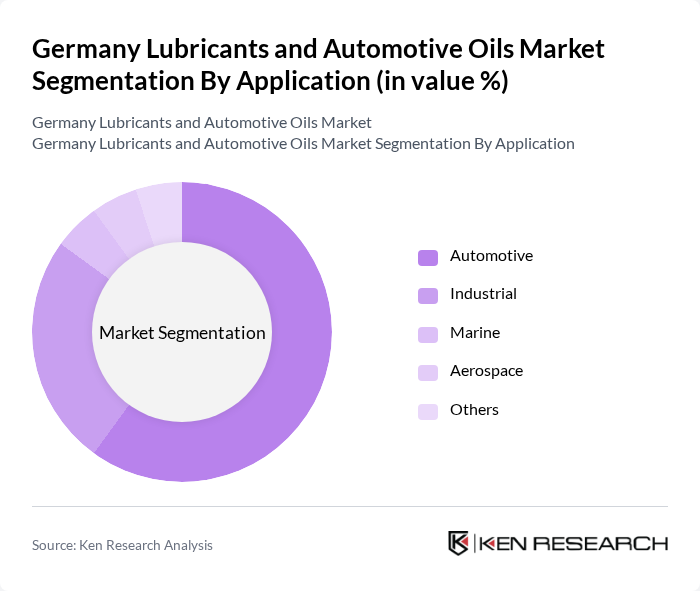

By Application:The lubricants and automotive oils market is segmented by application into automotive, industrial, marine, aerospace, and others. The automotive application segment holds the largest share, driven by the increasing vehicle production and sales in Germany. The growing trend of vehicle electrification and the need for efficient lubrication solutions in electric vehicles are also contributing to the expansion of this segment. Additionally, the industrial application segment is witnessing growth due to the rising demand for lubricants in manufacturing processes and machinery maintenance.

The Germany Lubricants and Automotive Oils Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shell Deutschland Oil GmbH, BP Europa SE, TotalEnergies Marketing Deutschland GmbH, Fuchs Petrolub SE, Castrol Limited, Mobil Oil GmbH, Liqui Moly GmbH, Klüber Lubrication München SE & Co. KG, Chevron Deutschland GmbH, Motul S.A., Ravenol GmbH, Valvoline Inc., Amsoil Inc., Petronas Lubricants International, Repsol S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany lubricants and automotive oils market appears promising, driven by technological advancements and a shift towards sustainability. The increasing adoption of electric vehicles is expected to reshape lubricant formulations, emphasizing eco-friendly and bio-based products. Additionally, the digitalization of distribution channels will enhance market accessibility and efficiency, allowing manufacturers to reach consumers more effectively. As the market evolves, companies that prioritize innovation and sustainability will likely gain a competitive edge.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Oils Transmission Fluids Hydraulic Fluids Greases Industrial Oils Specialty Lubricants Others |

| By Application | Automotive Industrial Marine Aerospace Others |

| By End-User | OEMs Aftermarket Fleet Operators Government & Utilities |

| By Distribution Channel | Direct Sales Retail Online Sales Distributors |

| By Packaging Type | Bulk Packaging Retail Packaging Industrial Packaging |

| By Price Range | Economy Mid-Range Premium |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Lubricant Retailers | 100 | Store Managers, Sales Representatives |

| Automotive Service Centers | 80 | Service Managers, Technicians |

| OEMs and Vehicle Manufacturers | 60 | Product Development Engineers, Procurement Managers |

| Lubricant Distributors | 70 | Distribution Managers, Logistics Coordinators |

| Industry Experts and Analysts | 50 | Market Analysts, Industry Consultants |

The Germany Lubricants and Automotive Oils Market is valued at approximately USD 8.5 billion, reflecting a robust demand for high-performance lubricants driven by advancements in technology and increasing vehicle ownership.