Region:Central and South America

Author(s):Shubham

Product Code:KRAA6218

Pages:86

Published On:September 2025

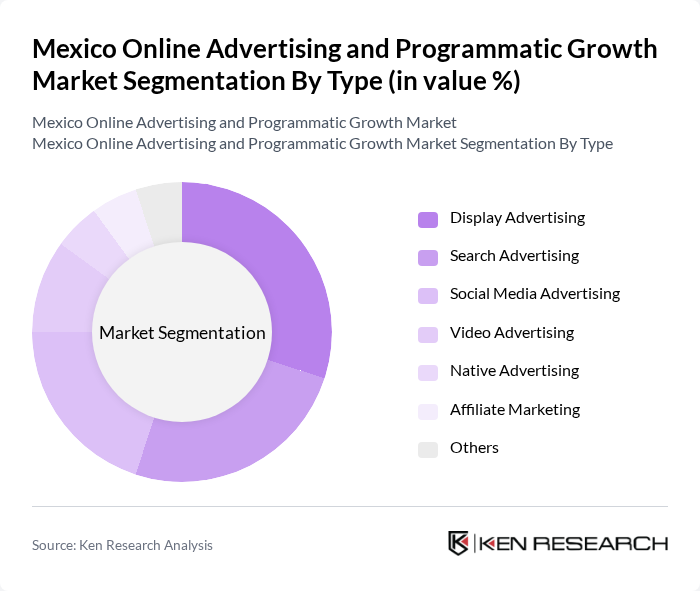

By Type:The online advertising market is segmented into various types, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, and Others. Among these, Display Advertising and Social Media Advertising are particularly prominent due to their visual appeal and ability to engage users effectively. The increasing use of social media platforms for brand promotion has significantly contributed to the growth of Social Media Advertising.

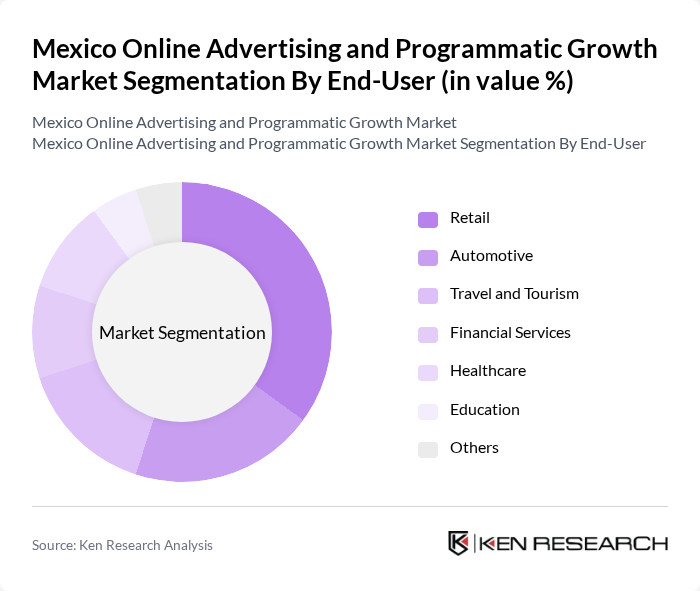

By End-User:The end-user segmentation includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Education, and Others. The Retail sector is the most significant contributor to the online advertising market, driven by the increasing trend of e-commerce and the need for brands to reach consumers directly through digital channels. The shift towards online shopping has prompted retailers to invest heavily in online advertising strategies.

The Mexico Online Advertising and Programmatic Growth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Bimbo, Televisa, Cinépolis, Grupo Salinas, América Móvil, Grupo Modelo, FEMSA, Banorte, Walmart de México, OXXO, Coppel, Liverpool, Grupo Carso, Alsea, Grupo Aeroportuario del Pacífico contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online advertising and programmatic growth market in Mexico appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt data-driven strategies, the integration of artificial intelligence and machine learning will enhance targeting capabilities. Additionally, the rise of localized content will cater to diverse consumer segments, fostering deeper engagement. However, navigating regulatory challenges and addressing ad fraud will be crucial for sustaining growth and building trust in the digital advertising ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Education Others |

| By Industry Vertical | E-commerce Entertainment Telecommunications Real Estate FMCG Technology Others |

| By Advertising Format | Banner Ads Sponsored Content Email Marketing Mobile Ads Programmatic Ads Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Programmatic Platforms Others |

| By Geographic Region | Northern Mexico Central Mexico Southern Mexico Urban Areas Rural Areas Others |

| By Customer Segment | Small Businesses Medium Enterprises Large Corporations Government Agencies Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Marketing Agencies | 100 | Agency Owners, Digital Strategists |

| Brand Advertisers | 80 | Marketing Directors, Brand Managers |

| Programmatic Ad Platforms | 60 | Product Managers, Data Analysts |

| Media Buying Firms | 70 | Media Buyers, Campaign Managers |

| Consumer Insights Specialists | 50 | Market Researchers, Consumer Behavior Analysts |

The Mexico Online Advertising and Programmatic Growth Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and digital transformation among businesses.