Region:Africa

Author(s):Shubham

Product Code:KRAB4430

Pages:81

Published On:October 2025

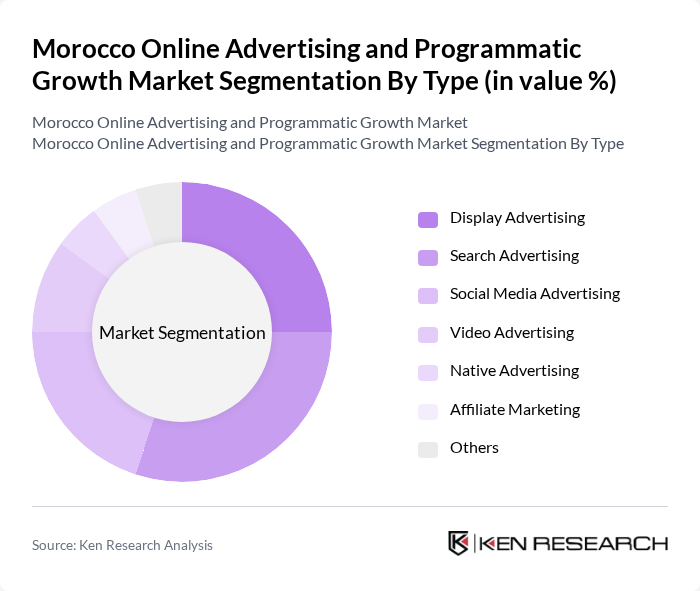

By Type:The market is segmented into various types of online advertising, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, and Others. Each of these segments caters to different advertising needs and consumer behaviors, with some segments experiencing more growth than others.

The dominant segment in the market is Search Advertising, which has gained traction due to its effectiveness in reaching consumers actively searching for products and services. This segment benefits from the increasing reliance on search engines for information and shopping, making it a preferred choice for advertisers aiming for high conversion rates. Display Advertising follows closely, leveraging visual content to capture audience attention across various platforms.

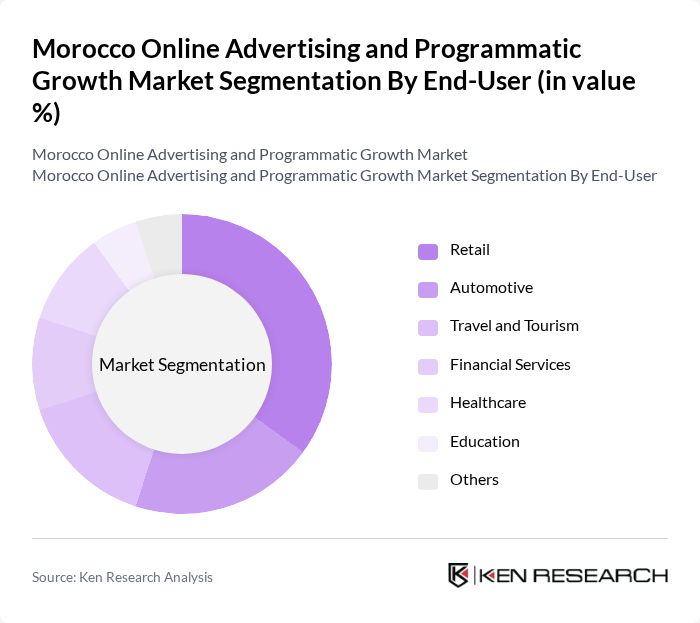

By End-User:The market is segmented by end-users, including Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Education, and Others. Each sector utilizes online advertising differently, reflecting their unique marketing strategies and target audiences.

The Retail sector is the leading end-user in the market, driven by the need for businesses to promote their products and services effectively in a competitive landscape. The rise of e-commerce has further accelerated the demand for online advertising in this sector. The Automotive and Travel and Tourism sectors also contribute significantly, utilizing targeted advertising to reach potential customers during their decision-making processes.

The Morocco Online Advertising and Programmatic Growth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adwa Group, Digital Ads Morocco, AdKhalifa, Webedia Morocco, Adverty, DDB Morocco, Havas Morocco, Publicis Groupe Morocco, WPP Morocco, GroupM Morocco, OMD Morocco, Starcom Morocco, Zenith Morocco, iProspect Morocco, Epsilon Morocco contribute to innovation, geographic expansion, and service delivery in this space.

The future of Morocco's online advertising market appears promising, driven by technological advancements and evolving consumer behaviors. As digital literacy improves and more users engage with online platforms, advertisers will increasingly leverage programmatic buying and data-driven strategies. The integration of AI technologies is expected to enhance targeting capabilities, while the expansion of social media and video content will provide new avenues for engagement. Overall, the market is poised for significant transformation, aligning with global digital trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Education Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Programmatic Platforms Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Others |

| By Device Type | Mobile Devices Desktop Computers Tablets Smart TVs Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Conversion Campaigns Retargeting Campaigns Others |

| By Budget Size | Small Budgets Medium Budgets Large Budgets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Small and Medium Enterprises (SMEs) Digital Advertising | 100 | Marketing Managers, Business Owners |

| Large Corporations' Online Marketing Strategies | 80 | Chief Marketing Officers, Digital Strategy Directors |

| Consumer Behavior towards Online Ads | 150 | General Consumers, Online Shoppers |

| Advertising Agencies' Insights on Programmatic Growth | 70 | Agency Executives, Media Buyers |

| Impact of Social Media Advertising | 90 | Social Media Managers, Content Strategists |

The Morocco Online Advertising and Programmatic Growth Market is valued at approximately USD 300 million, reflecting a significant increase driven by internet penetration, mobile device usage, and the demand for targeted advertising solutions among businesses.