Region:Central and South America

Author(s):Shubham

Product Code:KRAA4704

Pages:86

Published On:September 2025

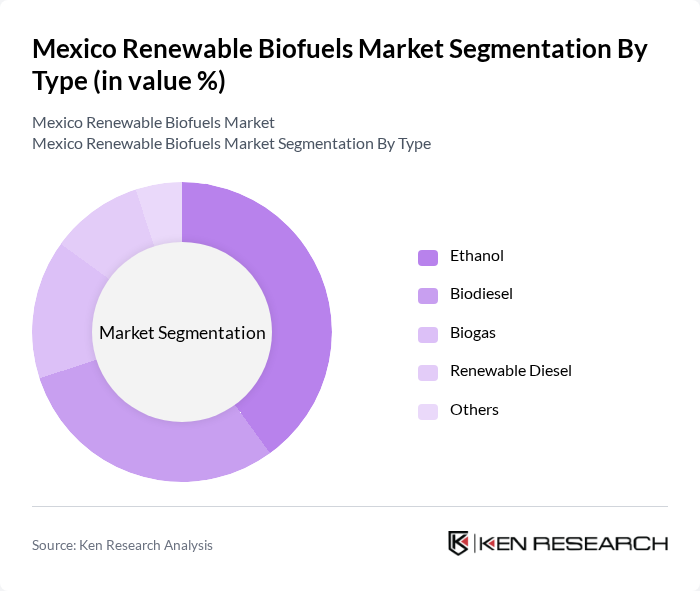

By Type:The market is segmented into various types of biofuels, including Ethanol, Biodiesel, Biogas, Renewable Diesel, and Others. Ethanol and Biodiesel are the most prominent segments, driven by their widespread use in transportation and industrial applications. The demand for Biogas is also increasing due to its potential as a clean energy source, while Renewable Diesel is gaining traction as a high-quality alternative to conventional diesel.

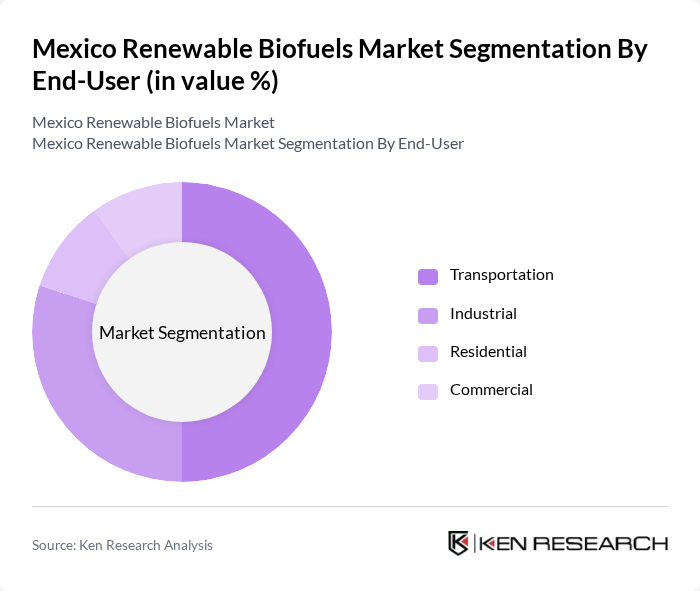

By End-User:The end-user segmentation includes Transportation, Industrial, Residential, and Commercial sectors. The Transportation sector is the largest consumer of biofuels, driven by the increasing adoption of biofuels in vehicles. The Industrial sector follows closely, utilizing biofuels for energy generation and as feedstock for various processes. Residential and Commercial sectors are also emerging as significant users, particularly in areas focused on sustainability.

The Mexico Renewable Biofuels Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pemex, BioFields S.A. de C.V., Grupo Bimbo, Cargill de Mexico S.A. de C.V., Abengoa Bioenergy, DuPont de Nemours, Inc., Archer Daniels Midland Company, Renewable Energy Group, Inc., Green Plains Inc., Biocycle, Algenol Biofuels, Neste Corporation, INEOS Bio, LanzaTech, Virent, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the renewable biofuels market in Mexico appears promising, driven by increasing investments in sustainable energy and technological advancements. In the near future, the market is expected to witness a surge in biofuel production capacity, supported by government initiatives and a growing consumer base favoring green energy. Additionally, the integration of advanced biofuels and waste-to-energy technologies will likely enhance the sector's sustainability, positioning Mexico as a leader in renewable energy within Latin America.

| Segment | Sub-Segments |

|---|---|

| By Type | Ethanol Biodiesel Biogas Renewable Diesel Others |

| By End-User | Transportation Industrial Residential Commercial |

| By Application | Fuel Production Energy Generation Chemical Feedstock Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Others |

| By Region | Northern Mexico Central Mexico Southern Mexico Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biofuel Production Facilities | 100 | Plant Managers, Production Supervisors |

| Agricultural Feedstock Suppliers | 80 | Farm Owners, Supply Chain Managers |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Biofuel Distributors and Retailers | 70 | Sales Managers, Distribution Coordinators |

| Research Institutions and Academia | 60 | Researchers, Professors in Renewable Energy |

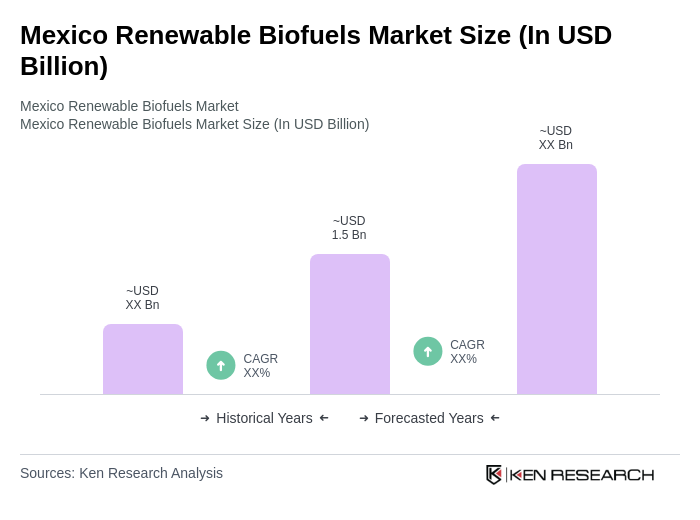

The Mexico Renewable Biofuels Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by government support, consumer demand for sustainable fuels, and technological advancements in the sector.