Region:Middle East

Author(s):Rebecca

Product Code:KRAC8523

Pages:81

Published On:November 2025

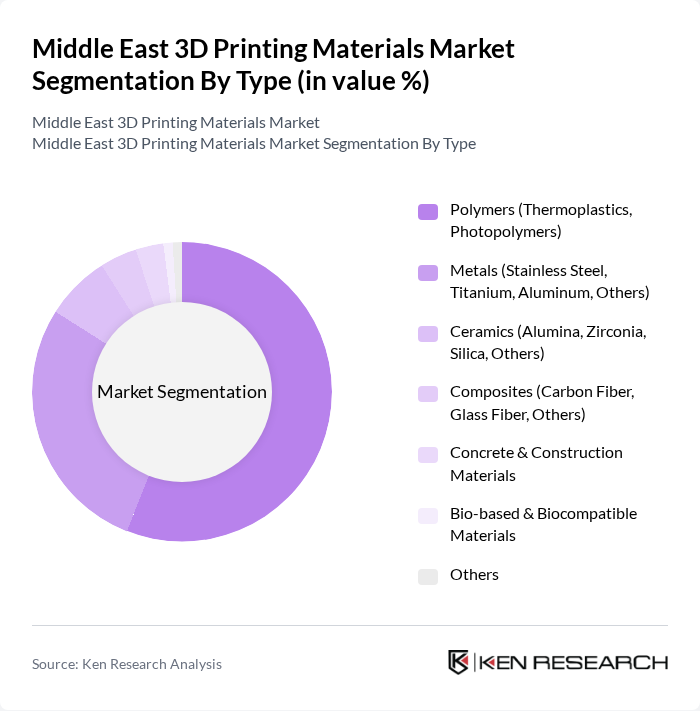

By Type:The market is segmented into various types of materials used in 3D printing, including polymers, metals, ceramics, composites, concrete and construction materials, bio-based and biocompatible materials, and others. Among these,polymers—especially thermoplastics and photopolymers—dominate the market due to their versatility, cost-effectiveness, and ease of processing. The demand formetalsis also significant, particularly in aerospace and automotive applications where high strength and durability are essential.Industrial and manufacturingapplications are the largest consumers of these materials, followed by healthcare and aerospace sectors .

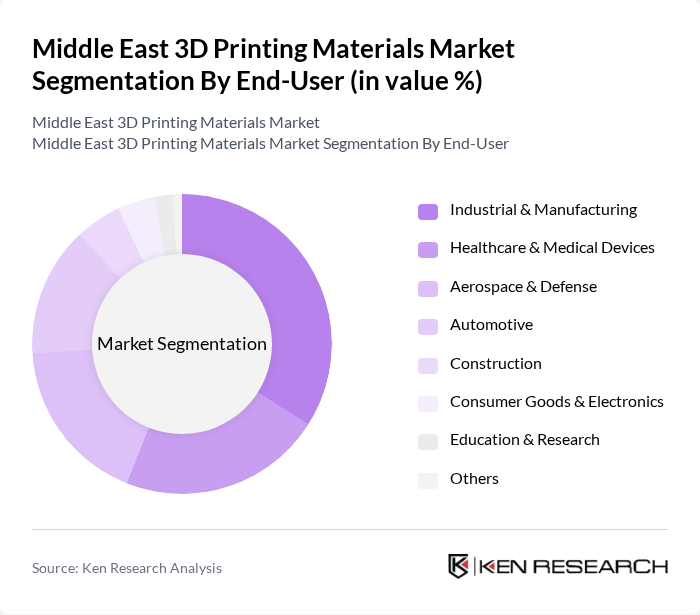

By End-User:The end-user segmentation includes aerospace and defense, automotive, healthcare and medical devices, industrial and manufacturing, construction, consumer goods and electronics, education and research, and others. Theindustrial and manufacturingsector is the largest contributor to the market, driven by the need for rapid prototyping, tooling, and low-volume production. Thehealthcare and medical devicessegment is also rapidly expanding, leveraging 3D printing for medical models, implants, and dental applications. Aerospace and defense remain key users due to the demand for lightweight, complex, and high-performance components .

The Middle East 3D Printing Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stratasys Ltd., 3D Systems Corporation, Materialise NV, EOS GmbH, HP Inc., Ultimaker B.V., Sculpteo, Formlabs, Xometry, Carbon, Inc., BASF SE, Arkema S.A., SABIC, Dow Inc., Mitsubishi Chemical Group Corporation, Polymaker, Evonik Industries AG, Royal DSM N.V., Replique GmbH, Immensa Additive Manufacturing Group, 3D Middle East, Additive Manufacturing Technologies (AMT), Localized (UAE), Zamil 3D Printing (Saudi Arabia), Shapeways Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East 3D printing materials market appears promising, driven by technological advancements and increasing applications across various sectors. As industries such as aerospace and healthcare continue to explore 3D printing, the demand for innovative materials is expected to rise. Additionally, the integration of AI and machine learning into manufacturing processes will enhance efficiency and customization, further propelling market growth. The focus on sustainability will also shape future developments, encouraging the use of eco-friendly materials.

| Segment | Sub-Segments |

|---|---|

| By Type | Polymers (Thermoplastics, Photopolymers) Metals (Stainless Steel, Titanium, Aluminum, Others) Ceramics (Alumina, Zirconia, Silica, Others) Composites (Carbon Fiber, Glass Fiber, Others) Concrete & Construction Materials Bio-based & Biocompatible Materials Others |

| By End-User | Aerospace & Defense Automotive Healthcare & Medical Devices Industrial & Manufacturing Construction Consumer Goods & Electronics Education & Research Others |

| By Application | Prototyping Tooling Production Parts Dental & Medical Implants Architectural Models & Construction Components Others |

| By Material Source | Domestic Suppliers International Suppliers Recycled Materials Others |

| By Technology | Fused Deposition Modeling (FDM) Stereolithography (SLA) Selective Laser Sintering (SLS) Digital Light Processing (DLP) Binder Jetting Direct Metal Laser Sintering (DMLS) / Selective Laser Melting (SLM) Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | GCC Countries (UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman) Levant Region (Israel, Jordan, Lebanon, Others) North Africa (Egypt, Morocco, Algeria, Others) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| 3D Printing Material Suppliers | 45 | Sales Managers, Product Development Leads |

| Aerospace Industry Users | 38 | Manufacturing Engineers, Procurement Specialists |

| Healthcare Sector Applications | 42 | Biomedical Engineers, R&D Managers |

| Automotive Industry Stakeholders | 50 | Design Engineers, Supply Chain Managers |

| Construction Sector Innovators | 35 | Project Managers, Material Scientists |

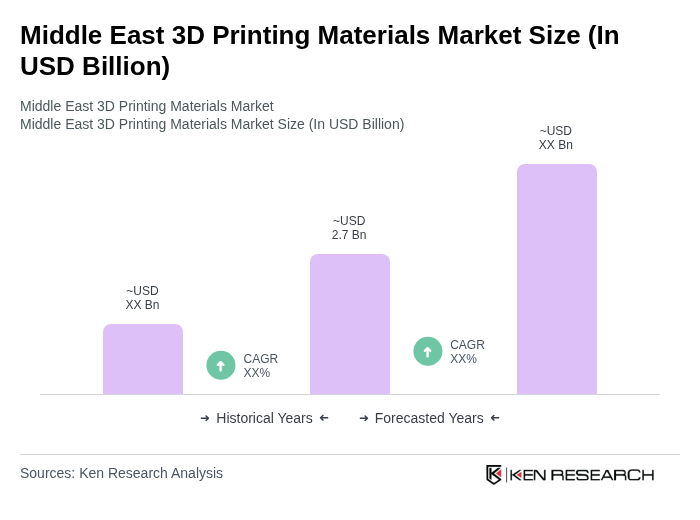

The Middle East 3D Printing Materials Market is valued at approximately USD 2.7 billion, reflecting significant growth driven by advancements in additive manufacturing technology and increased demand for customized products across various sectors.