Region:Middle East

Author(s):Dev

Product Code:KRAD6450

Pages:87

Published On:December 2025

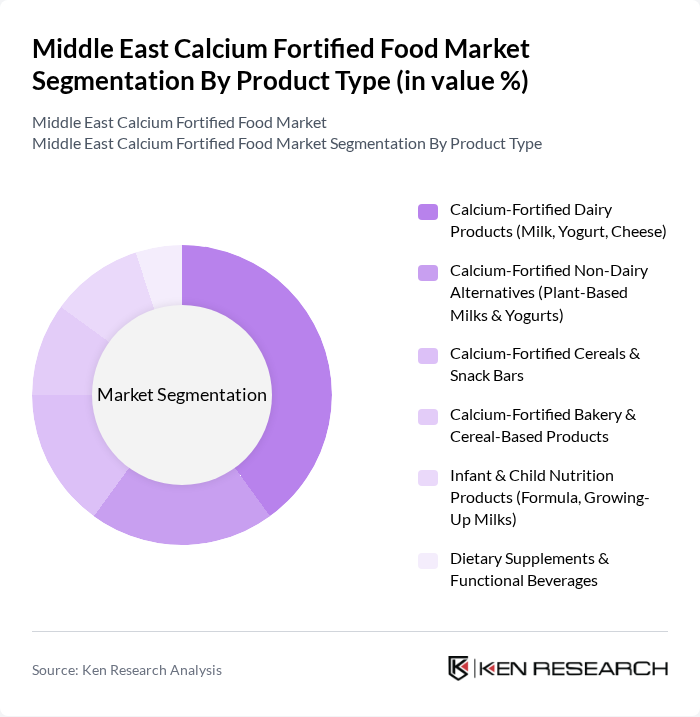

By Product Type:The product type segmentation includes various categories such as Calcium-Fortified Dairy Products, Non-Dairy Alternatives, Cereals & Snack Bars, Bakery Products, Infant & Child Nutrition Products, and Dietary Supplements. Among these, Calcium-Fortified Dairy Products, including milk, yogurt, and cheese, are leading the market due to their widespread consumption and established health benefits. The growing trend of health-conscious eating has further propelled the demand for these products, making them a staple in many households.

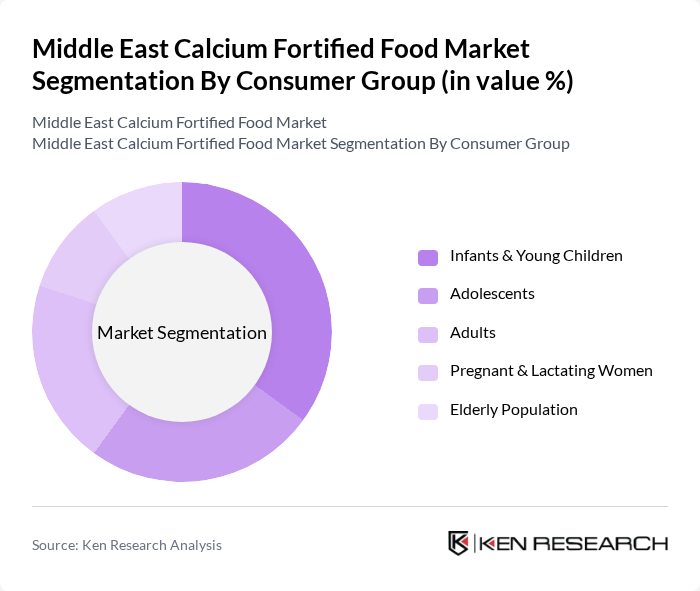

By Consumer Group:The consumer group segmentation includes Infants & Young Children, Adolescents, Adults, Pregnant & Lactating Women, and the Elderly Population. The segment for Infants & Young Children is particularly dominant, driven by increasing awareness among parents regarding the importance of calcium for growth and development. This demographic is highly targeted by manufacturers, leading to a surge in specialized products designed to meet their nutritional needs.

The Middle East Calcium Fortified Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., FrieslandCampina N.V., Abbott Laboratories, Arla Foods amba, Almarai Company, Al Ain Farms, Lactalis Group, General Mills, Inc., The Kraft Heinz Company, Unilever PLC, PepsiCo, Inc., The Kellogg Company, SADAFCO (Saudia Dairy & Foodstuff Company), National Dairy Company (Nadec) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East calcium-fortified food market appears promising, driven by increasing health awareness and government support for nutritional initiatives. As consumer preferences shift towards healthier options, the market is likely to witness a surge in innovative product offerings. Additionally, the expansion of e-commerce platforms will facilitate greater access to fortified foods, enabling manufacturers to reach a broader audience. This evolving landscape presents significant opportunities for growth and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Calcium-Fortified Dairy Products (Milk, Yogurt, Cheese) Calcium-Fortified Non-Dairy Alternatives (Plant-Based Milks & Yogurts) Calcium-Fortified Cereals & Snack Bars Calcium-Fortified Bakery & Cereal-Based Products Infant & Child Nutrition Products (Formula, Growing-Up Milks) Dietary Supplements & Functional Beverages |

| By Consumer Group | Infants & Young Children Adolescents Adults Pregnant & Lactating Women Elderly Population |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores & Groceries Online Retail & E-Commerce Platforms Pharmacies & Drug Stores Specialty & Health Food Stores |

| By Fortification Source | Calcium Carbonate–Fortified Products Calcium Citrate–Fortified Products Other Calcium Salts & Mineral Blends Naturally Calcium-Rich Fortified Bases (e.g., Sesame, Almond, etc.) |

| By Price Range | Economy Mid-Range Premium Super-Premium / Organic & Clean-Label |

| By Health Positioning | Bone & Joint Health Focused Products Women’s Health & Maternal Nutrition Products Sports & Performance Nutrition Products General Wellness & Preventive Nutrition Products |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman & Bahrain Rest of GCC Egypt Rest of Middle East & North Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market for Calcium Fortified Foods | 150 | Store Managers, Category Buyers |

| Food Manufacturing Sector Insights | 100 | Production Managers, Quality Assurance Officers |

| Consumer Awareness and Preferences | 120 | Health-Conscious Consumers, Parents |

| Nutrition and Health Expert Opinions | 50 | Registered Dietitians, Nutrition Researchers |

| Distribution Channel Analysis | 80 | Logistics Managers, Supply Chain Analysts |

The Middle East Calcium Fortified Food Market is valued at approximately USD 135 million, reflecting a significant growth trend driven by increasing health awareness, rising calcium deficiency, and a demand for fortified food products tailored to various dietary needs.