Region:Middle East

Author(s):Dev

Product Code:KRAB8615

Pages:92

Published On:October 2025

By Type:The market is segmented into various types of solutions that cater to different compliance needs. The primary subsegments include Customer Onboarding Solutions, Transaction Monitoring Systems, Risk Assessment Tools, Identity Verification Services, Compliance Management Software, Reporting Solutions, and Others. Among these, Customer Onboarding Solutions and Transaction Monitoring Systems are particularly significant due to their critical roles in ensuring compliance and mitigating risks associated with financial transactions.

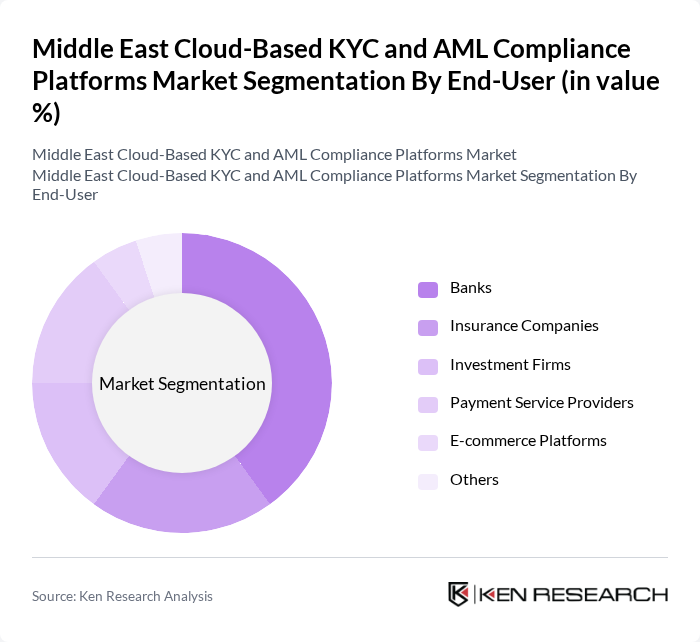

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Service Providers, E-commerce Platforms, and Others. Banks are the leading end-users of cloud-based KYC and AML compliance platforms, driven by stringent regulatory requirements and the need for robust risk management solutions. The increasing digitalization of banking services has further propelled the demand for these platforms among financial institutions.

The Middle East Cloud-Based KYC and AML Compliance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as FICO, SAS Institute Inc., Oracle Corporation, Amlify, ComplyAdvantage, NICE Actimize, LexisNexis Risk Solutions, Refinitiv, Actico, Verafin, RiskScreen, InfrasoftTech, Quantexa, Experian, Amlify contribute to innovation, geographic expansion, and service delivery in this space.

The future of cloud-based KYC and AML compliance platforms in the Middle East appears promising, driven by technological advancements and increasing regulatory scrutiny. As financial institutions prioritize digital transformation, the integration of AI and machine learning will enhance compliance efficiency and accuracy. Furthermore, the growing emphasis on real-time monitoring will lead to the development of more sophisticated solutions, ensuring that organizations can swiftly adapt to evolving threats and regulatory requirements, thereby fostering a secure financial environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Customer Onboarding Solutions Transaction Monitoring Systems Risk Assessment Tools Identity Verification Services Compliance Management Software Reporting Solutions Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Service Providers E-commerce Platforms Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Compliance Type | KYC Compliance AML Compliance Sanctions Screening Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| By Pricing Model | Subscription-Based Pay-Per-Use License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Compliance | 150 | Compliance Officers, Risk Management Heads |

| Insurance Industry KYC Practices | 100 | AML Compliance Managers, Underwriting Directors |

| Fintech Solutions Adoption | 80 | CTOs, Product Managers in Compliance Tech |

| Regulatory Body Insights | 50 | Regulatory Analysts, Policy Makers |

| Consulting Firms on Compliance Strategies | 70 | Consultants, Industry Analysts |

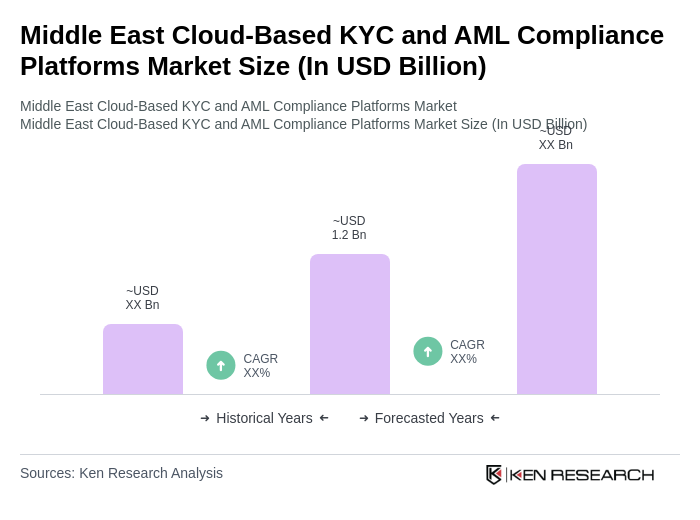

The Middle East Cloud-Based KYC and AML Compliance Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing regulatory requirements and the rise of digital banking and online transactions.