Region:Middle East

Author(s):Rebecca

Product Code:KRAD4986

Pages:95

Published On:December 2025

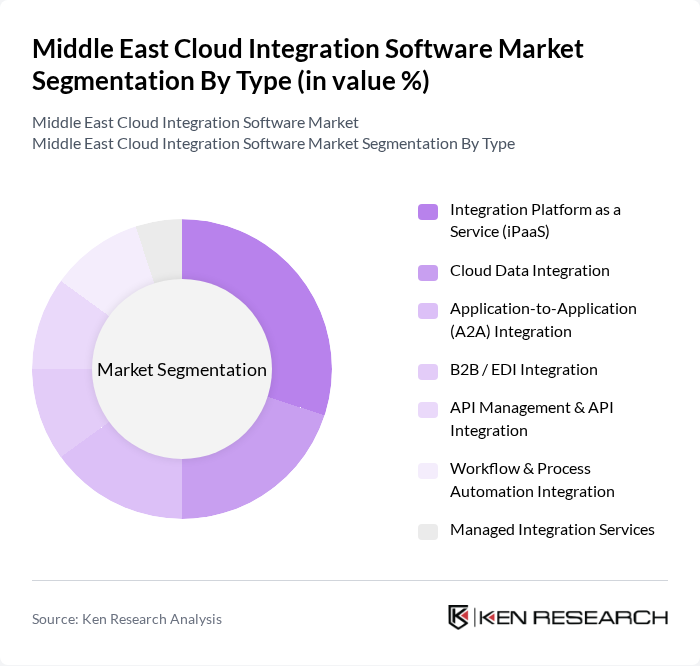

By Type:The market is segmented into various types of cloud integration solutions, including Integration Platform as a Service (iPaaS), Cloud Data Integration, Application-to-Application (A2A) Integration, B2B / EDI Integration, API Management & API Integration, Workflow & Process Automation Integration, and Managed Integration Services. Among these, iPaaS is gaining significant traction due to its ability to facilitate seamless integration across multiple cloud applications and on-premises systems, support reusable connectors and APIs, and provide low-code tooling that makes it a preferred choice for businesses looking to streamline their operations and accelerate SaaS adoption.

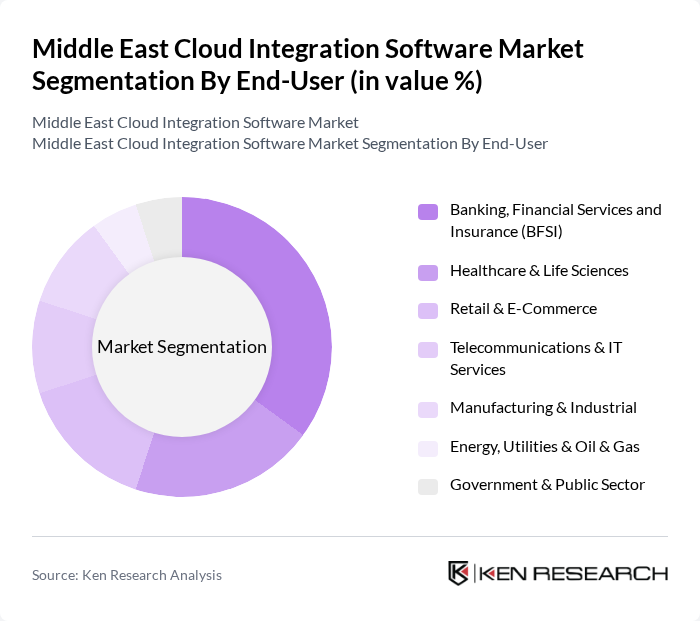

By End-User:The end-user segmentation includes Banking, Financial Services and Insurance (BFSI), Healthcare & Life Sciences, Retail & E-Commerce, Telecommunications & IT Services, Manufacturing & Industrial, Energy, Utilities & Oil & Gas, Government & Public Sector, and Others. The BFSI sector is leading the market due to its critical need for secure and efficient data integration solutions to manage customer data, meet stringent regulatory and reporting requirements, enable real-time payments, and support omnichannel digital banking and insurance experiences.

The Middle East Cloud Integration Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft (Azure Integration Services, Azure Logic Apps), Oracle (Oracle Cloud Infrastructure Integration, Oracle Integration Cloud), IBM (IBM Cloud Pak for Integration), SAP (SAP Integration Suite, SAP Cloud Platform Integration), Salesforce (Salesforce Integration Cloud, MuleSoft Anypoint Platform), Informatica (Informatica Intelligent Cloud Services), Boomi (Boomi iPaaS, formerly Dell Boomi), TIBCO Software (TIBCO Cloud Integration), SnapLogic, Jitterbit, Workato, Talend, Software AG (webMethods.io, based in Germany with strong Middle East presence), Seeburger (SEEBURGER Business Integration Suite), STS Group (Jordan – regional cloud and integration services provider) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East cloud integration software market appears promising, driven by technological advancements and increasing digitalization across industries. As organizations prioritize agility and innovation, the adoption of multi-cloud strategies and serverless computing is expected to rise. Additionally, sustainability initiatives will shape cloud solutions, with companies seeking environmentally friendly practices. This evolving landscape will create new opportunities for vendors to offer tailored solutions that address specific regional needs and compliance requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Integration Platform as a Service (iPaaS) Cloud Data Integration Application-to-Application (A2A) Integration B2B / EDI Integration API Management & API Integration Workflow & Process Automation Integration Managed Integration Services |

| By End-User | Banking, Financial Services and Insurance (BFSI) Healthcare & Life Sciences Retail & E?Commerce Telecommunications & IT Services Manufacturing & Industrial Energy, Utilities & Oil & Gas Government & Public Sector Others (Media & Entertainment, Transportation & Logistics, Hospitality, etc.) |

| By Deployment Model | Public Cloud Private Cloud Hybrid / Multi?Cloud |

| By Industry Vertical | Government & Public Sector Education Manufacturing Energy, Utilities & Oil & Gas Transportation & Logistics Media & Entertainment Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant Region (Jordan, Lebanon, Iraq, etc.) North Africa (Egypt, Morocco, Algeria, etc.) Others (Pakistan, Turkey, Iran, etc.) |

| By Service Type | Consulting & Advisory Services Integration & Implementation Services Managed Integration & Monitoring Services Support, Training & Maintenance Services |

| By Pricing Model | Subscription-Based (Per User / Per Connector / Per Integration Flow) Pay-As-You-Go (Usage / Consumption-Based) Enterprise License / Custom Contract Freemium & Tiered Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Integration Solutions | 120 | IT Managers, Cloud Architects |

| SME Cloud Adoption Trends | 100 | Business Owners, IT Consultants |

| Public Sector Digital Transformation | 80 | Government IT Officials, Policy Makers |

| Healthcare Cloud Integration | 60 | Healthcare IT Directors, CIOs |

| Financial Services Cloud Solutions | 90 | Banking IT Managers, Compliance Officers |

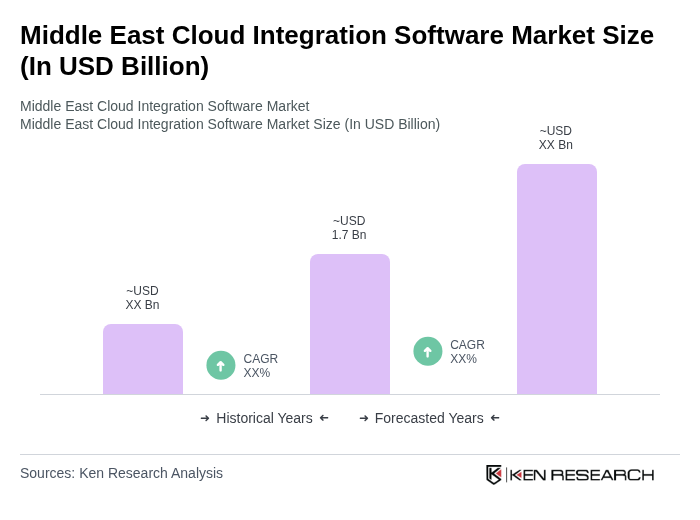

The Middle East Cloud Integration Software Market is valued at approximately USD 1.7 billion, reflecting its significant role within the global cloud integration software market and the broader regional cloud infrastructure ecosystem.