Region:Middle East

Author(s):Dev

Product Code:KRAC4059

Pages:91

Published On:October 2025

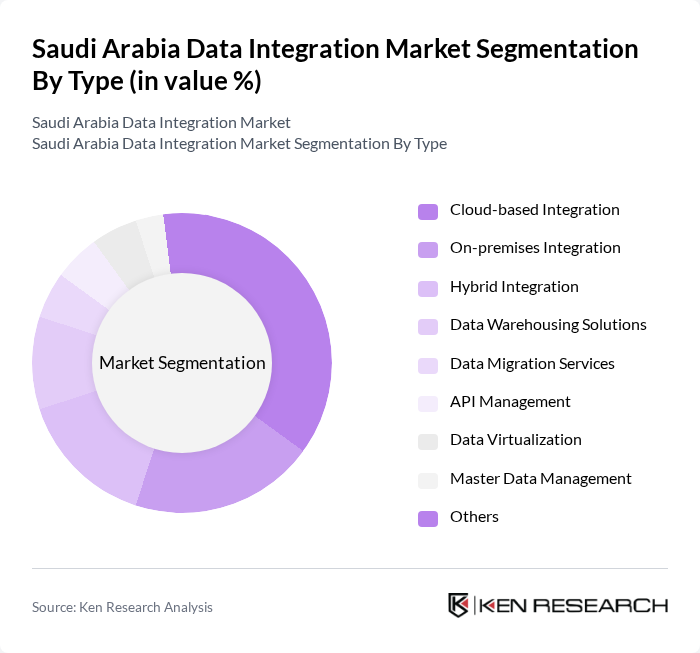

By Type:The market is segmented into Cloud-based Integration, On-premises Integration, Hybrid Integration, Data Warehousing Solutions, Data Migration Services, API Management, Data Virtualization, Master Data Management, and Others. Cloud-based Integration is gaining significant traction due to its scalability, cost-effectiveness, and ability to support real-time analytics and AI-driven applications. Data Warehousing Solutions remain essential for organizations consolidating and analyzing large volumes of structured and unstructured data, especially as enterprises seek to modernize legacy systems and enable business intelligence .

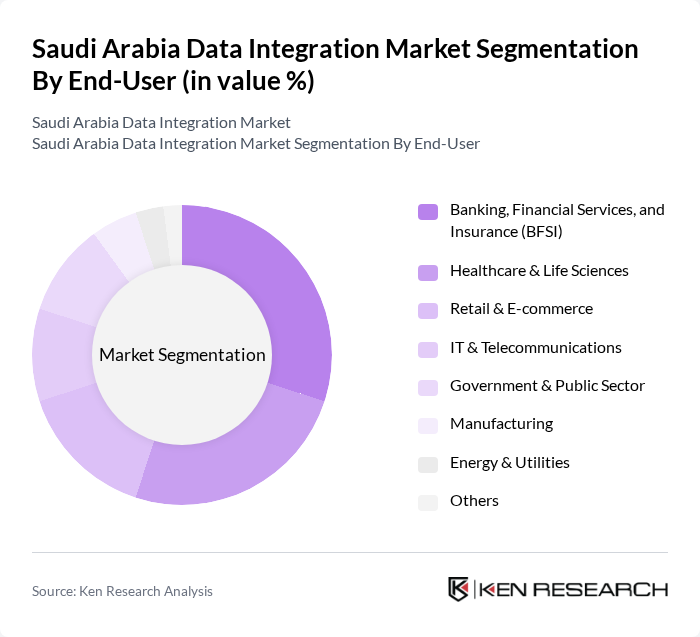

By End-User:The end-user segmentation includes Banking, Financial Services, and Insurance (BFSI), Healthcare & Life Sciences, Retail & E-commerce, IT & Telecommunications, Government & Public Sector, Manufacturing, Energy & Utilities, and Others. The BFSI sector leads the market, driven by regulatory compliance, risk management, and the need for real-time customer data access. Healthcare & Life Sciences are rapidly adopting integration solutions to improve patient care, enable digital health records, and support analytics for operational efficiency. Retail & E-commerce is the fastest-growing segment, leveraging data integration for omnichannel strategies and personalized customer experiences .

The Saudi Arabia Data Integration Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Informatica LLC, Talend S.A., MuleSoft, a Salesforce Company, TIBCO Software Inc., Dell Technologies Inc., SAS Institute Inc., SnapLogic Inc., Boomi, a Dell Technologies Company, Jitterbit Inc., Astera Software, Informatica Saudi Arabia (local entity), Ejada Systems Ltd., STC Solutions (Saudi Telecom Company), Sahara Net, Al Moammar Information Systems (MIS), Jeraisy Computer & Communication Services contribute to innovation, geographic expansion, and service delivery in this space .

The future of the data integration market in Saudi Arabia appears promising, driven by technological advancements and a strong push towards digital transformation. As organizations increasingly adopt hybrid integration solutions, the focus will shift towards enhancing data quality and accuracy. Furthermore, the rise of self-service data integration tools will empower businesses to manage their data more effectively, fostering innovation and efficiency. The emphasis on sustainability will also shape future strategies, as companies seek energy-efficient data solutions to align with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based Integration On-premises Integration Hybrid Integration Data Warehousing Solutions Data Migration Services API Management Data Virtualization Master Data Management Others |

| By End-User | Banking, Financial Services, and Insurance (BFSI) Healthcare & Life Sciences Retail & E-commerce IT & Telecommunications Government & Public Sector Manufacturing Energy & Utilities Others |

| By Application | Customer Data Integration Operational Data Integration Analytical Data Integration Real-time Data Integration Data Migration Data Synchronization Data Replication Others |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud |

| By Industry Vertical | Financial Services Healthcare Retail & E-commerce Government IT & Telecommunications Manufacturing Energy & Utilities Others |

| By Service Type | Consulting Services Implementation Services Support and Maintenance Services Managed Services |

| By Pricing Model | Subscription-based Pay-as-you-go One-time License Fee Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Data Integration | 80 | IT Managers, Data Analysts, Healthcare Administrators |

| Financial Services Data Management | 60 | Chief Data Officers, Risk Management Executives |

| Telecommunications Data Solutions | 50 | Network Architects, Data Engineers |

| Government Data Integration Projects | 40 | Policy Makers, IT Directors, Project Managers |

| Retail Sector Data Analytics | 70 | Business Intelligence Analysts, Marketing Managers |

The Saudi Arabia Data Integration Market is valued at approximately USD 210 million, reflecting a significant growth driven by the increasing demand for data-driven decision-making and the rapid adoption of cloud technologies.