Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2369

Pages:85

Published On:October 2025

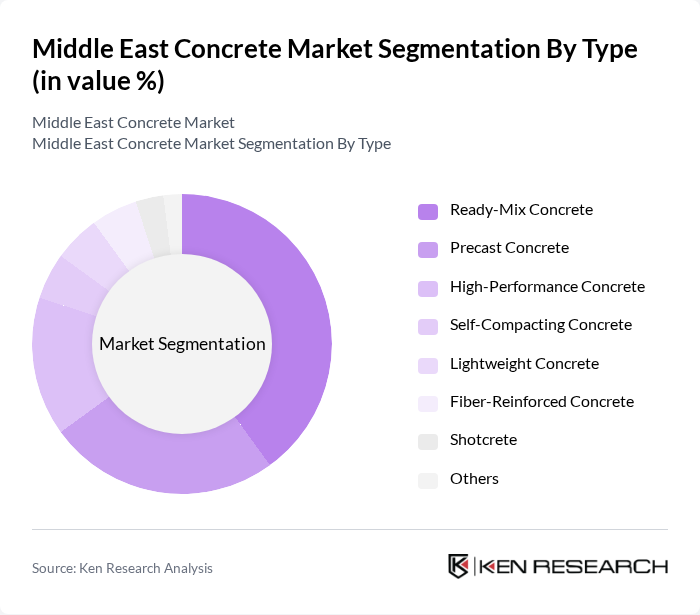

By Type:The concrete market is segmented into various types, including Ready-Mix Concrete, Precast Concrete, High-Performance Concrete, Self-Compacting Concrete, Lightweight Concrete, Fiber-Reinforced Concrete, Shotcrete, and Others. Among these, Ready-Mix Concrete is the most dominant segment due to its convenience, consistent quality, and efficiency in large-scale construction projects. The increasing demand for rapid, reliable, and sustainable concrete solutions in urban development and infrastructure has led to a significant rise in its usage .

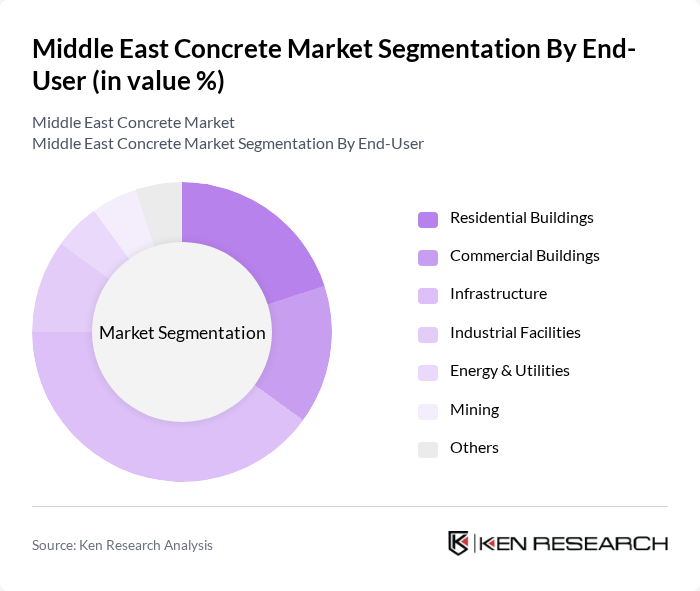

By End-User:The end-user segmentation includes Residential Buildings, Commercial Buildings, Infrastructure (Roads, Highways, Bridges, Tunnels, Airports, Ports), Industrial Facilities, Energy & Utilities (Dams, Power Plants), Mining, and Others. The Infrastructure segment is the leading end-user category, driven by extensive government spending on transportation and public works projects, which require large volumes of concrete. The region’s focus on smart cities, logistics hubs, and energy projects further accelerates demand from this segment .

The Middle East Concrete Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Readymix Concrete Co., Al Falah Ready Mix, Lafarge (Holcim Group), CEMEX UAE, Arabian Cement Company, Qatar National Cement Company, Emirates Cement Company (Arkan Building Materials), Al Ghurair Construction Readymix, National Cement Company (Dubai), Bina Ready Mix (Bina Precast), Al Jazeera Ready Mix, Al Kifah Ready Mix, Union Cement Company, Gulf Precast Concrete Co., and Suez Cement Group contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East concrete market is poised for significant transformation driven by technological advancements and sustainability initiatives. As governments push for greener construction practices, the adoption of smart concrete technologies and recycled materials is expected to rise. Additionally, the integration of digital tools in construction processes will enhance efficiency and reduce costs. These trends indicate a shift towards more sustainable and innovative practices, positioning the region for a resilient and adaptive concrete industry in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ready-Mix Concrete Precast Concrete High-Performance Concrete Self-Compacting Concrete Lightweight Concrete Fiber-Reinforced Concrete Shotcrete Others |

| By End-User | Residential Buildings Commercial Buildings Infrastructure (Roads, Highways, Bridges, Tunnels, Airports, Ports) Industrial Facilities Energy & Utilities (Dams, Power Plants) Mining Others |

| By Application | Structural Components (Beams, Columns, Slabs, Walls) Architectural Components (Façades, Decorative Elements) Pavements and Roads Tunnels and Underground Structures Water Retaining Structures Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Retail Outlets Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant (Jordan, Lebanon, Syria, Palestine, Iraq) North Africa (Egypt, Libya, Algeria, Morocco, Tunisia) Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| By Technology | Conventional Mixing Automated Mixing Mobile Mixing D Printing/Advanced Manufacturing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Project Managers, Site Supervisors |

| Commercial Infrastructure Developments | 90 | Construction Managers, Architects |

| Public Sector Infrastructure Initiatives | 60 | Government Officials, Urban Planners |

| Concrete Manufacturing Sector | 50 | Production Managers, Quality Control Officers |

| Supply Chain and Distribution Networks | 60 | Logistics Coordinators, Sales Managers |

The Middle East Concrete Market is valued at approximately USD 115 billion, driven by rapid urbanization, infrastructure development, and significant investments in construction projects across the region.