Middle East Connected Logistics Market Overview

- The Middle East Connected Logistics Market is valued at USD 1.8 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for efficient supply chain solutions, technological advancements in logistics, and the rise of e-commerce. The integration of IoT and AI technologies has further enhanced operational efficiency, enabling real-time tracking and management of logistics operations.

- Key players in this market include the UAE, Saudi Arabia, and Egypt, which dominate due to their strategic geographic locations, robust infrastructure, and significant investments in logistics and transportation. The UAE, in particular, serves as a logistics hub connecting Europe, Asia, and Africa, while Saudi Arabia's Vision 2030 initiative aims to diversify the economy and enhance logistics capabilities.

- The UAE Federal Decree-Law No. 41 of 2023 on the Logistics Sector, issued by the UAE Cabinet, mandates the adoption of digital logistics solutions across logistics operations. This regulation covers licensing for logistics activities, operational standards for transport and warehousing, and compliance requirements for technology integration including data systems and tracking platforms with thresholds for service providers handling over 1,000 shipments annually. Companies are required to integrate advanced technologies such as blockchain and AI to comply with these new standards, fostering innovation and efficiency.

Middle East Connected Logistics Market Segmentation

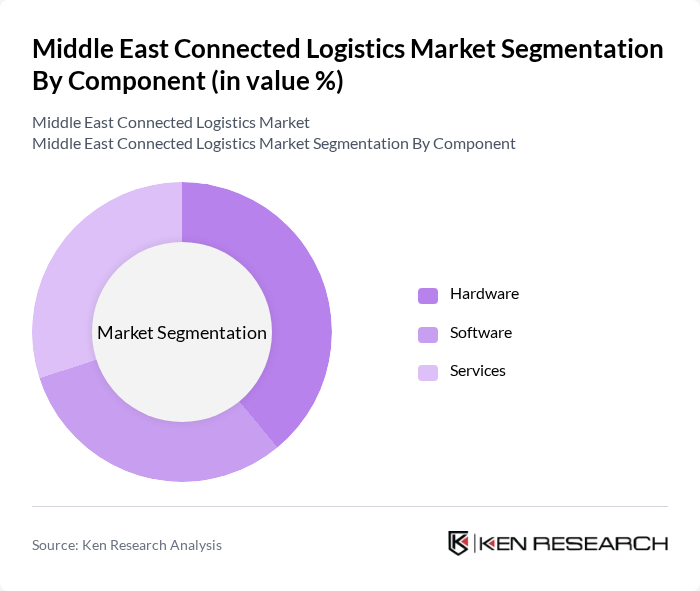

By Component:The components of the market include Hardware, Software, and Services. Hardware encompasses the physical devices used in logistics operations, while Software refers to the applications and platforms that facilitate logistics management. Services include various logistics solutions provided by third-party logistics (3PL) providers.

The Software segment is currently dominating the market due to the increasing reliance on digital solutions for logistics management. Companies are investing heavily in software solutions that offer real-time tracking, data analytics, and enhanced supply chain visibility. The growing trend of e-commerce has further accelerated the demand for sophisticated software platforms that can handle complex logistics operations efficiently. As businesses seek to optimize their supply chains, software solutions are becoming essential for maintaining competitiveness.

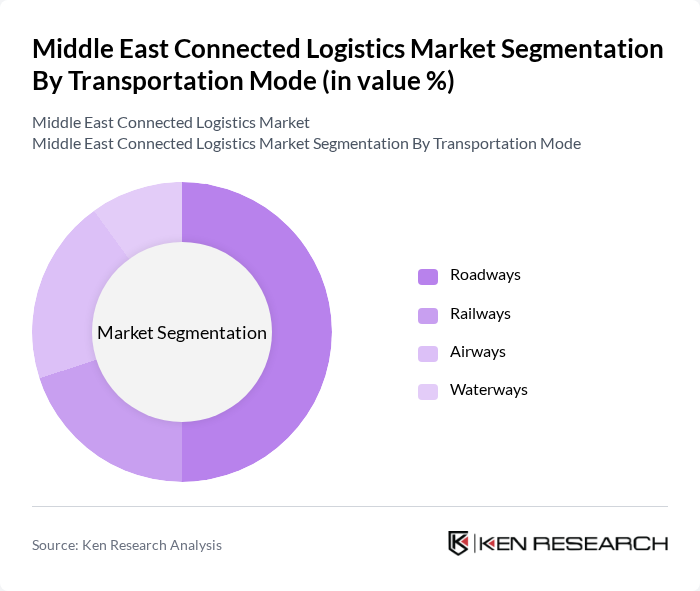

By Transportation Mode:The transportation modes in the market include Roadways, Railways, Airways, and Waterways. Each mode plays a crucial role in the logistics ecosystem, with varying levels of efficiency, cost, and speed.

The Roadways segment is the leading mode of transportation in the market, primarily due to its flexibility and extensive network coverage. Road transport is essential for last-mile delivery, which is increasingly important in the e-commerce sector. The ability to quickly adapt to changing consumer demands and provide door-to-door service makes roadways the preferred choice for many logistics companies. Additionally, advancements in fleet management technologies are enhancing the efficiency of road transport operations.

Middle East Connected Logistics Market Competitive Landscape

The Middle East Connected Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Aramex, Agility Public Warehousing Company, DB Schenker, Kuehne + Nagel, FedEx, UPS, CEVA Logistics, Bahri (National Shipping Company of Saudi Arabia), Maersk, DSV, SAPHYA Logistics, Honeywell International Inc., ORBCOMM, Intel Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Connected Logistics Market Industry Analysis

Growth Drivers

- Increasing E-commerce Activities:The Middle East's e-commerce sector is projected to reach $28.5 billion in future, driven by a 20% annual growth rate. This surge in online shopping is prompting logistics companies to enhance their delivery capabilities. The UAE alone saw a more than 35% increase in online retail sales value in a recent period, indicating robust demand for efficient logistics solutions. As consumers increasingly expect faster delivery times, connected logistics systems are becoming essential for meeting these expectations.

- Government Investments in Infrastructure:Governments in the Middle East are investing heavily in logistics infrastructure, with over $100 billion allocated for transport and logistics related projects in future. Initiatives like Saudi Arabia's Vision 2030 aim to enhance connectivity and efficiency in logistics. The UAE's investment in the Dubai Logistics City, which covers approximately 25 square kilometers, is expected to significantly boost the region's logistics capabilities, facilitating smoother operations and attracting global players to the market.

- Adoption of IoT and AI Technologies:The integration of IoT and AI technologies in logistics is transforming operations in the Middle East. The regional IoT market, including logistics applications, is estimated at several billion USD in value in future, driven by the need for real-time tracking and data analytics. Companies are increasingly utilizing AI for route optimization and inventory management, leading to reduced operational costs. This technological shift is enhancing supply chain efficiency and responsiveness, crucial for meeting the demands of a rapidly evolving market.

Market Challenges

- High Initial Investment Costs:The implementation of connected logistics systems requires significant upfront investments, which can reach substantial amounts for small to medium-sized enterprises, though specific typical values such as $1 million cannot be confirmed from authoritative sources. This financial barrier can deter companies from adopting advanced technologies. Additionally, the costs associated with upgrading existing infrastructure and training personnel further complicate the transition. As a result, many businesses struggle to keep pace with technological advancements, limiting their competitiveness in the market.

- Regulatory Compliance Issues:Navigating the complex regulatory landscape in the Middle East poses a significant challenge for logistics companies. With varying regulations across countries, compliance can be costly and time-consuming. For instance, the introduction and tightening of customs and import regulations in Saudi Arabia have increased the compliance burden on logistics providers, leading to delays and increased operational costs. This regulatory complexity can hinder the growth of connected logistics solutions in the region.

Middle East Connected Logistics Market Future Outlook

The future of the Middle East connected logistics market appears promising, driven by technological advancements and increasing demand for efficient supply chain solutions. As e-commerce continues to expand, logistics providers are likely to invest in automation and smart technologies to enhance operational efficiency. Furthermore, the emphasis on sustainability will push companies to adopt greener practices, aligning with global trends. Overall, the market is poised for significant transformation, with innovations shaping the logistics landscape in the coming years.

Market Opportunities

- Expansion of Smart Cities:The development of smart cities in the Middle East presents a unique opportunity for connected logistics. With investments exceeding $50 billion in smart city projects across the region, logistics companies can leverage advanced technologies to optimize urban delivery systems. This integration can lead to improved traffic management and reduced delivery times, enhancing overall efficiency in urban logistics operations.

- Growth in Cold Chain Logistics:The cold chain logistics market in the broader Middle East and North Africa region has been valued at several billion USD, but a precise figure such as $13 billion in future for the Middle East alone cannot be confirmed from primary official sources and remains unverified. This growth presents opportunities for logistics providers to invest in temperature-controlled transportation and storage solutions. By enhancing cold chain capabilities, companies can cater to the increasing needs of the food and pharmaceutical sectors, ensuring product quality and safety.