Region:Middle East

Author(s):Shubham

Product Code:KRAD6724

Pages:93

Published On:December 2025

By Type:The market is segmented into various types of digestive health products, including probiotic supplements, prebiotic supplements, digestive enzyme supplements, fiber supplements, herbal and botanical digestive aids, functional foods & beverages, dairy-based digestive health products, and others. Among these, probiotic supplements are leading the market due to their proven benefits in gut health and increasing consumer awareness about the importance of gut microbiome balance. The trend towards natural and organic products is also boosting the demand for herbal and botanical digestive aids.

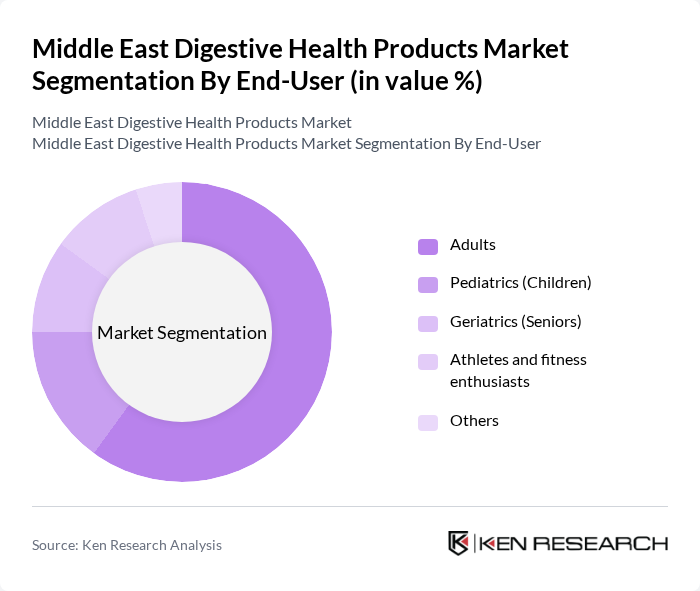

By End-User:The end-user segmentation includes adults, pediatrics (children), geriatrics (seniors), athletes and fitness enthusiasts, and others. Adults represent the largest segment, driven by increasing health consciousness and the prevalence of digestive issues in this demographic. The growing trend of fitness and wellness among younger populations is also contributing to the rise in demand for digestive health products among athletes and fitness enthusiasts.

The Middle East Digestive Health Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Health Science (including Nestlé Middle East & North Africa), Danone (Activia, Actimel, and other digestive health brands), Procter & Gamble (Metamucil and related digestive health products), Abbott Laboratories (including Ensure, Similac, and digestive nutrition lines), Herbalife Nutrition Ltd., Yakult Honsha Co., Ltd., Haleon plc (formerly GSK Consumer Healthcare), Reckitt Benckiser Group plc (including Gaviscon and related brands), Amway Corporation, DSM-Firmenich (nutritional and gut health ingredients), Bayer AG (including digestive health and probiotic supplements), Jamjoom Pharma (regional gastrointestinal and digestive products), Julphar – Gulf Pharmaceutical Industries, Oman Pharmaceutical Products Co. LLC, Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East digestive health products market appears promising, driven by increasing consumer awareness and a growing focus on preventive health measures. Innovations in product formulations, particularly those incorporating natural ingredients, are expected to gain traction. Additionally, the rise of e-commerce platforms is facilitating easier access to these products, allowing companies to reach a broader audience. As health trends evolve, the market is likely to witness a shift towards personalized nutrition solutions tailored to individual digestive health needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Probiotic supplements Prebiotic supplements Digestive enzyme supplements Fiber supplements Herbal and botanical digestive aids Functional foods & beverages (yogurt, fermented dairy, fortified foods) Dairy-based digestive health products Others |

| By End-User | Adults Pediatrics (Children) Geriatrics (Seniors) Athletes and fitness enthusiasts Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies (hospital & community) Health food stores & specialty nutrition stores Online retail & e-commerce Direct sales Others |

| By Region | Saudi Arabia United Arab Emirates Other GCC Countries (Kuwait, Qatar, Bahrain, Oman) Turkey Levant (Jordan, Lebanon, etc.) Rest of Middle East & North Africa |

| By Product Form | Tablets Capsules Powders & sachets Liquids Gummies & chewables Others |

| By Age Group | Children Adults Seniors Others |

| By Health Benefit | Management of bloating, gas, and indigestion Constipation relief & bowel regularity Irritable bowel syndrome (IBS) and gut discomfort Gut microbiome balance & overall digestive wellness Immune support Weight management & metabolic support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Awareness of Digestive Health Products | 120 | General Consumers, Health-Conscious Individuals |

| Healthcare Professional Insights | 100 | Gastroenterologists, Nutritionists, Dietitians |

| Retailer Perspectives on Digestive Health Products | 80 | Pharmacy Managers, Health Food Store Owners |

| Market Trends and Consumer Preferences | 100 | Market Analysts, Health Product Distributors |

| Product Efficacy and Consumer Feedback | 90 | Regular Users of Digestive Health Products, Health Bloggers |

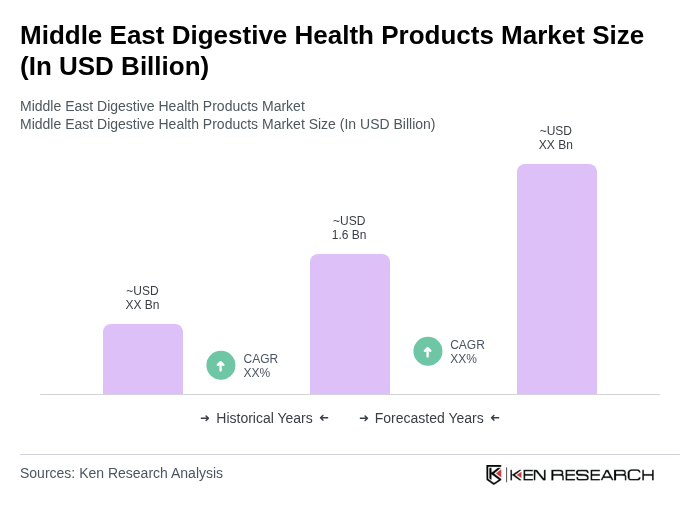

The Middle East Digestive Health Products Market is valued at approximately USD 1.6 billion, reflecting a significant growth trend driven by increasing health awareness and the rising prevalence of digestive disorders among the population.