Region:Middle East

Author(s):Shubham

Product Code:KRAD0862

Pages:93

Published On:November 2025

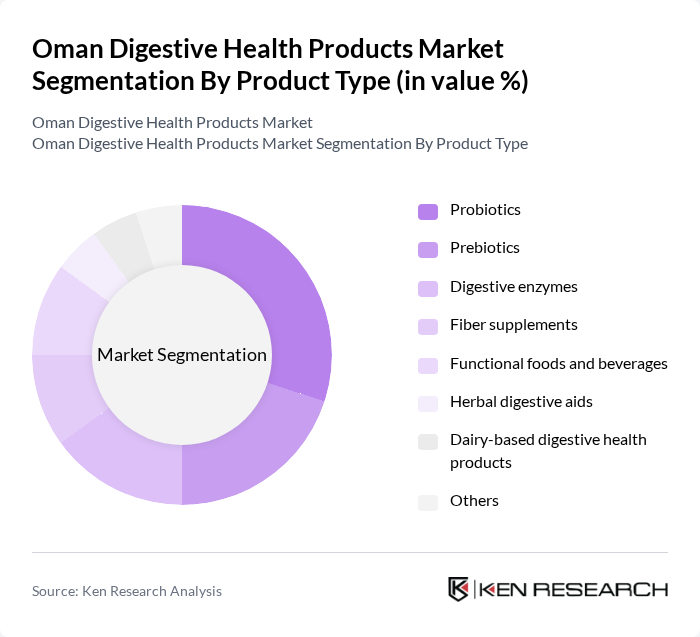

By Product Type:The product type segmentation includes various categories such as probiotics, prebiotics, digestive enzymes, fiber supplements, functional foods and beverages, herbal digestive aids, dairy-based digestive health products, and others. Among these, probiotics are gaining significant traction due to their proven benefits in gut health and immunity. The increasing consumer awareness regarding the importance of gut microbiome balance is driving the demand for probiotics, making them the leading subsegment in the market. Prebiotics and digestive enzymes are also witnessing strong growth, supported by rising interest in holistic digestive wellness and targeted formulations for specific digestive concerns .

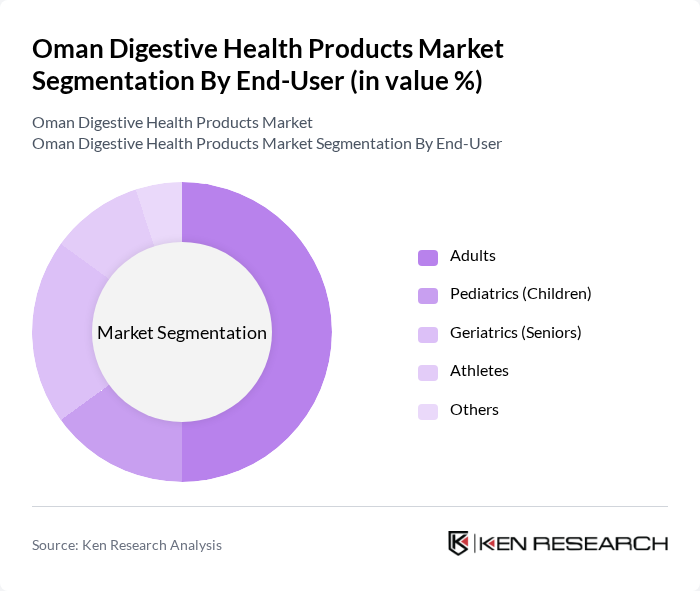

By End-User:The end-user segmentation includes adults, pediatrics (children), geriatrics (seniors), athletes, and others. Adults represent the largest consumer group, driven by increasing health consciousness and the prevalence of digestive issues in this demographic. The growing trend of self-medication and preventive health measures among adults is propelling the demand for digestive health products tailored to their needs. The pediatric and geriatric segments are also expanding, supported by rising awareness of early gut health intervention and age-related digestive challenges .

The Oman Digestive Health Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Pharmaceutical Products Co. LLC, Muscat Pharmacy & Stores LLC, Al Nahda International Medical Company, Dhofar Pharmaceutical Industries LLC, Oman Medical Supplies & Services Co. LLC, Al Jazeera Pharmaceutical Industries LLC, United Pharmaceuticals LLC, Gulf Pharmaceutical Industries (Julphar), Al Ahlia Pharmaceutical Company, Al Batinah Pharmaceuticals LLC, Oman Health Products LLC, Muscat Nutraceuticals LLC, Al Harthy Group, Al Mufeedah Trading LLC, Al Muna Trading LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman digestive health products market appears promising, driven by increasing consumer awareness and a shift towards preventive healthcare. As more individuals prioritize their health, the demand for innovative and effective digestive solutions is expected to rise. Additionally, the integration of technology in health consultations and personalized nutrition will likely enhance product offerings, catering to the specific needs of consumers and fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Probiotics Prebiotics Digestive enzymes Fiber supplements Functional foods and beverages Herbal digestive aids Dairy-based digestive health products Others |

| By End-User | Adults Pediatrics (Children) Geriatrics (Seniors) Athletes Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online retail Health food stores Pharmacies (including hospital and community pharmacies) Direct sales Others |

| By Formulation | Tablets Capsules Powders Liquids Gummies & Chewables Others |

| By Age Group | Children Adults Seniors Others |

| By Health Concern | Bloating Constipation Diarrhea Irritable bowel syndrome Gut microbiome balance Others |

| By Packaging Type | Bottles Sachets Blister packs Jars Eco-friendly packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Digestive Health Products | 120 | Health-conscious Consumers, Regular Supplement Users |

| Healthcare Provider Insights on Digestive Health | 60 | Gastroenterologists, General Practitioners |

| Retailer Perspectives on Product Demand | 40 | Pharmacy Managers, Health Food Store Owners |

| Market Trends in Nutritional Supplements | 50 | Nutritionists, Dietitians |

| Consumer Awareness of Digestive Health Issues | 70 | General Public, Health Enthusiasts |

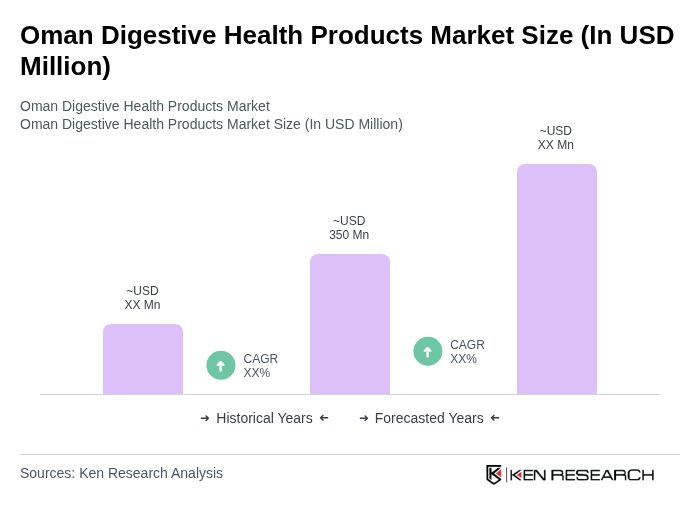

The Oman Digestive Health Products Market is valued at approximately USD 350 million, reflecting a significant growth trend driven by increasing health awareness, rising digestive disorders, and a shift towards preventive healthcare among consumers.