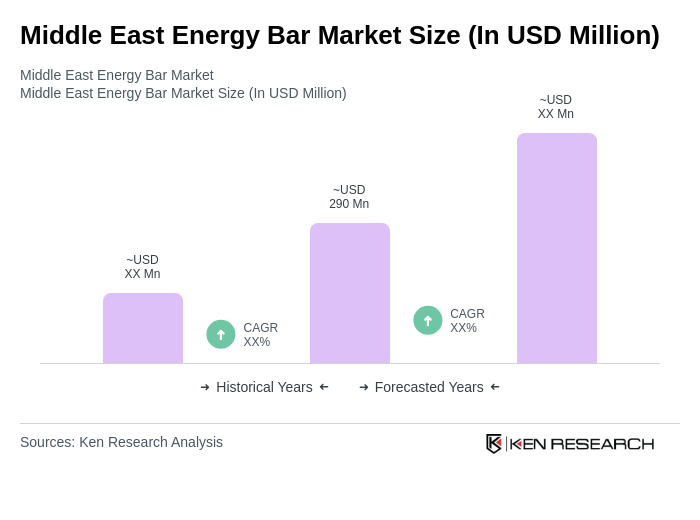

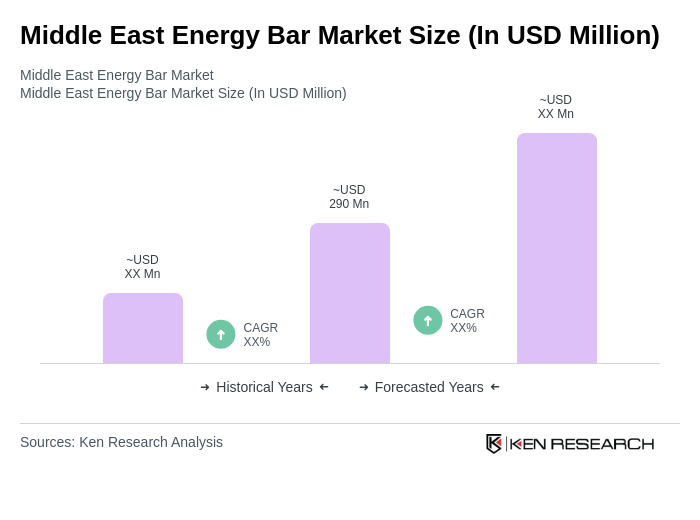

Middle East Energy Bar Market Overview

- The Middle East Energy Bar Market is valued at USD 290 million, based on a five-year historical analysis. This growth is primarily driven by rising health consciousness among consumers, increased participation in fitness and athleisure activities, and the expanding trend of on-the-go snacking. The market is further supported by the proliferation of supermarkets, hypermarkets, and online retail channels, which enhance product accessibility and convenience for consumers. The demand for energy bars continues to surge as consumers seek convenient, nutritious options to support active lifestyles and wellness goals .

- Key players in this market include the United Arab Emirates, Saudi Arabia, and Israel. The UAE leads due to its robust retail infrastructure and high disposable income, while Saudi Arabia benefits from a large population and growing health awareness. Israel's innovative food technology sector also contributes to its market prominence, with a strong focus on health-oriented products and functional ingredients. These countries demonstrate higher per capita consumption and brand diversification compared to other regional markets .

- In 2023, the Saudi Food and Drug Authority (SFDA) implemented the "Food Labeling Requirements Regulation, 2023," mandating that all packaged food products, including energy bars, must display clear nutritional information on their labels. This regulation, issued by the SFDA, aims to enhance consumer awareness and encourage healthier choices, thereby positively influencing the energy bar market. The regulation requires standardized labeling formats and compliance with nutrient disclosure thresholds for packaged foods .

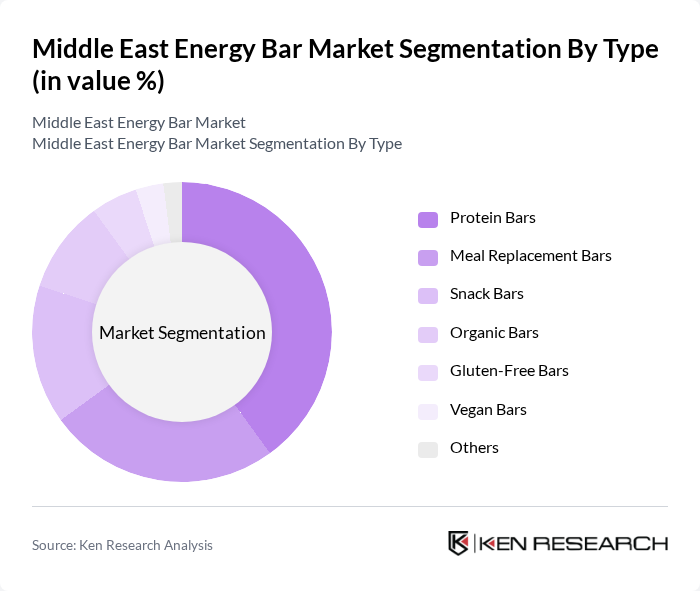

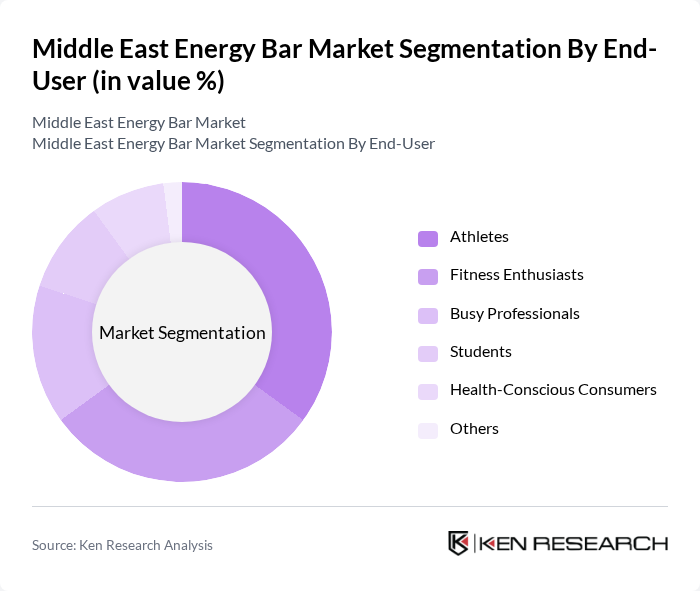

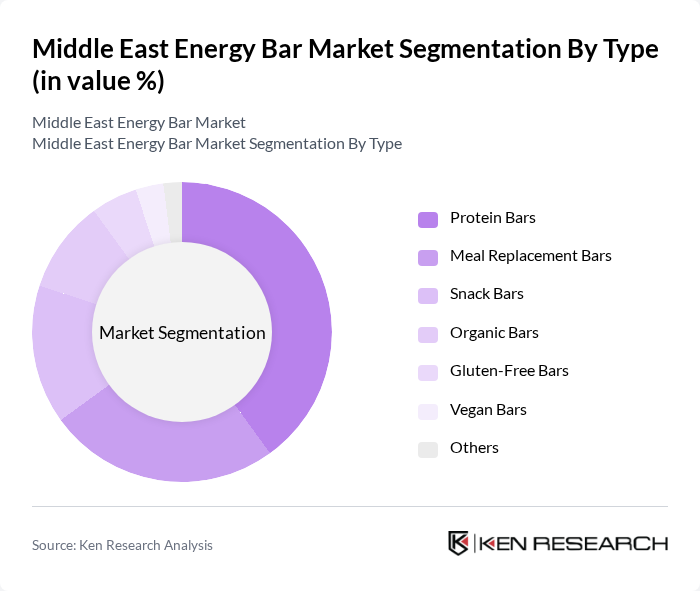

Middle East Energy Bar Market Segmentation

By Type:The energy bar market is segmented into Protein Bars, Meal Replacement Bars, Snack Bars, Organic Bars, Gluten-Free Bars, Vegan Bars, and Others. Protein Bars hold the largest market share, driven by their high protein content and appeal to fitness enthusiasts and athletes seeking quick nutrition. The growing trend of health and fitness, coupled with increased interest in functional ingredients such as probiotics and adaptogens, has led to heightened demand for protein-rich snacks. Organic, gluten-free, and vegan bars are also gaining traction among health-conscious consumers seeking specialized dietary options .

By End-User:The market is segmented by end-users, including Athletes, Fitness Enthusiasts, Busy Professionals, Students, Health-Conscious Consumers, and Others. Athletes represent the leading sub-segment, driven by their need for quick energy and recovery options post-exercise. The increasing participation in sports and fitness activities, coupled with the rise of gym memberships and wellness programs, has led to a higher demand for energy bars among this demographic. Fitness enthusiasts and busy professionals also contribute significantly, seeking convenient nutrition for active and fast-paced lifestyles .

Middle East Energy Bar Market Competitive Landscape

The Middle East Energy Bar Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Mills, Inc., Quest Nutrition, LLC, Post Holdings, KIND LLC, Optimum Nutrition, Inc., Nestlé S.A., Clif Bar & Company, RXBAR, Atkins Nutritionals, Inc., GoMacro, LLC contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Energy Bar Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The Middle East has seen a significant rise in health awareness, with 60% of the population actively seeking healthier food options. According to the World Health Organization, obesity rates in the region have increased by 20% over the last decade, prompting consumers to opt for nutritious snacks like energy bars. This shift is supported by a growing number of health campaigns and initiatives aimed at promoting better dietary choices, further driving the demand for energy bars.

- Rising Demand for Convenient Snacks:The convenience food market in the Middle East is projected to reach $30 billion in the future, with energy bars becoming a popular choice among busy consumers. A survey by Euromonitor International indicates that 45% of consumers prefer on-the-go snacks due to their hectic lifestyles. This trend is particularly evident among urban populations, where the demand for quick, nutritious options is increasing, thus boosting energy bar sales significantly.

- Growth in Fitness and Sports Activities:The fitness industry in the Middle East is expanding rapidly, with a 15% annual growth rate in gym memberships reported by the International Health, Racquet & Sportsclub Association. This surge in fitness activities has led to a higher demand for energy bars as a source of nutrition for athletes and fitness enthusiasts. The increasing number of sports events and marathons in the region further contributes to this trend, creating a robust market for energy bars.

Market Challenges

- High Competition:The energy bar market in the Middle East is characterized by intense competition, with over 200 brands vying for market share. According to a report by Mordor Intelligence, the top five brands account for nearly 40% of the market, making it challenging for new entrants to establish themselves. This competitive landscape necessitates significant marketing investments and innovation to differentiate products, which can strain resources for smaller companies.

- Price Sensitivity Among Consumers:Economic fluctuations in the Middle East have led to increased price sensitivity among consumers, with 70% of shoppers prioritizing cost over brand loyalty. The IMF projects a 3% inflation rate in the region for the future, which may further impact consumer purchasing behavior. As a result, energy bar manufacturers must balance quality and affordability to attract price-conscious consumers, complicating pricing strategies in the market.

Middle East Energy Bar Market Future Outlook

The Middle East energy bar market is poised for dynamic growth, driven by evolving consumer preferences towards healthier and convenient snack options. As the region's fitness culture continues to flourish, energy bars are likely to gain traction among health-conscious individuals. Additionally, the rise of e-commerce platforms will facilitate broader distribution, making these products more accessible. Companies that innovate with flavors and focus on sustainability will likely capture a larger share of this expanding market, aligning with consumer trends towards organic and eco-friendly products.

Market Opportunities

- Introduction of Innovative Flavors:There is a growing opportunity for energy bar manufacturers to introduce unique flavors that cater to local tastes. With the Middle East's diverse culinary heritage, incorporating regional ingredients can attract consumers seeking novel experiences, potentially increasing market share and brand loyalty.

- Growth of E-commerce Platforms:The rise of e-commerce in the Middle East, projected to reach $28 billion in the future, presents a significant opportunity for energy bar brands. By leveraging online sales channels, companies can reach a broader audience, enhance customer engagement, and streamline distribution, ultimately driving sales growth in this competitive market.