Region:Middle East

Author(s):Rebecca

Product Code:KRAD5012

Pages:94

Published On:December 2025

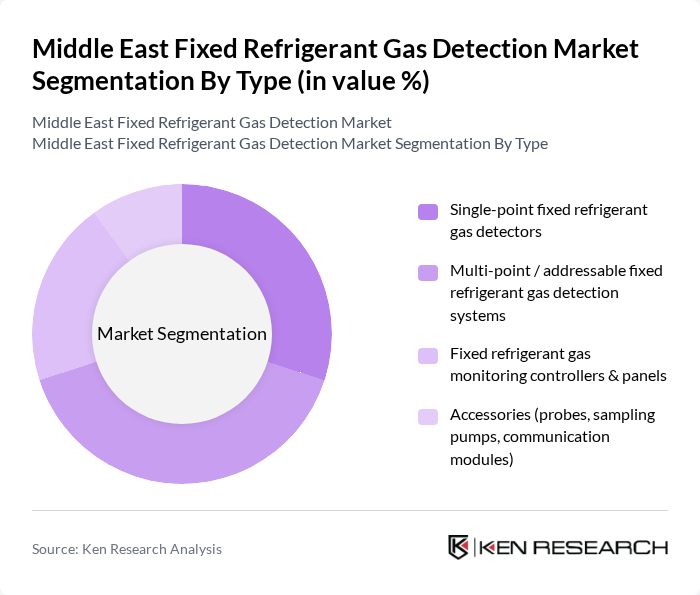

By Type:The market is segmented into four main types: Single-point fixed refrigerant gas detectors, Multi-point / addressable fixed refrigerant gas detection systems, Fixed refrigerant gas monitoring controllers & panels, and Accessories (probes, sampling pumps, communication modules). Each of these subsegments plays a crucial role in ensuring safety and compliance in various applications, with multi-point and addressable systems increasingly preferred in large commercial and industrial facilities for centralized monitoring and integration with building management and fire alarm systems.

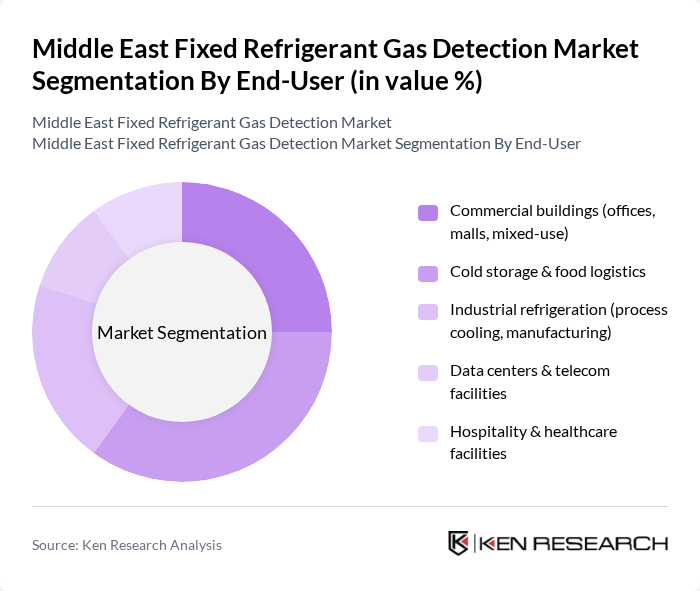

By End-User:The end-user segmentation includes Commercial buildings (offices, malls, mixed-use), Cold storage & food logistics, Industrial refrigeration (process cooling, manufacturing), Data centers & telecom facilities, and Hospitality & healthcare facilities. Each sector has unique requirements for gas detection systems, with cold storage, food logistics, and industrial refrigeration increasingly deploying fixed detectors to meet food safety, worker protection, and environmental standards, while commercial buildings, data centers, and healthcare facilities emphasize integration with building management systems and continuous monitoring of mechanical and chiller rooms.

The Middle East Fixed Refrigerant Gas Detection Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc. (Honeywell Analytics / Honeywell Gas Detection), Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, Emerson Electric Co. (Emerson – Dixell, Lumity & Copeland controls), Bacharach, Inc. (a MSA Safety brand), Danfoss A/S (Danfoss gas detection & refrigeration controls), Johnson Controls International plc (JCI – YORK & Metasys solutions), Schneider Electric SE, Siemens AG (Siemens Building Technologies), Sensidyne, LP (GASD – Gas Detection Product Line), Crowcon Detection Instruments Ltd., RKI Instruments, Inc., Teledyne Technologies Incorporated (Teledyne Gas & Flame Detection), Industrial Scientific Corporation, GfG Gesellschaft für Gerätebau mbH contribute to innovation, geographic expansion, and service delivery in this space, offering fixed refrigerant leak detectors, multi-gas systems, and integrated monitoring platforms tailored to HVAC-R, industrial, and commercial applications in the region.

The future of the Middle East fixed refrigerant gas detection market appears promising, driven by increasing regulatory pressures and technological innovations. As industries prioritize safety and compliance, the integration of smart technologies and IoT solutions will likely become standard practice. Furthermore, the growing emphasis on sustainability will push companies to adopt eco-friendly refrigerants, enhancing the demand for advanced detection systems. Overall, the market is set to evolve significantly, aligning with global safety and environmental standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-point fixed refrigerant gas detectors Multi-point / addressable fixed refrigerant gas detection systems Fixed refrigerant gas monitoring controllers & panels Accessories (probes, sampling pumps, communication modules) |

| By End-User | Commercial buildings (offices, malls, mixed-use) Cold storage & food logistics Industrial refrigeration (process cooling, manufacturing) Data centers & telecom facilities Hospitality & healthcare facilities |

| By Application | Chiller and plant room monitoring Cold room & warehouse leak detection Supermarket & retail refrigeration monitoring VRF/VRV and comfort cooling system monitoring |

| By Technology | Infrared (NDIR) refrigerant gas sensors Electrochemical refrigerant gas sensors Semiconductor / metal-oxide sensors Photoacoustic & other advanced sensing technologies |

| By Industry Vertical | Food & beverage processing Pharmaceuticals & life sciences Oil, gas & petrochemical facilities (HVAC/refrigeration areas) Commercial real estate & infrastructure Transportation & cold-chain logistics |

| By Region | GCC countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant (Jordan, Lebanon, Iraq, others) Iran Rest of Middle East & North Africa |

| By Policy Support | Compliance with F?Gas / Kigali-aligned refrigerant regulations Occupational safety mandates for machinery rooms Green building and energy-efficiency rating incentives Insurance and risk-management driven requirements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Refrigeration Systems | 120 | Facility Managers, HVAC Technicians |

| Industrial Refrigerant Applications | 90 | Operations Managers, Safety Compliance Officers |

| Residential HVAC Systems | 80 | Homeowners, HVAC Installers |

| Environmental Compliance in Refrigeration | 60 | Environmental Managers, Regulatory Affairs Specialists |

| Refrigerant Gas Suppliers | 70 | Sales Managers, Product Development Engineers |

The Middle East Fixed Refrigerant Gas Detection Market is valued at approximately USD 60 million, driven by regulatory compliance, environmental safety awareness, and the growth of industrial refrigeration systems across various sectors, including cold chain logistics and healthcare.