Middle East Gaming Simulator Market Overview

- The Middle East Gaming Simulator Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing popularity of esports, advancements in gaming technology, and a surge in consumer spending on entertainment. The rise of online gaming platforms and the integration of virtual reality (VR) and augmented reality (AR) technologies have further fueled market expansion. The adoption of immersive technologies, such as haptic feedback and motion control, along with the expansion of gaming zones and esports championships, are accelerating demand for advanced simulator experiences .

- Key players in this market include theUAE, Saudi Arabia, and Qatar, which dominate due to their robust infrastructure, high disposable incomes, and a young, tech-savvy population. The presence of major gaming events and tournaments in these countries also contributes to their leadership in the gaming simulator market, attracting both local and international investments. Saudi Arabia, in particular, has made significant investments in gaming and esports infrastructure as part of its Vision 2030 program, while the UAE continues to host leading gaming expos and tournaments .

- In 2023, the UAE government implemented regulations to promote the gaming industry, including tax incentives for gaming companies and support for local game developers. TheUAE Cabinet Decision No. 55 of 2023issued by the Ministry of Economy introduced a framework for digital content and gaming sector development, providing tax incentives, streamlined licensing, and funding support for local studios. This initiative aims to position the UAE as a regional hub for gaming innovation and development, fostering a conducive environment for growth in the gaming simulator market .

Middle East Gaming Simulator Market Segmentation

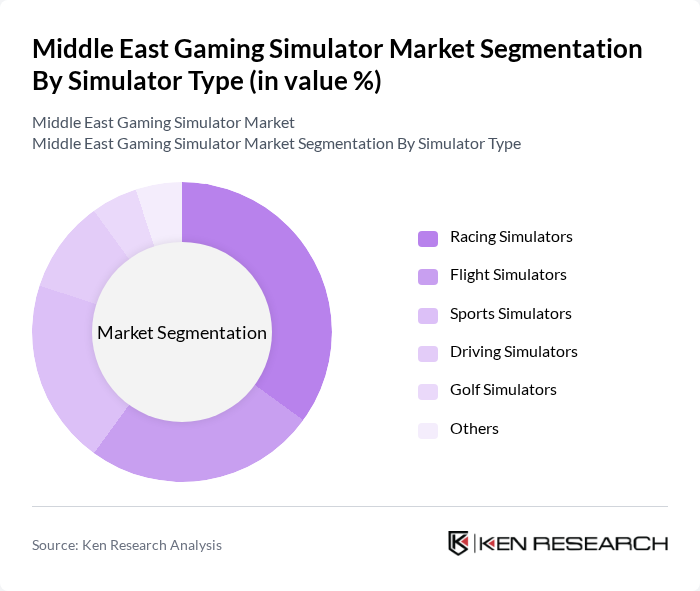

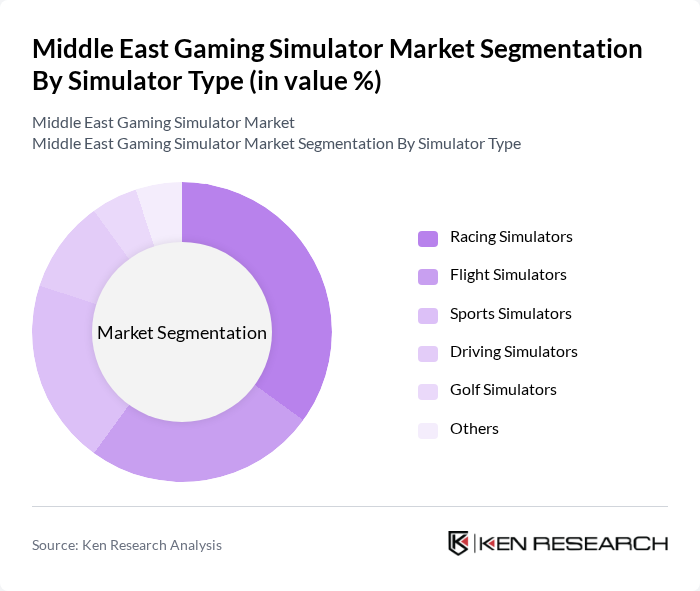

By Simulator Type:The simulator type segmentation includes various categories such as Racing Simulators, Flight Simulators, Sports Simulators, Driving Simulators, Golf Simulators, and Others. Among these,Racing Simulatorsare particularly popular due to the increasing interest in motorsports and competitive racing games.Flight Simulatorsalso see significant usage, especially among aviation enthusiasts and training institutions. The demand forSports Simulatorsis growing as well, driven by the popularity of sports games and virtual sports experiences. The integration of VR and AR technologies is further enhancing the realism and appeal of these simulator types .

By Product Type:The product type segmentation includesPortable SimulatorsandBuilt-in Simulators. Portable Simulators are gaining traction due to their convenience and ease of use, allowing gamers to enjoy simulations on the go. Built-in Simulators, often found in dedicated gaming setups, provide a more immersive experience and are preferred by serious gamers and training institutions. The trend towards high-quality, immersive gaming experiences is driving the demand for both types of simulators. The portable segment is the fastest-growing, supported by increasing demand for flexible and mobile gaming solutions .

Middle East Gaming Simulator Market Competitive Landscape

The Middle East Gaming Simulator Market is characterized by a dynamic mix of regional and international players. Leading participants such as Razer Inc., Logitech International S.A., Thrustmaster, Fanatec, Playseat, SimXperience, Next Level Racing, Oculus VR (Meta Platforms, Inc.), Sony Interactive Entertainment, Microsoft Corporation, Corsair Gaming, Inc., HP Inc., Dell Technologies, Alienware, HyperX, Virtuix, VRX Simulators, D-BOX Technologies Inc., Simworx, Simul8 Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Middle East Gaming Simulator Market Industry Analysis

Growth Drivers

- Increasing Popularity of Esports:The esports industry in the Middle East is projected to generate revenues exceeding $1 billion by in future, driven by a growing audience of over 18 million gamers. This surge is attributed to increased viewership on platforms like Twitch and YouTube, where esports events attract millions of viewers. The rise of local tournaments and international events in countries like Saudi Arabia and the UAE further fuels interest, creating a robust environment for gaming simulators to thrive.

- Rising Disposable Income Among Consumers:The Middle East's GDP per capita is expected to reach approximately $18,000 in future, reflecting a significant increase in disposable income. This economic growth enables consumers to invest in gaming simulators and related technologies. As more households can afford high-end gaming equipment, the demand for immersive gaming experiences rises, driving the market for gaming simulators, particularly among younger demographics who prioritize entertainment spending.

- Expansion of Gaming Infrastructure:The Middle East is witnessing substantial investments in gaming infrastructure, with over $600 million allocated for the development of gaming hubs and arenas in future. Countries like the UAE and Saudi Arabia are establishing state-of-the-art facilities to host gaming events and tournaments. This infrastructure not only supports local gamers but also attracts international events, enhancing the visibility and acceptance of gaming simulators in the region.

Market Challenges

- Regulatory Hurdles in Gaming:The gaming industry in the Middle East faces significant regulatory challenges, with varying laws across countries. For instance, Saudi Arabia has strict regulations that can hinder the growth of gaming simulators. Compliance with local laws is essential, and the lack of a unified regulatory framework can create barriers for companies looking to enter the market, potentially stifling innovation and investment in gaming technologies.

- High Initial Investment Costs:The initial investment required for developing and marketing gaming simulators can exceed $1 million, posing a significant barrier for startups and smaller companies. This high cost includes expenses for advanced technology, software development, and marketing efforts. As a result, many potential entrants may be deterred from entering the market, limiting competition and innovation in the gaming simulator sector.

Middle East Gaming Simulator Market Future Outlook

The future of the Middle East gaming simulator market appears promising, driven by technological advancements and a growing consumer base. As virtual reality and augmented reality technologies continue to evolve, they are expected to enhance the gaming experience significantly. Additionally, the increasing integration of artificial intelligence in gaming will create more personalized and engaging experiences. The region's focus on diversifying its economy away from oil dependency will further support the growth of the gaming industry, making it a key player in the entertainment sector.

Market Opportunities

- Growth of Virtual Reality Gaming:The virtual reality gaming segment is projected to grow significantly, with investments expected to reach $300 million in future. This growth presents an opportunity for gaming simulators to integrate VR technology, enhancing user experiences and attracting a broader audience, particularly among younger gamers seeking immersive environments.

- Partnerships with Educational Institutions:Collaborations with educational institutions can open new avenues for gaming simulators, particularly in training and skill development. With over 600 universities in the region, integrating gaming simulators into curricula can enhance learning experiences, making education more engaging and interactive, thus expanding the market reach.