Region:Middle East

Author(s):Rebecca

Product Code:KRAC9646

Pages:86

Published On:November 2025

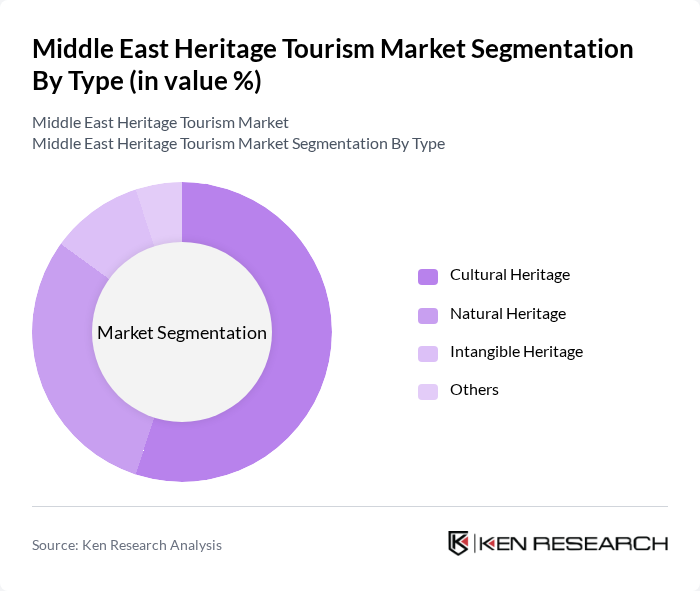

By Type:The market is segmented into Cultural Heritage, Natural Heritage, Intangible Heritage, and Others.Cultural Heritageis the leading segment, driven by high demand for historical tours and experiences that showcase the region's rich traditions and history.Natural Heritagefollows, appealing to eco-tourists and adventure seekers interested in the region's unique landscapes and biodiversity. This segmentation aligns with recent trends, where cultural heritage accounts for over half of market revenue and natural heritage is the fastest-growing segment .

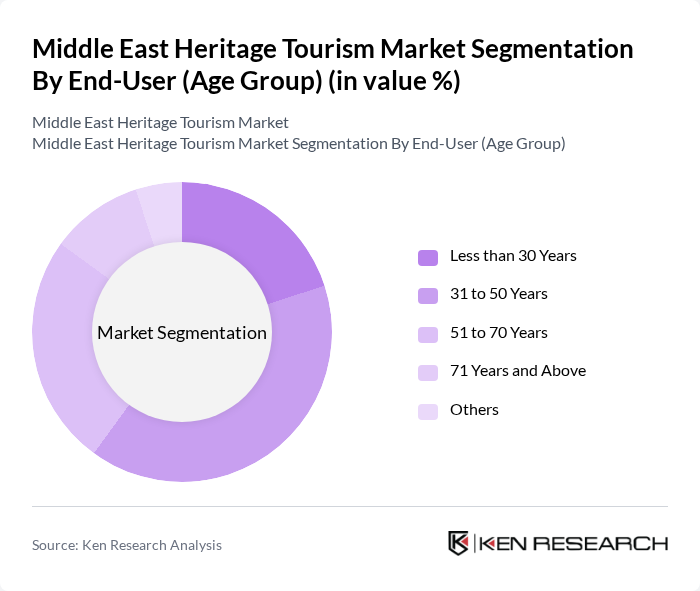

By End-User (Age Group):The market is segmented by age groups, including Less than 30 Years, 31 to 50 Years, 51 to 70 Years, 71 Years and Above, and Others. The31 to 50 Yearsage group dominates the market, as this demographic is more likely to travel for cultural experiences and has the financial means to do so. The younger generation is also increasingly interested in heritage tourism, contributing to the growth of this segment. This segmentation reflects current market patterns, with the 31 to 50 Years group representing the largest share of heritage tourism participants .

The Middle East Heritage Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Airlines, Abu Dhabi Department of Culture and Tourism, Qatar Tourism, Saudi Tourism Authority, Jordan Tourism Board, Ministry of Heritage and Tourism, Oman, Bahrain Tourism and Exhibitions Authority, Dubai Department of Economy and Tourism, Kuwait Tourism, Egyptian Tourism Authority, Ministry of Tourism, Lebanon, Palestinian Ministry of Tourism and Antiquities, Tunisian National Tourist Office, Moroccan National Tourist Office, Iraq Ministry of Culture, Tourism and Antiquities, Exodus Travels, TUI Group, Expedia Group Inc., ACE Cultural Tours, Martin Randall Travel contribute to innovation, geographic expansion, and service delivery in this space.

The future of heritage tourism in the Middle East appears promising, driven by increasing global interest in cultural experiences and sustainable travel. As governments continue to invest in infrastructure and promote heritage sites, the region is likely to see a resurgence in visitor numbers. Additionally, the integration of technology in tourism, such as virtual reality experiences, will enhance visitor engagement, making heritage tourism more appealing to younger generations. This trend is expected to shape the market significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cultural Heritage Natural Heritage Intangible Heritage Others |

| By End-User (Age Group) | Less than 30 Years to 50 Years to 70 Years Years and Above Others |

| By Region | Gulf Cooperation Council (GCC) Levant Region North Africa Others |

| By Booking Channel | Online Offline Others |

| By Activity | Guided Tours Workshops and Classes Cultural Performances Culinary Heritage Experiences Heritage Festivals Others |

| By Duration of Stay | Short-term Visits Long-term Stays Others |

| By Travel Purpose | Leisure Education Business Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Heritage Site Visitors | 120 | International Tourists, Local Visitors |

| Tour Operators | 60 | Travel Agency Owners, Tour Guides |

| Government Tourism Officials | 40 | Tourism Board Executives, Policy Makers |

| Cultural Heritage Experts | 40 | Academics, Museum Curators |

| Local Business Owners | 50 | Restaurant Owners, Souvenir Shop Managers |

The Middle East Heritage Tourism Market is valued at approximately USD 38 billion, reflecting significant growth driven by the region's rich cultural heritage, historical sites, and increased investments in tourism infrastructure.