Region:Middle East

Author(s):Dev

Product Code:KRAC2768

Pages:100

Published On:October 2025

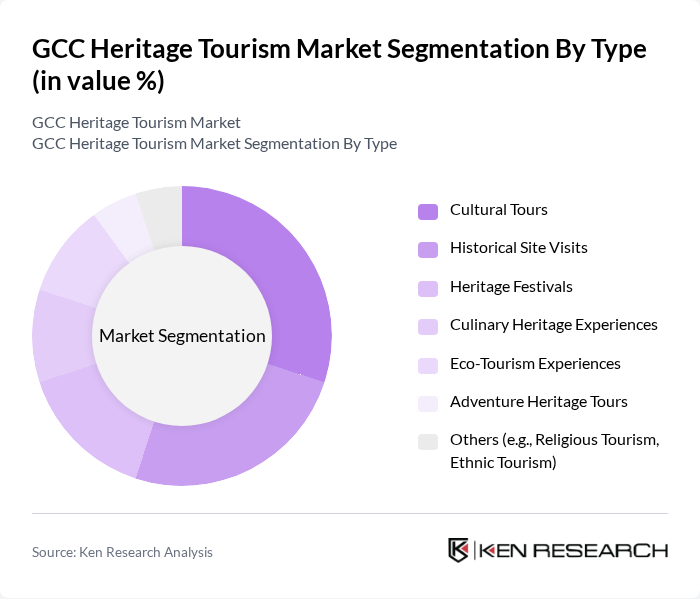

By Type:The market is segmented into various types, including Cultural Tours, Historical Site Visits, Heritage Festivals, Culinary Heritage Experiences, Eco-Tourism Experiences, Adventure Heritage Tours, and Others (e.g., Religious Tourism, Ethnic Tourism). Among these, Cultural Tours and Historical Site Visits are particularly dominant due to the increasing interest in immersive experiences that allow travelers to connect with local traditions and histories. The demand for Culinary Heritage Experiences is also on the rise, as tourists seek to explore local cuisines as part of their cultural journey .

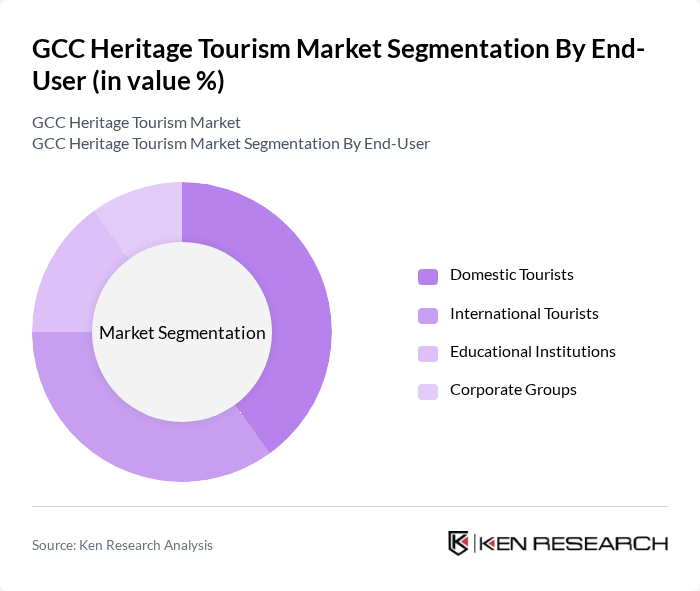

By End-User:The end-user segmentation includes Domestic Tourists, International Tourists, Educational Institutions, and Corporate Groups. Domestic Tourists are the largest segment, driven by a growing interest in local heritage and cultural experiences. International Tourists are also significant, as they seek unique experiences that highlight the rich history of the GCC region. Educational Institutions are increasingly organizing trips to heritage sites for educational purposes, while Corporate Groups are utilizing heritage tourism for team-building and corporate retreats .

The GCC Heritage Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Airlines, Qatar Airways, Abu Dhabi Tourism & Culture Authority, Saudi Commission for Tourism and National Heritage, Oman Tourism, Bahrain Tourism and Exhibitions Authority, Kuwait Tourism, Dubai Tourism, Qatar National Tourism Council, Sharjah Commerce and Tourism Development Authority, Ras Al Khaimah Tourism Development Authority, Ajman Tourism Development Department, Fujairah Tourism and Antiquities Authority, Saudi Arabian Airlines, AlUla Development Company, Zahara Tours, Platinum Heritage, Gulf Adventures contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC heritage tourism market appears promising, driven by increasing global interest in cultural experiences and sustainable travel. As governments continue to invest in infrastructure and preservation, the region is likely to see a rise in both domestic and international tourist numbers. Additionally, the integration of technology in marketing and visitor engagement will enhance the overall experience, making heritage tourism more accessible and appealing to a broader audience, thus fostering long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Cultural Tours Historical Site Visits Heritage Festivals Culinary Heritage Experiences Eco-Tourism Experiences Adventure Heritage Tours Others (e.g., Religious Tourism, Ethnic Tourism) |

| By End-User | Domestic Tourists International Tourists Educational Institutions Corporate Groups |

| By Region | United Arab Emirates Saudi Arabia Qatar Oman Kuwait Bahrain |

| By Seasonality | Peak Season (Winter and Spring) Off-Peak Season (Summer and Fall) |

| By Marketing Channel | Online Travel Agencies Direct Bookings Travel Agents |

| By Package Type | Group Packages Individual Packages Customizable Packages |

| By Price Range | Budget Mid-Range Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Heritage Site Visitors | 120 | Domestic and International Tourists |

| Cultural Heritage Experts | 45 | Academics, Historians, and Cultural Consultants |

| Tourism Operators | 90 | Travel Agency Owners, Tour Guides |

| Local Artisans and Craftsmen | 60 | Local Business Owners, Craft Producers |

| Government Tourism Officials | 40 | Policy Makers, Tourism Board Representatives |

The GCC Heritage Tourism Market is valued at approximately USD 1 billion, driven by investments in cultural preservation, government initiatives, and a growing interest in authentic travel experiences among both domestic and international tourists.