Region:Middle East

Author(s):Rebecca

Product Code:KRAC9649

Pages:87

Published On:November 2025

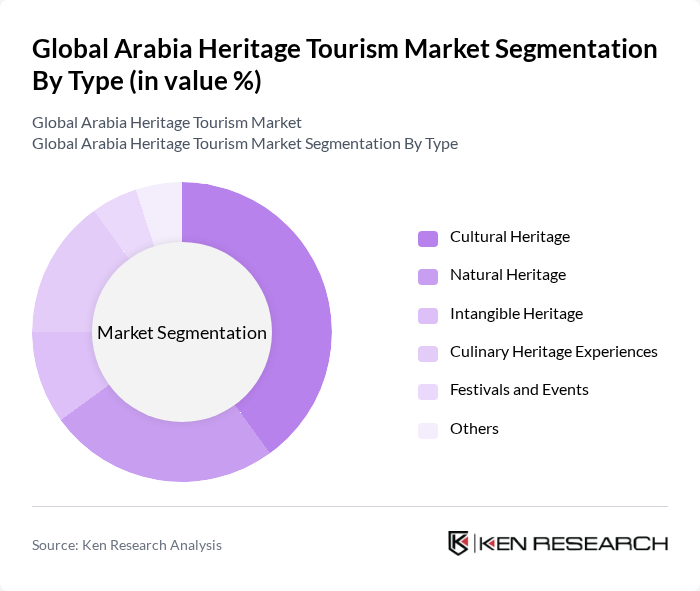

By Type:The market is segmented into various types, including Cultural Heritage, Natural Heritage, Intangible Heritage, Culinary Heritage Experiences, Festivals and Events, and Others. Among these, Cultural Heritage is the most dominant segment, driven by the increasing demand for immersive experiences that allow travelers to engage with local traditions and histories. Natural Heritage also plays a significant role, particularly in regions with unique landscapes and biodiversity that attract eco-tourists. Culinary Heritage Experiences are gaining traction as travelers seek authentic local cuisines, while Festivals and Events provide unique opportunities for cultural engagement.

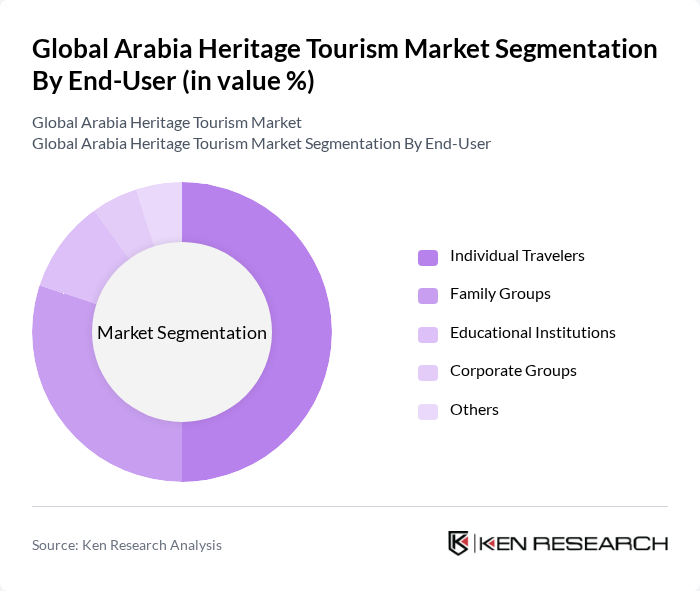

By End-User:The end-user segmentation includes Individual Travelers, Family Groups, Educational Institutions, Corporate Groups, and Others. Individual Travelers represent the largest segment, as they often seek personalized experiences and are more likely to engage in heritage tourism. Family Groups are also significant, as they tend to participate in activities that cater to all ages, such as cultural festivals and workshops. Educational Institutions are increasingly organizing trips to heritage sites for learning purposes, while Corporate Groups are utilizing heritage tourism for team-building and corporate retreats.

The Global Arabia Heritage Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Royal Commission for AlUla, Department of Culture and Tourism – Abu Dhabi, Saudi Tourism Authority, Jordan Tourism Board, Qatar Tourism, Ministry of Heritage and Tourism, Oman, Egyptian Tourism Authority, Dubai Department of Economy and Tourism, Bahrain Tourism and Exhibitions Authority, Kuwait Tourism and Antiquities Department, Ministry of Tourism, Lebanon, Tunisian National Tourist Office, Moroccan National Tourist Office, Ministry of Tourism and Antiquities, Palestine, Ministry of Tourism, Yemen, Seera Group (Saudi Arabia), Almosafer (Saudi Arabia), Zahid Travel Group (Saudi Arabia), Al Faris International Travel & Tourism (Saudi Arabia), Fursan Travel (Saudi Arabia), Rahhalah Explorers (UAE), Awtad Travel & Tourism (Saudi Arabia), Tourist Saudi (Saudi Arabia), Jana Tours (Saudi Arabia), Wadi Tours (Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of heritage tourism in the Arabian region appears promising, driven by increasing global interest in cultural experiences and significant government investments in infrastructure. As travelers seek authentic experiences, the market is likely to see a rise in eco-friendly tourism initiatives and digital marketing strategies aimed at attracting a broader audience. Additionally, the integration of technology, such as virtual reality, will enhance visitor engagement, making heritage sites more accessible and appealing to a tech-savvy generation of tourists.

| Segment | Sub-Segments |

|---|---|

| By Type | Cultural Heritage Natural Heritage Intangible Heritage Culinary Heritage Experiences Festivals and Events Others |

| By End-User | Individual Travelers Family Groups Educational Institutions Corporate Groups Others |

| By Region | Middle East North Africa South Asia Others |

| By Activity | Guided Tours Workshops and Classes Adventure Activities Cultural Performances Others |

| By Duration of Stay | Short-term Visits Long-term Stays Weekend Getaways Others |

| By Pricing Tier | Budget Mid-range Luxury Others |

| By Marketing Channel | Online Travel Agencies Direct Bookings Travel Agents Social Media Promotions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Heritage Site Management | 60 | Site Managers, Cultural Heritage Officers |

| Tour Operator Insights | 50 | Tour Operators, Travel Agency Owners |

| Visitor Experience Feedback | 70 | Tourists, Local Visitors |

| Cultural Event Organizers | 40 | Event Coordinators, Cultural Program Directors |

| Community Engagement in Heritage Tourism | 40 | Community Leaders, Local Business Owners |

The Global Arabia Heritage Tourism Market is valued at approximately USD 586.5 billion, reflecting significant growth driven by increasing interest in cultural experiences and government initiatives promoting heritage sites across the Arabian region.