Region:Middle East

Author(s):Rebecca

Product Code:KRAD8167

Pages:97

Published On:December 2025

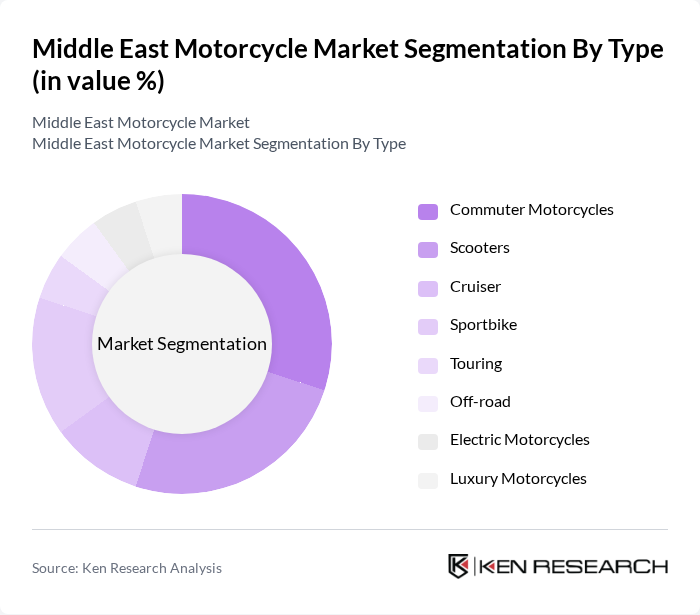

By Type:The motorcycle market can be segmented into various types, including commuter motorcycles, scooters, cruisers, sportbikes, touring motorcycles, off-road bikes, electric motorcycles, and luxury motorcycles. Each type caters to different consumer preferences and usage scenarios, with commuter motorcycles and scooters being particularly popular due to their practicality and affordability in urban settings.

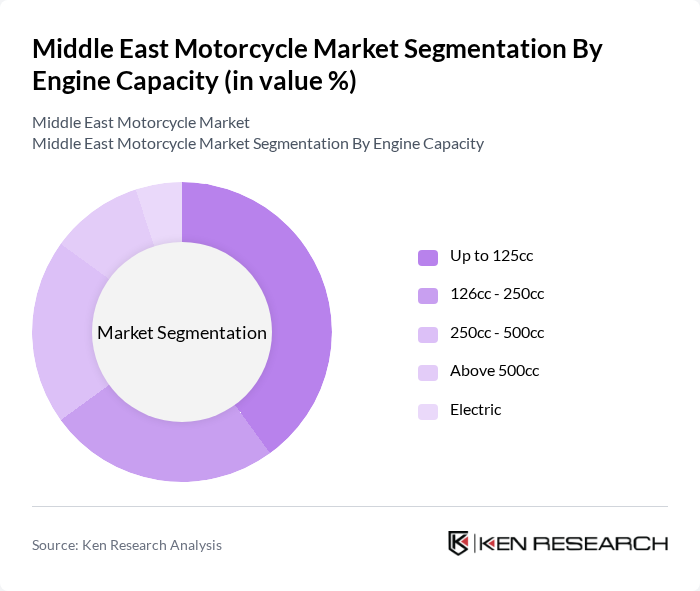

By Engine Capacity:The market can also be segmented based on engine capacity, which includes motorcycles with engine sizes below 125cc, from 126cc to 250cc, from 251cc to 500cc, from 501cc to 1000cc, and above 1000cc. Smaller engine capacities are favored for their fuel efficiency and lower costs, making them ideal for urban commuting.

The Middle East Motorcycle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yamaha Motor Co., Ltd., Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Suzuki Motor Corporation, KTM AG, Harley-Davidson, Inc., BMW Motorrad, Ducati Motor Holding S.p.A., Piaggio & C. S.p.A., Royal Enfield, Bajaj Auto Ltd., TVS Motor Company, Polaris Industries Inc., Triumph Motorcycles Ltd., Zero Motorcycles, Inc., and Turkish Manufacturers (Local Production Leaders) contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East motorcycle market is poised for transformative growth driven by urbanization, rising incomes, and evolving consumer preferences. As the region embraces sustainable transportation solutions, electric motorcycles are expected to gain traction, supported by government initiatives promoting eco-friendly practices. Additionally, the increasing popularity of adventure tourism will further stimulate demand for motorcycles, creating a vibrant market landscape. The integration of smart technologies will also enhance user experience, making motorcycles more appealing to tech-savvy consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Commuter Motorcycles Scooters Cruiser Sportbike Touring Off-road Electric Motorcycles Luxury Motorcycles |

| By Engine Capacity | Below 125cc cc to 250cc cc to 500cc cc to 1000cc Above 1000cc |

| By Distribution Channel | Online Retail Offline Retail Authorized Dealerships Direct Sales B2B/B2C Marketplaces |

| By Region | GCC Countries (Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, Oman) Levant Region (Syria, Lebanon, Jordan, Palestine) Iraq and Iran Egypt and North Africa |

| By Purpose | Commuting Recreation Delivery Services Motorcycle Rental Others |

| By Brand Category | Premium International Brands Mid-range Brands Budget/Affordable Brands Local/Regional Manufacturers |

| By Customer Segment | Individual Consumers Corporate Clients and Fleet Operators Government Agencies Rental and Sharing Service Providers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Motorcycle Retailers | 150 | Dealership Owners, Sales Managers |

| Motorcycle Users | 120 | Casual Riders, Enthusiasts, Commuters |

| Motorcycle Manufacturers | 80 | Production Managers, Product Development Heads |

| Aftermarket Parts Suppliers | 60 | Supply Chain Managers, Marketing Directors |

| Motorcycle Safety and Training Organizations | 50 | Instructors, Program Coordinators |

The Middle East Motorcycle Market is valued at approximately USD 410 million, driven by factors such as urbanization, rising disposable incomes, and increased demand for efficient commuting options in densely populated urban areas.