Region:Middle East

Author(s):Rebecca

Product Code:KRAD8412

Pages:97

Published On:December 2025

By Type:The market is segmented into four types: Rigid PVC, Flexible PVC, Non-Plasticized PVC, and Chlorinated PVC (CPVC). Rigid PVC is widely used in construction and plumbing applications due to its strength and durability. Flexible PVC is favored in applications requiring flexibility, such as electrical cables and flooring. Non-Plasticized PVC is utilized in medical devices and packaging, while CPVC is preferred for hot water applications due to its higher temperature resistance.

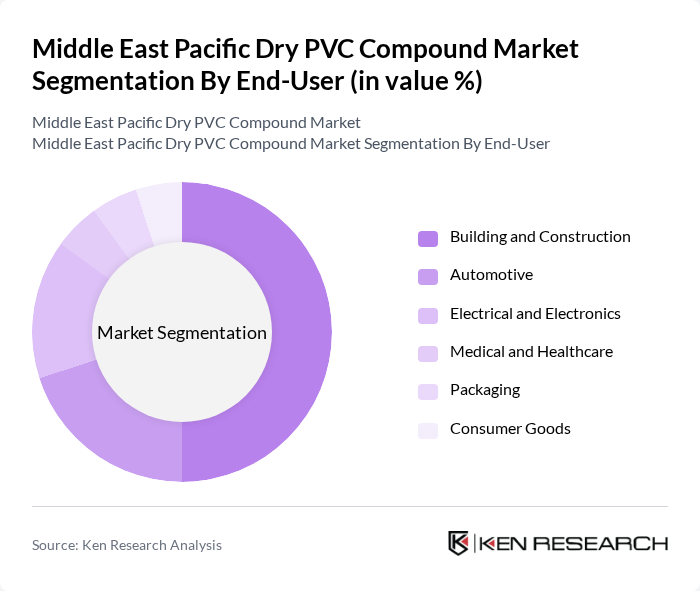

By End-User:The end-user segmentation includes Building and Construction, Automotive, Electrical & Electronics, Healthcare and Life Sciences, and Packaging. The Building and Construction sector is the largest consumer of PVC due to its extensive use in pipes, fittings, and profiles. The Automotive sector utilizes PVC for interior components, while the Electrical & Electronics sector employs it for insulation and protective coverings. The Healthcare sector uses PVC in medical devices, and the Packaging sector benefits from its lightweight and durable properties.

The Middle East Pacific Dry PVC Compound Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Westlake Chemical Corporation, INEOS Group Holdings plc, Formosa Plastics Corporation, Solvay S.A., LG Chem Ltd., Shin-Etsu Chemical Co., Ltd., China National Chemical Corporation (ChemChina), Reliance Industries Limited, Al-Jazeera Plastics Company, National Petrochemical Company (NPC) - Saudi Arabia, Egyptian Petrochemicals Company (EPC), Qatar Petrochemical Company (QAPCO), Abu Dhabi Polymers Company Limited (Borouge), Oman Oil Refineries and Petroleum Industries Company (ORPIC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East Pacific dry PVC compound market appears promising, driven by technological advancements and a shift towards sustainable practices. As manufacturers invest in innovative production techniques, the efficiency and quality of PVC compounds are expected to improve. Additionally, the growing emphasis on eco-friendly materials will likely lead to increased demand for recycled PVC, creating new avenues for growth. The market is poised to adapt to evolving consumer preferences and regulatory landscapes, ensuring resilience and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid PVC Flexible PVC Non-Plasticized PVC Chlorinated PVC (CPVC) |

| By End-User | Building and Construction Automotive Electrical & Electronics Healthcare and Life Sciences Packaging |

| By Application | Pipes and Fittings Films and Sheets Profiles and Extrusions Flexible Packaging |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant Region (Syria, Lebanon, Jordan, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia) Sub-Saharan Africa |

| By Distribution Channel | Direct Sales to OEMs Distributors and Resellers Online Sales Platforms Specialty Chemical Retailers |

| By Product Form | Granules Powders Pellets Liquid Compounds |

| By End-Use Industry | Building and Construction Automotive Interiors and Components Consumer Goods and Footwear Medical Device Manufacturing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry PVC Usage | 120 | Project Managers, Procurement Officers |

| Automotive Sector PVC Applications | 100 | Product Development Engineers, Supply Chain Managers |

| Consumer Goods Manufacturing | 90 | Operations Managers, Quality Assurance Specialists |

| Electrical and Electronics Sector | 80 | Design Engineers, Technical Managers |

| Recycling and Sustainability Initiatives | 70 | Sustainability Managers, Environmental Compliance Officers |

The Middle East Pacific Dry PVC Compound Market is valued at approximately USD 1.3 billion, reflecting a robust growth trajectory driven by increasing demand in construction, automotive, and packaging sectors, alongside urbanization and infrastructure development in the region.