Region:Middle East

Author(s):Dev

Product Code:KRAB8213

Pages:90

Published On:October 2025

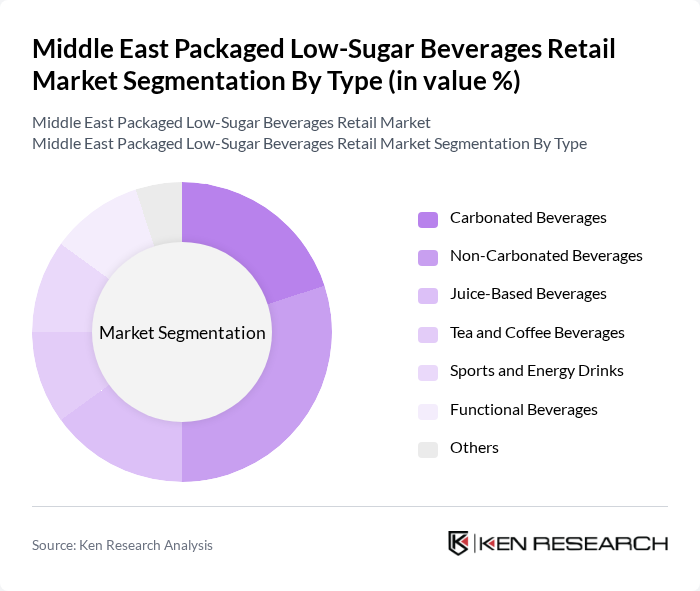

By Type:The market is segmented into various types of beverages, including Carbonated Beverages, Non-Carbonated Beverages, Juice-Based Beverages, Tea and Coffee Beverages, Sports and Energy Drinks, Functional Beverages, and Others. Among these, Non-Carbonated Beverages are gaining significant traction due to their perceived health benefits and lower sugar content, appealing to health-conscious consumers.

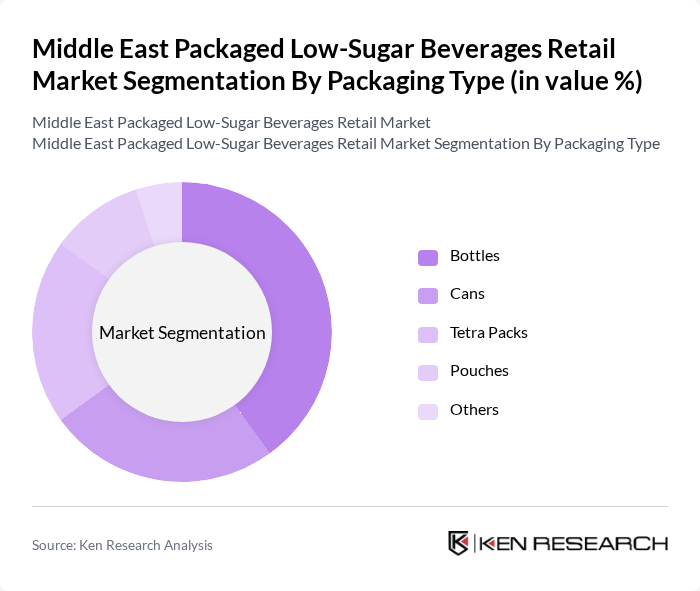

By Packaging Type:The market is also segmented by packaging types, including Bottles, Cans, Tetra Packs, Pouches, and Others. Bottles are the most popular packaging type due to their convenience and portability, making them a preferred choice for consumers on the go.

The Middle East Packaged Low-Sugar Beverages Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coca-Cola Company, PepsiCo, Inc., Nestlé S.A., Dr Pepper Snapple Group, Suntory Beverage & Food Limited, Red Bull GmbH, Monster Beverage Corporation, Unilever PLC, Danone S.A., The Kraft Heinz Company, FrieslandCampina, The Coca-Cola Company (Middle East Division), Al Ain Water, Almarai Company, Al Safi Danone contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East packaged low-sugar beverages market appears promising, driven by evolving consumer preferences and technological advancements. As health awareness continues to rise, manufacturers are likely to invest in innovative product development, focusing on natural sweeteners and functional ingredients. Furthermore, the expansion of e-commerce platforms will facilitate greater market penetration, allowing brands to reach a broader audience. This dynamic environment is expected to foster sustainable growth and diversification in product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbonated Beverages Non-Carbonated Beverages Juice-Based Beverages Tea and Coffee Beverages Sports and Energy Drinks Functional Beverages Others |

| By Packaging Type | Bottles Cans Tetra Packs Pouches Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender Income Level Lifestyle Preferences |

| By Flavor Profile | Citrus Berry Tropical Herbal Others |

| By Brand Positioning | Premium Mid-Range Budget Private Label |

| By Health Benefits | Weight Management Hydration Energy Boosting Nutritional Enhancement |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Beverage Outlets | 150 | Store Managers, Category Buyers |

| Health and Wellness Stores | 100 | Store Owners, Product Managers |

| Consumer Focus Groups | 80 | Health-Conscious Consumers, Fitness Enthusiasts |

| Food and Beverage Distributors | 70 | Sales Representatives, Distribution Managers |

| Market Analysts and Experts | 50 | Industry Analysts, Research Consultants |

The Middle East Packaged Low-Sugar Beverages Retail Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by increasing health consciousness and a shift towards healthier beverage options among consumers.