Region:Middle East

Author(s):Geetanshi

Product Code:KRAE7907

Pages:118

Published On:December 2025

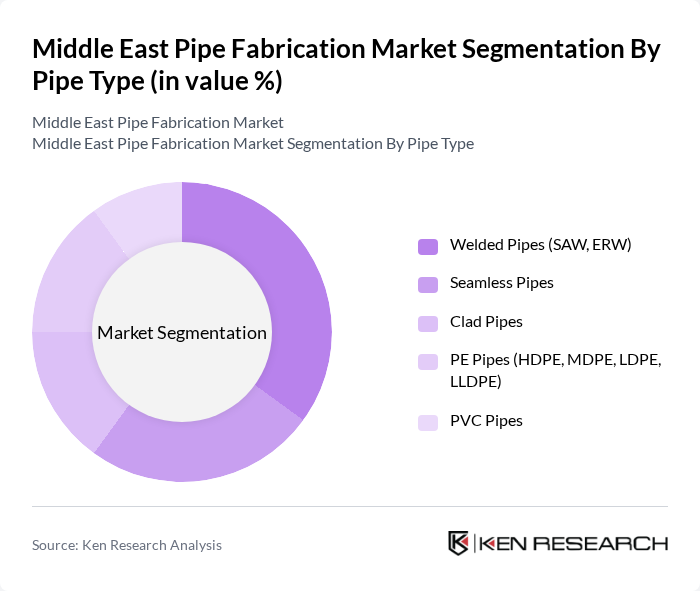

By Pipe Type:The segmentation by pipe type includes various categories such as welded pipes, seamless pipes, clad pipes, PE pipes, and PVC pipes. Each type serves different applications and industries, with welded pipes being widely used in oil and gas infrastructure due to their strength and durability. Seamless pipes are preferred for high-pressure applications, while PE and PVC pipes are commonly used in water infrastructure.

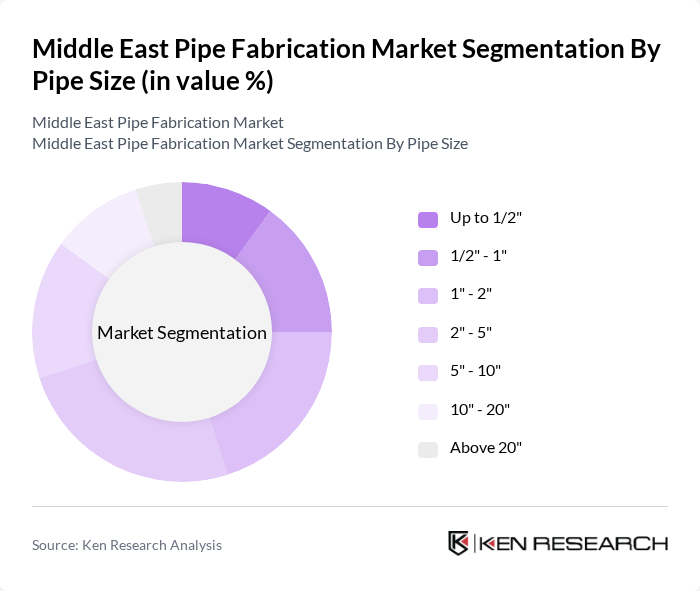

By Pipe Size:The segmentation by pipe size includes various categories ranging from small to large diameters. This segmentation is crucial as different industries require specific sizes for their applications. Smaller pipes are often used in residential and commercial applications, while larger pipes are essential for industrial and infrastructure projects.

The Middle East Pipe Fabrication Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arabian Pipes Company, Abu Dhabi Metal Pipes & Profiles, Emirates Steel Arkan, Tenaris Saudi Steel Pipes, National Pipe Company, Al Jazeera Steel Products Co. SAOG, Gulf International Pipe Industry, Al-Falak Pipe & Steel, Al-Babtain Group, Al-Khodari & Sons Company, Saudi Arabian Amiantit Company, Qatar Steel Company, Jindal Saw Ltd., Vallourec, Borusan Mannesmann contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East pipe fabrication market appears promising, driven by ongoing infrastructure projects and a shift towards sustainable practices. As governments prioritize renewable energy initiatives, the demand for innovative piping solutions will likely increase. Additionally, the integration of digital technologies, such as IoT and AI, will enhance operational efficiency and quality control. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Pipe Type | Welded Pipes (SAW, ERW) Seamless Pipes Clad Pipes PE Pipes (HDPE, MDPE, LDPE, LLDPE) PVC Pipes |

| By Pipe Size | Up to 1/2" /2" - 1" " - 2" " - 5" " - 10" " - 20" Above 20" |

| By End-User Industry | Oil & Gas Infrastructure Water Infrastructure Building Infrastructure Industrial Infrastructure Others |

| By Application | Flow Lines Gathering Lines Transmission Lines Distribution Lines Water Supply & Irrigation Sewerage & Drainage |

| By Fabrication Method | Submerged Arc Welding (SAW) Electric Resistance Welding (ERW) Seamless Drawing Spiral Welding Others |

| By Material Grade | API 5L (Carbon Steel Line Pipe) Duplex & Super-Duplex Grades Corrosion-Resistant Alloys Low-Carbon & Green Steel Others |

| By Geography | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Pipeline Projects | 100 | Project Managers, Engineers |

| Water Supply Infrastructure | 80 | Procurement Officers, Municipal Engineers |

| Construction Sector Fabrication | 70 | Construction Managers, Site Supervisors |

| Industrial Pipe Manufacturing | 60 | Operations Managers, Quality Control Inspectors |

| Renewable Energy Pipeline Applications | 50 | R&D Managers, Sustainability Officers |

The Middle East Pipe Fabrication Market is valued at approximately USD 8.5 billion, driven by infrastructure development, particularly in the oil and gas sector, and the increasing need for water management systems.