Region:Middle East

Author(s):Shubham

Product Code:KRAA8882

Pages:86

Published On:November 2025

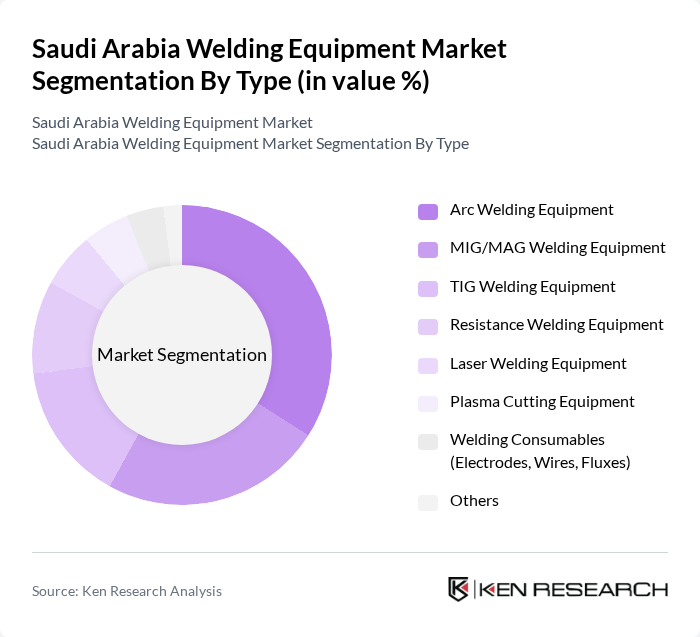

By Type:The welding equipment market can be segmented into various types, including Arc Welding Equipment, MIG/MAG Welding Equipment, TIG Welding Equipment, Resistance Welding Equipment, Laser Welding Equipment, Plasma Cutting Equipment, Welding Consumables (Electrodes, Wires, Fluxes), and Others. Among these, Arc Welding Equipment is the most widely used due to its versatility and efficiency in various applications. The increasing demand for robust and reliable welding solutions in construction and manufacturing sectors drives the growth of this segment .

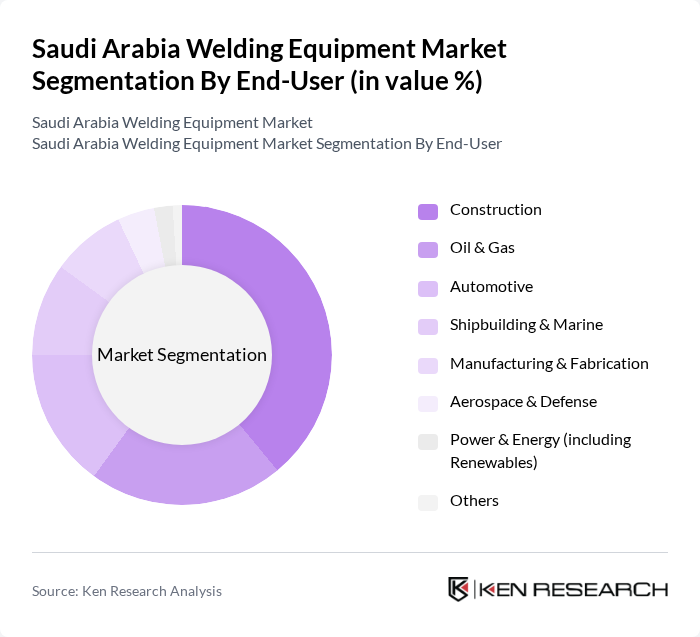

By End-User:The end-user segments of the welding equipment market include Construction, Oil & Gas, Automotive, Shipbuilding & Marine, Manufacturing & Fabrication, Aerospace & Defense, Power & Energy (including Renewables), and Others. The Construction sector is the leading end-user, driven by ongoing infrastructure projects and the need for high-quality welding solutions. The demand for welding equipment in the Oil & Gas sector is also significant due to the industry's stringent safety and quality requirements .

The Saudi Arabia Welding Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as ESAB Arabia, Lincoln Electric Saudi Arabia, Miller Electric (Saudi Arabia), Al-Ittefaq Steel Products Company, Al-Jazira Equipment Co. Ltd. (Auto Weld), Gulf Welding Solutions (GWS), Al Suwaidi Industrial Services Co. Ltd. (SIS), Al-Babtain Power & Telecommunication Co., Saudi Mechanical Industries Co., Al-Khodari Sons Company, Al-Muhaidib Group, National Industrialization Company (Tasnee), Saudi Basic Industries Corporation (SABIC), Saudi Arabian Oil Company (Saudi Aramco), Saudi Arabian Mining Company (Ma'aden) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia welding equipment market appears promising, driven by ongoing investments in infrastructure and technological advancements. As the government continues to prioritize economic diversification, the demand for innovative welding solutions is expected to rise. Additionally, the integration of automation and IoT technologies will enhance operational efficiency, allowing companies to optimize their processes. This evolving landscape presents opportunities for manufacturers to develop cutting-edge products that meet the growing needs of various industries, ensuring sustained market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Arc Welding Equipment MIG/MAG Welding Equipment TIG Welding Equipment Resistance Welding Equipment Laser Welding Equipment Plasma Cutting Equipment Welding Consumables (Electrodes, Wires, Fluxes) Others |

| By End-User | Construction Oil & Gas Automotive Shipbuilding & Marine Manufacturing & Fabrication Aerospace & Defense Power & Energy (including Renewables) Others |

| By Application | Structural Welding Pipe & Pipeline Welding Fabrication Maintenance & Repair Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Retail Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Manual Welding Automated Welding Robotic Welding Conventional Welding Others |

| By Market Segment | Large Enterprises SMEs Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Users | 100 | Project Managers, Site Supervisors |

| Manufacturing Sector Clients | 70 | Production Managers, Quality Control Engineers |

| Oil & Gas Sector Professionals | 60 | Maintenance Engineers, Safety Officers |

| Educational Institutions & Training Centers | 40 | Instructors, Program Coordinators |

| Welding Equipment Distributors | 50 | Sales Managers, Product Specialists |

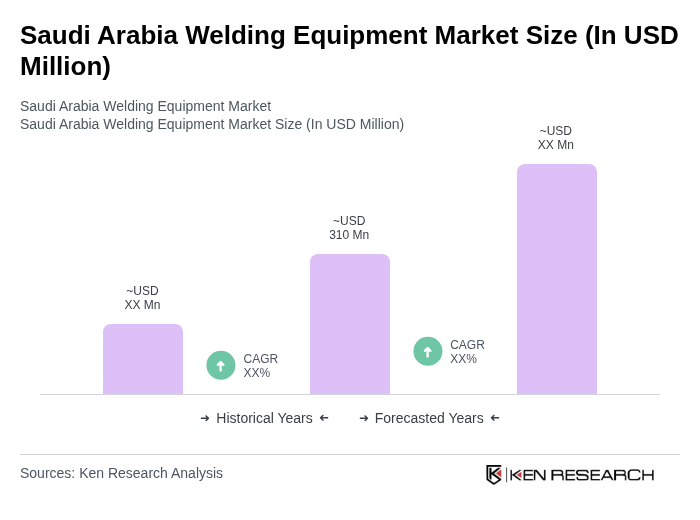

The Saudi Arabia Welding Equipment Market is valued at approximately USD 310 million, driven by growth in the construction and manufacturing sectors, as well as significant investments in infrastructure projects under Vision 2030.