Region:Middle East

Author(s):Dev

Product Code:KRAD1663

Pages:95

Published On:November 2025

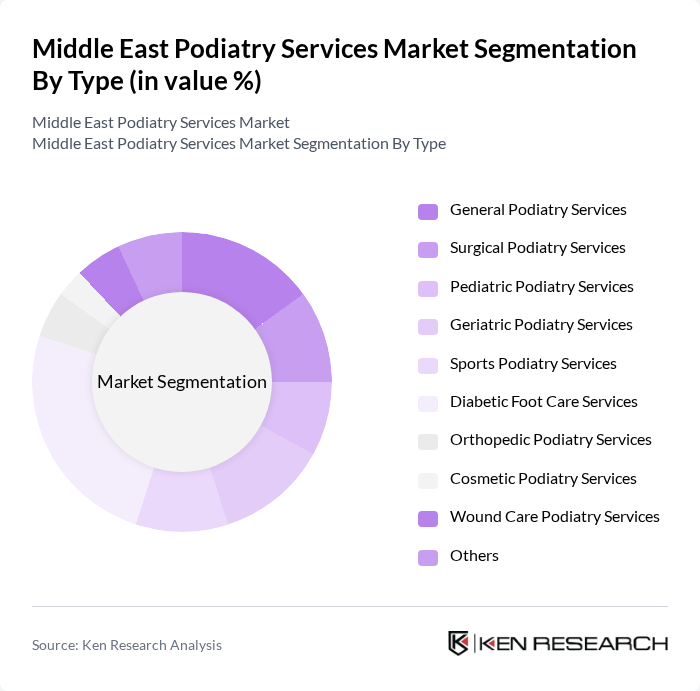

By Type:The market is segmented into various types of podiatry services, including General Podiatry Services, Surgical Podiatry Services, Pediatric Podiatry Services, Geriatric Podiatry Services, Sports Podiatry Services, Diabetic Foot Care Services, Orthopedic Podiatry Services, Cosmetic Podiatry Services, Wound Care Podiatry Services, and Others. Among these,Diabetic Foot Care Servicescurrently dominate the market due to the rising incidence of diabetes in the region, which necessitates specialized care for foot-related complications. The increasing awareness of diabetic foot health and the importance of preventive care are driving demand in this segment. Sports podiatry is also experiencing notable growth, reflecting increased participation in recreational and competitive sports.

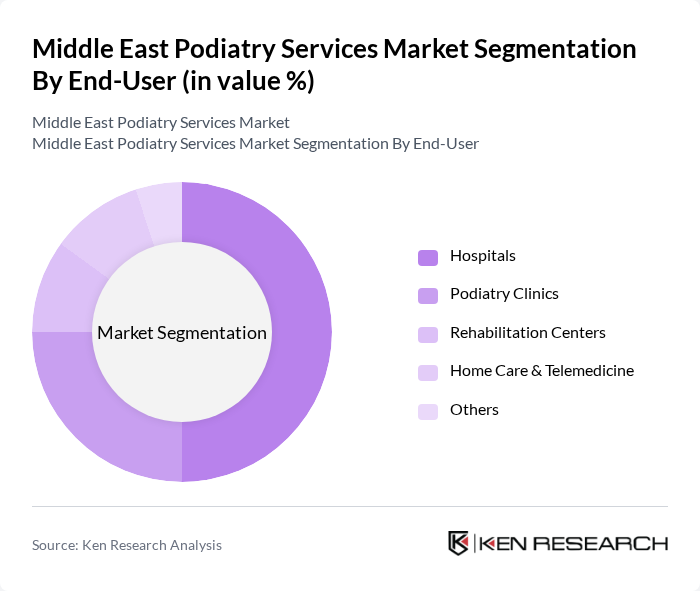

By End-User:The market is segmented by end-users, including Hospitals, Podiatry Clinics, Rehabilitation Centers, Home Care & Telemedicine, and Others.Hospitalsare the leading end-user segment, primarily due to their comprehensive facilities and access to advanced medical technologies. The increasing number of specialized hospitals and the integration of podiatry services into general healthcare practices are contributing to the growth of this segment. Telemedicine and home care services are also gaining traction, reflecting broader digital health adoption in the region.

The Middle East Podiatry Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dubai Podiatry Centre, Burjeel Hospital for Advanced Surgery Dubai, Bauerfeind Polyclinic, Euromed Clinic Dubai, Abu Dhabi Foot Care Center, Medicine Middle East, Oman International Hospital, Bahrain Specialist Hospital, Jordan Hospital Podiatry Department, Kuwait Hospital Podiatry Clinic, American University of Beirut Medical Center (AUBMC) – Podiatry Unit, Al Salam Hospital Iraq – Podiatry Services, Emirates Podiatry Group, Podiatry Solutions Middle East, Middle East Foot Health Alliance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East podiatry services market appears promising, driven by increasing healthcare investments and a growing focus on preventive care. As the population ages and the prevalence of diabetes continues to rise, demand for specialized foot care will likely increase. Additionally, the integration of telehealth services and mobile health applications will enhance access to podiatric care, making it more convenient for patients. These trends indicate a robust growth trajectory for the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | General Podiatry Services Surgical Podiatry Services Pediatric Podiatry Services Geriatric Podiatry Services Sports Podiatry Services Diabetic Foot Care Services Orthopedic Podiatry Services Cosmetic Podiatry Services Wound Care Podiatry Services Others |

| By End-User | Hospitals Podiatry Clinics Rehabilitation Centers Home Care & Telemedicine Others |

| By Patient Demographics | Adults Children Elderly Others |

| By Treatment Type | Orthotic Treatments (Custom & Off-the-Shelf) Physical Therapy Surgical Interventions Preventive Care Diabetic Foot Management Others |

| By Geographic Distribution | GCC Countries Levant Region North Africa Others |

| By Insurance Coverage | Private Insurance Public Insurance Out-of-Pocket Payments Others |

| By Service Delivery Model | In-Person Consultations Telehealth Services Mobile Clinics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Podiatry Clinics | 100 | Podiatrists, Clinic Managers |

| Healthcare Providers | 60 | General Practitioners, Orthopedic Surgeons |

| Patient Experience Surveys | 120 | Patients receiving podiatric care, Caregivers |

| Health Insurance Companies | 40 | Health Insurance Analysts, Policy Makers |

| Medical Equipment Suppliers | 50 | Sales Representatives, Product Managers |

The Middle East Podiatry Services Market is valued at approximately USD 180 million, driven by the rising prevalence of diabetes, foot-related disorders, and advancements in podiatric treatments, alongside increased healthcare facility expansion and telehealth service integration.