Region:Middle East

Author(s):Shubham

Product Code:KRAB6922

Pages:93

Published On:October 2025

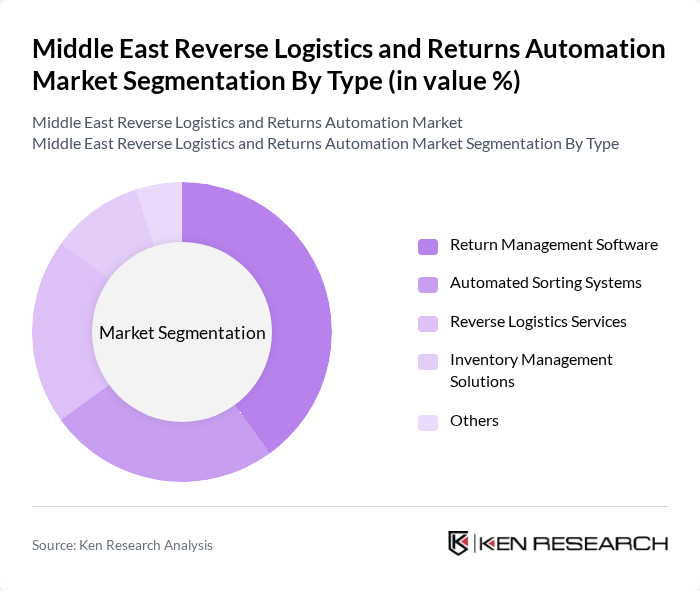

By Type:The market is segmented into Return Management Software, Automated Sorting Systems, Reverse Logistics Services, Inventory Management Solutions, and Others. Among these, Return Management Software is the leading sub-segment due to its critical role in managing product returns efficiently. The increasing demand for seamless return processes in e-commerce has driven the adoption of such software, enabling businesses to enhance customer experience and reduce costs associated with returns.

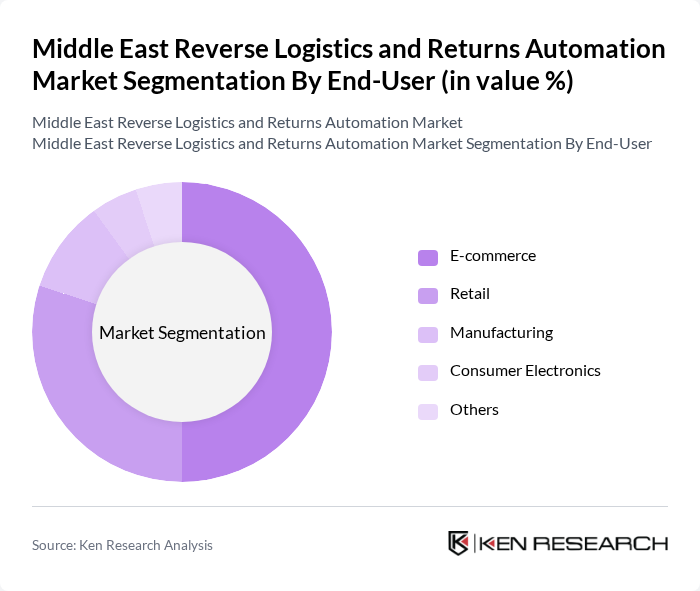

By End-User:The end-user segmentation includes Retail, E-commerce, Manufacturing, Consumer Electronics, and Others. The E-commerce sector dominates this market segment, driven by the exponential growth of online shopping and the increasing need for efficient return processes. Retailers are increasingly adopting returns automation solutions to manage the high volume of returns, thereby improving operational efficiency and customer satisfaction.

The Middle East Reverse Logistics and Returns Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, FedEx, UPS, XPO Logistics, DB Schenker, Kuehne + Nagel, CEVA Logistics, Agility Logistics, DSV Panalpina, Maersk, Rhenus Logistics, Geodis, Bolloré Logistics, Nippon Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East reverse logistics and returns automation market appears promising, driven by the increasing integration of technology and evolving consumer expectations. As e-commerce continues to expand, businesses are likely to invest more in automated solutions to streamline returns processes. Additionally, the growing emphasis on sustainability will push companies to adopt eco-friendly practices in logistics, further enhancing operational efficiency. The market is expected to witness significant transformations as companies adapt to these trends and leverage technology to meet consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Return Management Software Automated Sorting Systems Reverse Logistics Services Inventory Management Solutions Others |

| By End-User | Retail E-commerce Manufacturing Consumer Electronics Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Sales Channel | Online Sales Offline Sales B2B Sales Others |

| By Application | Product Returns Warranty Returns Defective Product Returns Others |

| By Industry Vertical | Fashion Automotive Healthcare Electronics Others |

| By Policy Support | Subsidies for Sustainable Practices Tax Incentives for E-commerce Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 150 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 100 | Operations Managers, Customer Service Heads |

| Automotive Parts Recovery | 80 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 70 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 90 | eCommerce Managers, Fulfillment Center Supervisors |

The Middle East Reverse Logistics and Returns Automation Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the expansion of e-commerce and the increasing demand for efficient return processes.