Region:Middle East

Author(s):Shubham

Product Code:KRAC4955

Pages:100

Published On:October 2025

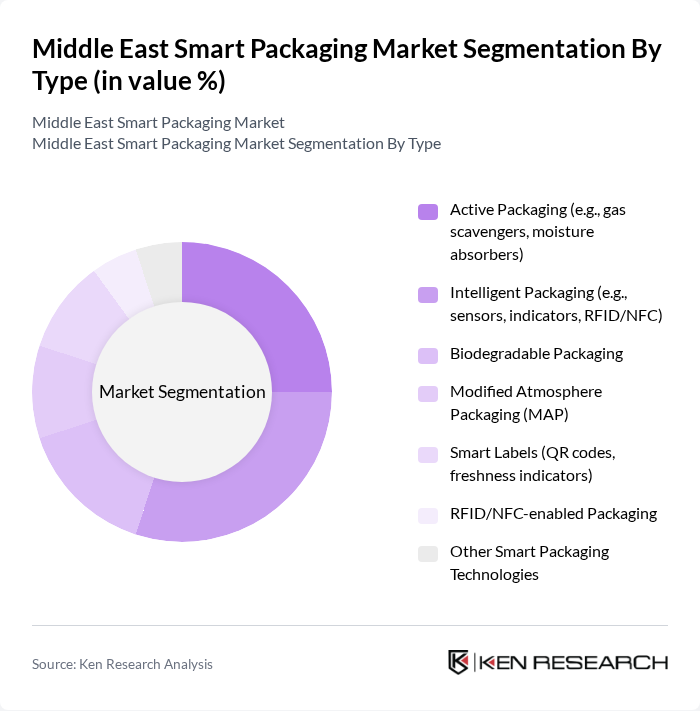

By Type:The segmentation by type includes various innovative packaging solutions that cater to different consumer needs and industry requirements. The subsegments are as follows:

The dominant subsegment in this category isIntelligent Packaging, which is gaining traction due to its ability to provide real-time data and enhance consumer interaction. The integration of sensors, RFID, and NFC technology allows for better tracking, monitoring, and authentication of products throughout the supply chain. This trend is driven by the increasing demand for transparency and safety in food and pharmaceuticals, as well as the growing consumer preference for interactive packaging solutions that enhance the overall user experience. The adoption of connected packaging is further accelerated by regulatory requirements for traceability and anti-counterfeiting in the region .

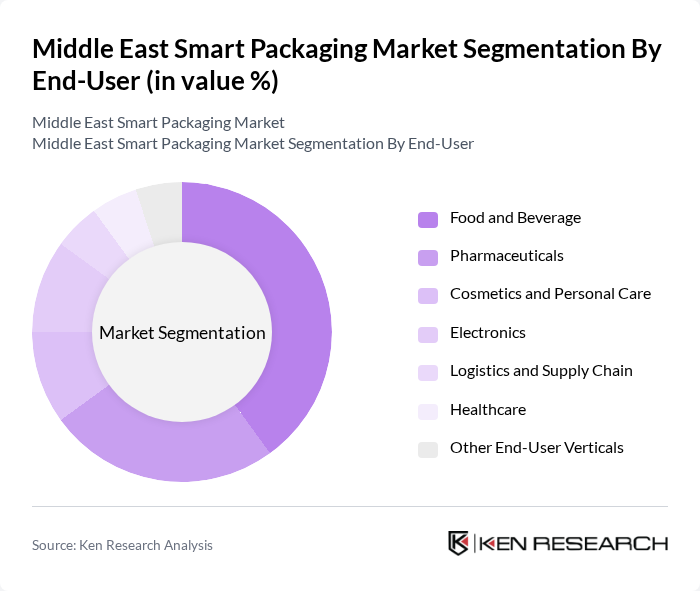

By End-User:The segmentation by end-user highlights the diverse applications of smart packaging across various industries. The subsegments are as follows:

TheFood and Beveragesector is the leading subsegment, driven by the need for enhanced product safety, extended shelf life, and regulatory compliance. Increasing consumer awareness regarding food quality and safety, along with the adoption of freshness indicators and smart seals, has led to a surge in demand for smart packaging solutions. The rapid growth of e-commerce in the food sector has further accelerated the adoption of tamper-evident and interactive packaging technologies, making this sector a critical area for innovation and investment .

The Middle East Smart Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Smurfit Kappa Group, Mondi Group, Huhtamaki Oyj, Berry Global, Inc., WestRock Company, DS Smith Plc, Tetra Pak International S.A., Sonoco Products Company, Constantia Flexibles Group, Graphic Packaging Holding Company, International Paper Company, Avery Dennison Corporation, ProAmpac LLC, Mayr-Melnhof Karton AG, SIG Combibloc Group AG, Zultec Group, Gulf Cryo, Aypek Ambalaj, SEALPAC GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart packaging market in the Middle East appears promising, driven by increasing consumer demand for innovative and sustainable solutions. As e-commerce continues to grow, companies are expected to invest more in smart packaging technologies that enhance product safety and customer engagement. Additionally, the integration of IoT and AI in packaging processes will likely streamline operations and improve supply chain efficiency, positioning the region as a leader in smart packaging innovations in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Packaging (e.g., gas scavengers, moisture absorbers) Intelligent Packaging (e.g., sensors, indicators, RFID/NFC) Biodegradable Packaging Modified Atmosphere Packaging (MAP) Smart Labels (QR codes, freshness indicators) RFID/NFC-enabled Packaging Other Smart Packaging Technologies |

| By End-User | Food and Beverage Pharmaceuticals Cosmetics and Personal Care Electronics Logistics and Supply Chain Healthcare Other End-User Verticals |

| By Application | Food Preservation and Safety Product Tracking and Traceability Anti-Counterfeiting Consumer Engagement and Interaction Supply Chain Optimization Other Applications |

| By Material | Plastics Paper and Paperboard Glass Metal Other Materials |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Other Channels |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Israel) North Africa (Egypt, Morocco, Algeria) Other Middle East Countries |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Engineers, Quality Assurance Managers |

| Pharmaceutical Packaging Solutions | 90 | Regulatory Affairs Specialists, Product Development Managers |

| Consumer Electronics Packaging | 60 | Supply Chain Managers, Product Managers |

| Logistics and Distribution Insights | 80 | Logistics Coordinators, Operations Directors |

| Sustainability Initiatives in Packaging | 50 | Sustainability Managers, Corporate Social Responsibility Officers |

The Middle East Smart Packaging Market is valued at approximately USD 1.2 billion, driven by the demand for innovative packaging solutions that enhance product safety, extend shelf life, and improve consumer engagement across various sectors, including food, beverage, and pharmaceuticals.