Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2372

Pages:81

Published On:October 2025

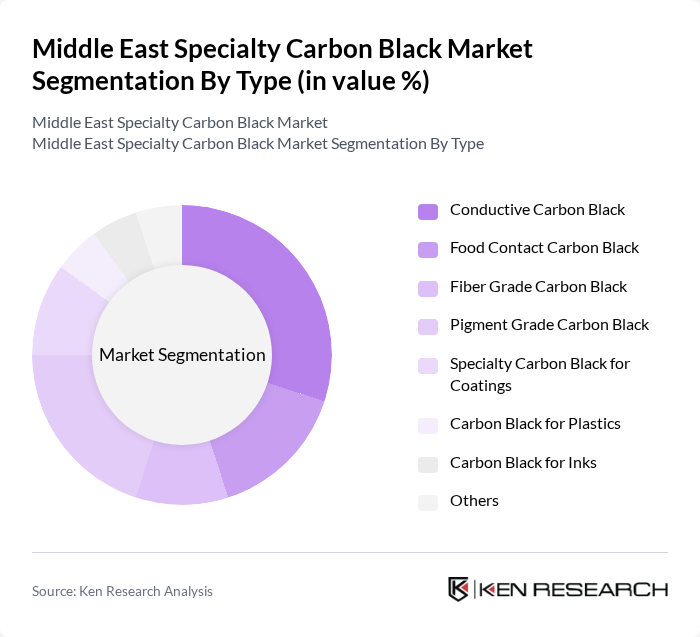

By Type:The market is segmented into various types of specialty carbon black, including Conductive Carbon Black, Food Contact Carbon Black, Fiber Grade Carbon Black, Pigment Grade Carbon Black, Specialty Carbon Black for Coatings, Carbon Black for Plastics, Carbon Black for Inks, and Others. Among these, Conductive Carbon Black is the leading subsegment due to its extensive use in electronics and automotive applications, driven by the increasing demand for lightweight and high-performance materials. Food Contact Carbon Black also represents a significant share, reflecting its use in packaging and consumer goods.

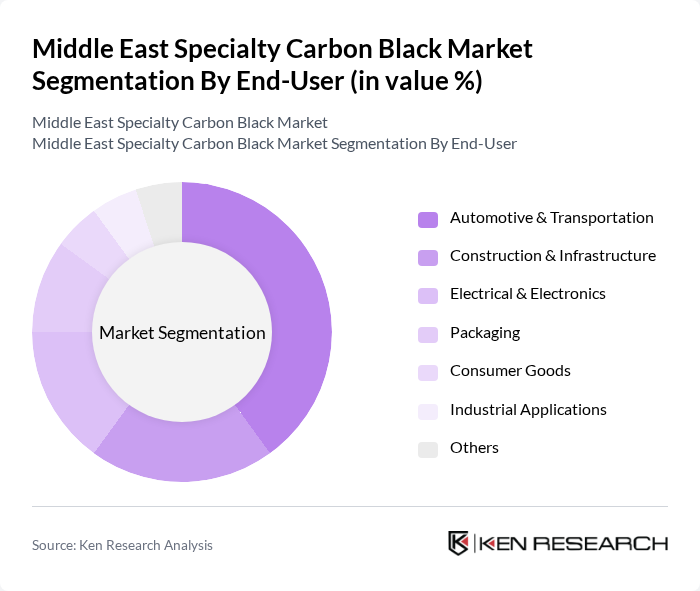

By End-User:The end-user segmentation includes Automotive & Transportation, Construction & Infrastructure, Electrical & Electronics, Packaging, Consumer Goods, Industrial Applications, and Others. The Automotive & Transportation sector is the dominant end-user, driven by the increasing production of vehicles and the demand for high-performance materials that enhance fuel efficiency and reduce emissions. Construction & Infrastructure and Electrical & Electronics also represent substantial market shares, reflecting ongoing urbanization and technological adoption.

The Middle East Specialty Carbon Black Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cabot Corporation, Orion Engineered Carbons S.A., Tokai Carbon Co., Ltd., Phillips Carbon Black Limited (PCBL Limited), Continental Carbon Company, Aditya Birla Group (Birla Carbon), Omsk Carbon Group, Mitsubishi Chemical Corporation, Black Bear Carbon, Epsilon Carbon Private Limited, Asahi Carbon Co., Ltd., Jiangxi Black Cat Carbon Black Inc., Ltd., Shandong Huadong Rubber Material Co., Ltd., Jiangxi Daguangming Carbon Black Co., Ltd., TIANJIN KUNLUN CHEMICAL CO., LTD. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the specialty carbon black market in the Middle East appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers invest in innovative production techniques, efficiency is expected to improve, reducing costs and environmental impact. Additionally, the increasing integration of specialty carbon black in renewable energy applications, such as solar panels, is likely to create new avenues for growth. Overall, the market is poised for significant evolution, aligning with global sustainability trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Conductive Carbon Black Food Contact Carbon Black Fiber Grade Carbon Black Pigment Grade Carbon Black Specialty Carbon Black for Coatings Carbon Black for Plastics Carbon Black for Inks Others |

| By End-User | Automotive & Transportation Construction & Infrastructure Electrical & Electronics Packaging Consumer Goods Industrial Applications Others |

| By Application | Tires & Industrial Rubber Products Plastics Coatings Inks & Toners Adhesives & Sealants Fiber Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Turkey, Egypt, Jordan, Lebanon, etc.) North Africa (Egypt, Morocco, Algeria, Tunisia, etc.) Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tire Manufacturing Sector | 100 | Production Managers, R&D Heads |

| Coatings and Inks Industry | 60 | Product Development Managers, Quality Control Specialists |

| Plastics and Polymers Applications | 50 | Procurement Managers, Technical Sales Representatives |

| Electronics and Electrical Applications | 40 | Design Engineers, Supply Chain Managers |

| Construction and Building Materials | 40 | Project Managers, Material Engineers |

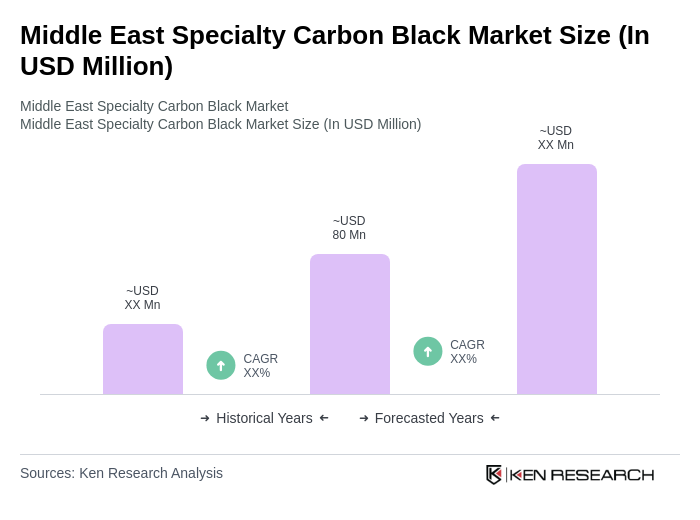

The Middle East Specialty Carbon Black Market is valued at approximately USD 80 million, reflecting a robust growth driven by increasing demand in automotive, coatings, and plastics applications, alongside a focus on sustainability and advanced manufacturing materials.