Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1174

Pages:89

Published On:November 2025

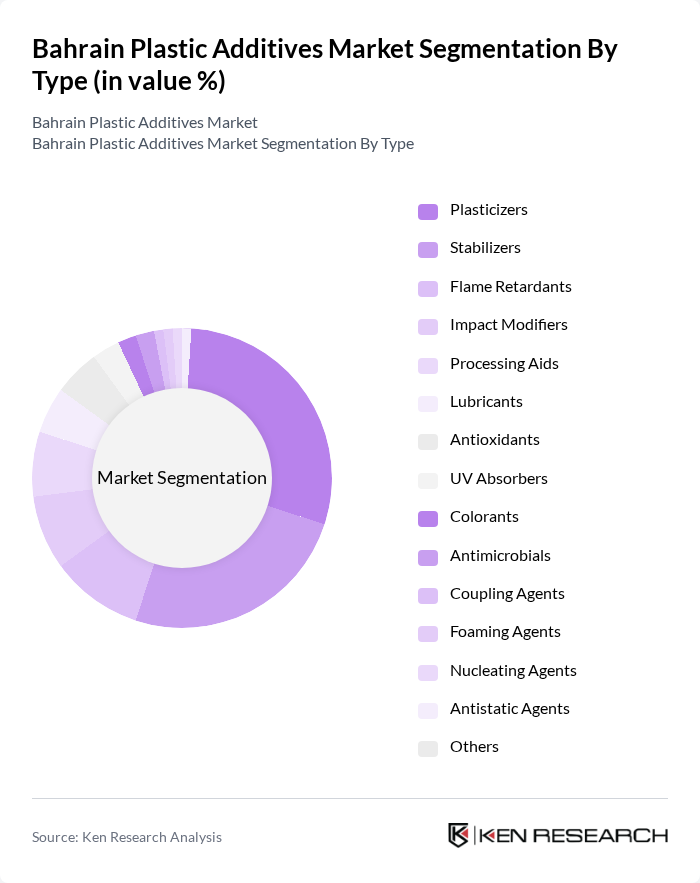

By Type:The market is segmented into various types of plastic additives, including plasticizers, stabilizers, flame retardants, impact modifiers, processing aids, lubricants, antioxidants, UV absorbers, colorants, antimicrobials, coupling agents, foaming agents, nucleating agents, antistatic agents, and others. Among these, plasticizers and stabilizers remain the most prominent, owing to their critical roles in enhancing the flexibility, processability, and durability of plastic products. The demand for flame retardants and impact modifiers is also rising due to increased safety and performance requirements in automotive and construction sectors .

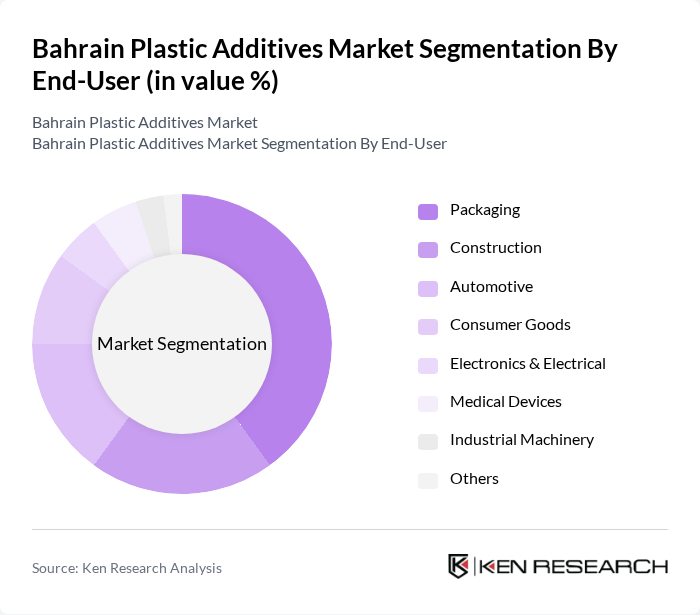

By End-User:The end-user segmentation includes packaging, construction, automotive, consumer goods, electronics & electrical, medical devices, industrial machinery, and others. The packaging sector is the largest consumer of plastic additives, driven by the surging demand for flexible, durable, and sustainable packaging solutions in the food and beverage industry. Construction and automotive sectors also account for significant shares, reflecting the growing use of advanced plastic materials in these applications .

The Bahrain Plastic Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Evonik Industries AG, Dow Chemical Company, A. Schulman, Inc., Solvay S.A., LANXESS AG, Arkema S.A., Mitsubishi Chemical Corporation, Avient Corporation, INEOS Group, SABIC (Saudi Basic Industries Corporation), LyondellBasell Industries N.V., Huntsman Corporation, Eastman Chemical Company, Astra Polymer Compounding Co. Ltd., Gulf Stabilizers Industries (GSI), United Chemicals Company (UCC), Bahrain, Interplast Co. Ltd., Al Watania Plastics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Bahrain plastic additives market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt digital technologies, such as automation and data analytics, production efficiency is expected to improve significantly. Additionally, the trend towards eco-friendly products will likely accelerate, with a focus on developing innovative additives that meet stringent environmental standards. This evolving landscape presents opportunities for companies to differentiate themselves through sustainable practices and advanced product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Plasticizers Stabilizers Flame Retardants Impact Modifiers Processing Aids Lubricants Antioxidants UV Absorbers Colorants Antimicrobials Coupling Agents Foaming Agents Nucleating Agents Antistatic Agents Others |

| By End-User | Packaging Construction Automotive Consumer Goods Electronics & Electrical Medical Devices Industrial Machinery Others |

| By Application | Pipes & Fittings Profiles & Tubing Rigid Sheets & Panels Bottles Wire & Cables Films & Coatings Adhesives Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Geography | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Product Form | Granules Powders Liquids Others |

| By Regulatory Compliance | REACH Compliance RoHS Compliance ISO Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Additives | 100 | Production Managers, Quality Control Supervisors |

| Automotive Plastic Additives | 50 | Procurement Managers, Design Engineers |

| Construction Material Additives | 40 | Project Managers, Supply Chain Coordinators |

| Consumer Goods Additives | 55 | Marketing Managers, Product Development Leads |

| Recycling and Sustainability Initiatives | 45 | Sustainability Officers, Compliance Managers |

The Bahrain Plastic Additives Market is valued at approximately USD 145 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for plastic products in various industries, including packaging, automotive, and construction.