Region:Global

Author(s):Rebecca

Product Code:KRAA2473

Pages:80

Published On:August 2025

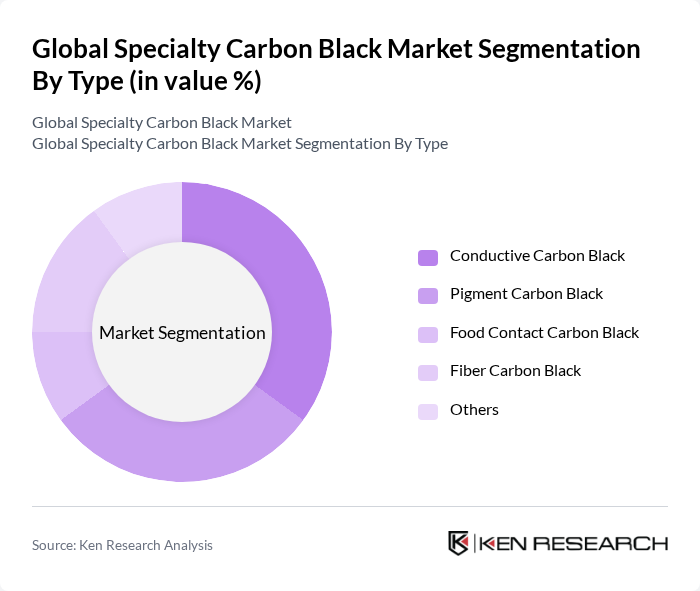

By Type:The market is segmented into Conductive Carbon Black, Pigment Carbon Black, Food Contact Carbon Black, Fiber Carbon Black, and Others. Conductive Carbon Black is widely used in electronics and battery applications for its electrical conductivity, while Pigment Carbon Black is primarily utilized in coatings, plastics, and inks for its deep black color and tinting strength. Fiber Carbon Black is important for textile and polymer applications, and Food Contact Carbon Black is formulated for safety in packaging and food-grade uses .

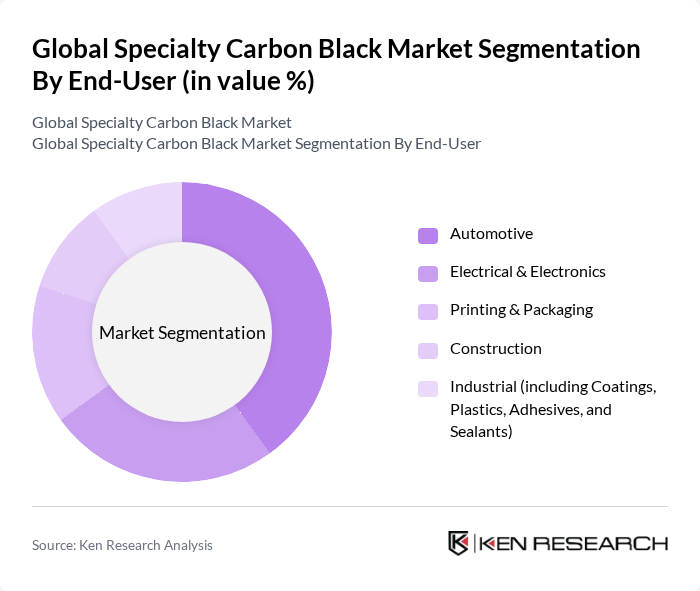

By End-User:The end-user segmentation includes Automotive, Electrical & Electronics, Printing & Packaging, Construction, Industrial (including Coatings, Plastics, Adhesives, and Sealants), and Others. The automotive sector remains the largest consumer, driven by the need for durable, high-performance materials in tires, battery components, and coatings. Electrical & Electronics applications are expanding rapidly due to the rise in consumer electronics, IoT devices, and lithium-ion battery production. Printing & Packaging, Construction, and Industrial sectors continue to adopt specialty carbon black for its functional and aesthetic benefits .

The Global Specialty Carbon Black Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cabot Corporation, Orion Engineered Carbons S.A., Birla Carbon, Tokai Carbon Co., Ltd., Phillips Carbon Black Limited, Mitsubishi Chemical Corporation, Omsk Carbon Group, Black Bear Carbon, Asahi Carbon Co., Ltd., Jiangxi Black Cat Carbon Black Inc., Ltd., Shandong Huibaichuan Chemical Co., Ltd., China Synthetic Rubber Corporation (CSRC), Himadri Speciality Chemical Ltd., Denka Company Limited, Longxing Chemical Stock Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the specialty carbon black market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in production technologies are expected to enhance efficiency and reduce environmental impact, while the growing demand for eco-friendly products will likely shape market dynamics. Additionally, the expansion of applications in emerging markets will provide new growth avenues, as industries increasingly seek high-performance materials that meet regulatory standards and consumer preferences for sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Conductive Carbon Black Pigment Carbon Black Food Contact Carbon Black Fiber Carbon Black Others |

| By End-User | Automotive Electrical & Electronics Printing & Packaging Construction Industrial (including Coatings, Plastics, Adhesives, and Sealants) Others |

| By Application | Plastics Paints & Coatings Inks & Toners Batteries & Energy Storage Cables & Wires Adhesives & Sealants Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Medium Price High Price |

| By Product Form | Powder Granules Pellets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 120 | Product Development Managers, Quality Assurance Engineers |

| Electronics and Electrical Components | 90 | Procurement Managers, R&D Specialists |

| Coatings and Inks Sector | 70 | Formulation Chemists, Marketing Directors |

| Plastics and Rubber Manufacturing | 60 | Production Managers, Supply Chain Analysts |

| Specialty Carbon Black Innovations | 50 | Innovation Managers, Technical Sales Representatives |

The Global Specialty Carbon Black Market is valued at approximately USD 7.7 billion, driven by increasing demand across various sectors such as automotive, electronics, plastics, and coatings, particularly with the rise of electric vehicle production and advancements in battery technology.