Region:Africa

Author(s):Rebecca

Product Code:KRAA5071

Pages:86

Published On:September 2025

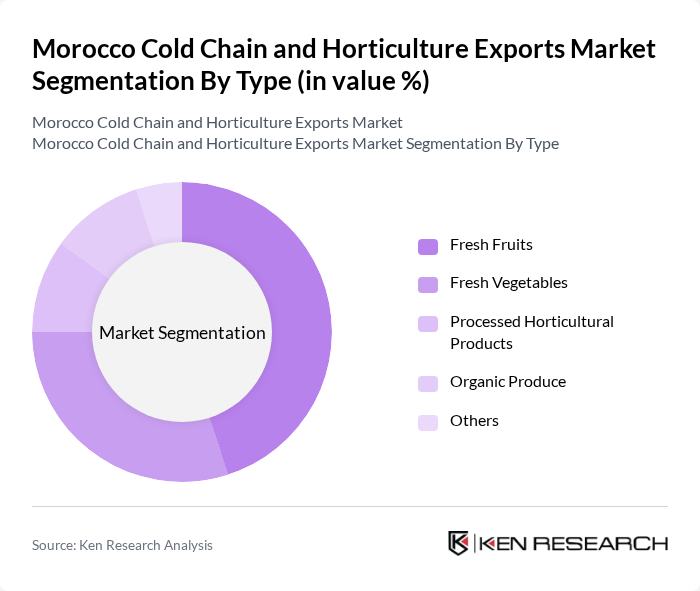

By Type:The market is segmented into various types of horticultural products, including fresh fruits, fresh vegetables, processed horticultural products, organic produce, and others. Among these, fresh fruits and vegetables dominate the market due to their high demand in both domestic and international markets. The increasing consumer preference for healthy and fresh produce has led to a surge in the cultivation and export of these products. Organic produce is also gaining traction as consumers become more health-conscious and environmentally aware.

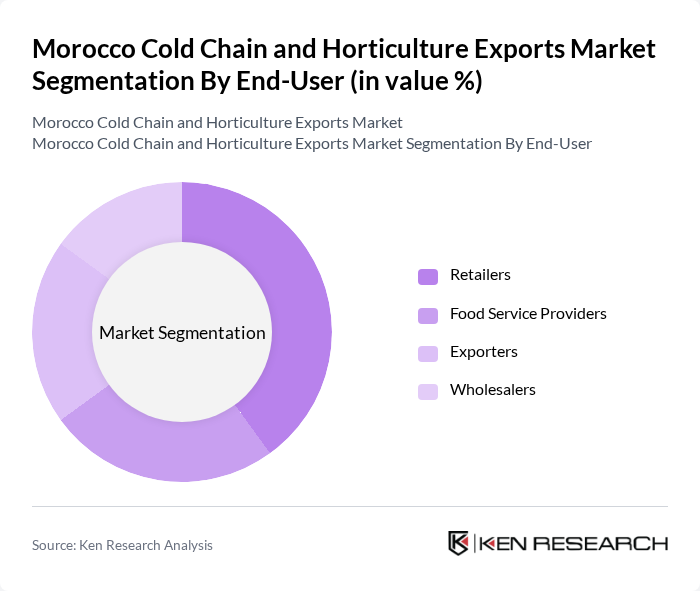

By End-User:The end-user segmentation includes retailers, food service providers, exporters, and wholesalers. Retailers and exporters are the leading segments, driven by the growing demand for fresh produce in supermarkets and international markets. Retailers benefit from the increasing trend of health-conscious consumers seeking fresh fruits and vegetables, while exporters capitalize on Morocco's favorable climate for horticulture, allowing them to supply high-quality products to global markets.

The Morocco Cold Chain and Horticulture Exports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maroc Horticulture, Les Domaines Agricoles, Agri Maroc, Export Horticole, Agro-Food Export, Cold Chain Solutions Morocco, Horticulture Maroc, Fresh Fruits Morocco, Maroc Fruits, Green Valley, Agro-Logistics, HortiTech, Fresh Logistics, Maroc Export, Eco Horticulture contribute to innovation, geographic expansion, and service delivery in this space.

The future of Morocco's cold chain and horticulture exports market appears promising, driven by increasing global demand for fresh produce and advancements in logistics technology. As the country enhances its cold chain infrastructure, it is expected to reduce post-harvest losses significantly. Furthermore, the growing trend towards organic produce and sustainable practices will likely open new avenues for Moroccan exporters, positioning them favorably in international markets while meeting consumer preferences for quality and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Fruits Fresh Vegetables Processed Horticultural Products Organic Produce Others |

| By End-User | Retailers Food Service Providers Exporters Wholesalers |

| By Distribution Mode | Direct Sales Online Sales Third-Party Logistics Others |

| By Packaging Type | Plastic Containers Cardboard Boxes Vacuum Packaging Others |

| By Temperature Control | Chilled Frozen Ambient |

| By Market Channel | Domestic Market International Market |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Horticulture Exporters | 100 | Export Managers, Business Development Executives |

| Cold Chain Logistics Providers | 80 | Operations Managers, Logistics Coordinators |

| Farmers and Cooperatives | 120 | Farm Owners, Cooperative Leaders |

| Regulatory Bodies | 50 | Policy Makers, Agricultural Inspectors |

| Retail Buyers and Distributors | 70 | Procurement Managers, Supply Chain Analysts |

The Morocco Cold Chain and Horticulture Exports Market is valued at approximately USD 1.5 billion, driven by increasing global demand for fresh produce and advancements in cold chain logistics that enhance product quality and shelf life.