Region:Africa

Author(s):Geetanshi

Product Code:KRAA2020

Pages:94

Published On:August 2025

By Type:The market is segmented into Transportation Management Systems (TMS), Warehouse Management Systems (WMS), Inventory Management Solutions, Order Management Systems, Supply Chain Planning Software, Freight Management Solutions, Real-Time Tracking & Visibility Platforms, Last-Mile Delivery Solutions, and Others. Transportation Management Systems (TMS) are currently leading the market, driven by the increasing need for efficient transportation solutions and real-time tracking capabilities. The rise of e-commerce and the demand for streamlined logistics operations have further fueled TMS adoption, with businesses prioritizing solutions that optimize route planning, shipment tracking, and cost management .

By End-User:End-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, Oil & Gas, Mining and Quarrying, Logistics & Transportation, Agriculture, Fishing, and Forestry, Construction, and Others. The Retail & E-commerce sector is the dominant end-user, driven by rapid growth in online shopping and the need for efficient supply chain solutions to meet consumer demands. Increasing reliance on technology for inventory management, order fulfillment, and last-mile delivery has solidified this sector's leading position, with manufacturing and healthcare also contributing significantly to market growth .

The Nigeria Supply Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP Nigeria, Oracle Nigeria, IBM Nigeria, Jumia Logistics, DHL Global Forwarding Nigeria, Kuehne + Nagel Nigeria, Maersk Nigeria, FedEx Red Star Express, GEODIS Nigeria, Bolloré Transport & Logistics Nigeria, Transcorp Logistics, GIG Logistics, Red Star Express, Chisco Transport, ABC Transport contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria supply chain technology market appears promising, driven by ongoing digital transformation and increased investment in logistics infrastructure. As businesses adapt to the growing e-commerce landscape, the integration of advanced technologies such as AI and machine learning will become essential for optimizing supply chain operations. Additionally, the focus on sustainability will likely lead to innovative solutions that reduce environmental impact while enhancing efficiency, positioning companies for long-term success in a competitive market.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Systems (TMS) Warehouse Management Systems (WMS) Inventory Management Solutions Order Management Systems Supply Chain Planning Software Freight Management Solutions Real-Time Tracking & Visibility Platforms Last-Mile Delivery Solutions Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Oil & Gas, Mining and Quarrying Logistics & Transportation Agriculture, Fishing, and Forestry Construction Others |

| By Component | Software Hardware Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Road Rail Air Sea and Inland Waterways |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Technology Adoption | 100 | Supply Chain Managers, IT Directors |

| Manufacturing Process Optimization | 60 | Operations Managers, Production Supervisors |

| Agricultural Supply Chain Innovations | 50 | Agribusiness Owners, Logistics Coordinators |

| Logistics Technology Integration | 70 | Logistics Directors, Technology Officers |

| E-commerce Supply Chain Solutions | 65 | eCommerce Managers, Fulfillment Specialists |

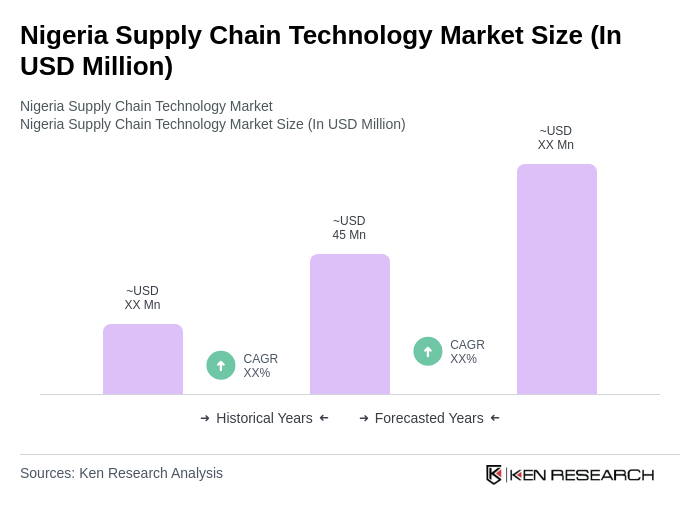

The Nigeria Supply Chain Technology Market is valued at approximately USD 45 million, reflecting a five-year historical analysis. This growth is driven by the increasing adoption of digital technologies and the expansion of e-commerce platforms.