Japan Cold Chain and Horticulture Exports Market Overview

- The Japan Cold Chain and Horticulture Exports Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for fresh produce, advancements in cold chain logistics, and a growing focus on food safety and quality. The market has seen a significant rise in exports, particularly in fresh fruits and vegetables, as Japan continues to enhance its agricultural practices and export capabilities.

- Key players in this market include Tokyo, Osaka, and Yokohama, which dominate due to their strategic locations, advanced infrastructure, and access to major transportation networks. These cities serve as critical hubs for logistics and distribution, facilitating efficient cold chain operations and enabling exporters to reach international markets effectively.

- In 2023, the Japanese government implemented the Food Safety Basic Act, which mandates stricter regulations on the handling and transportation of perishable goods. This regulation aims to enhance food safety standards and ensure that cold chain logistics comply with international safety protocols, thereby boosting consumer confidence in exported horticultural products.

Japan Cold Chain and Horticulture Exports Market Segmentation

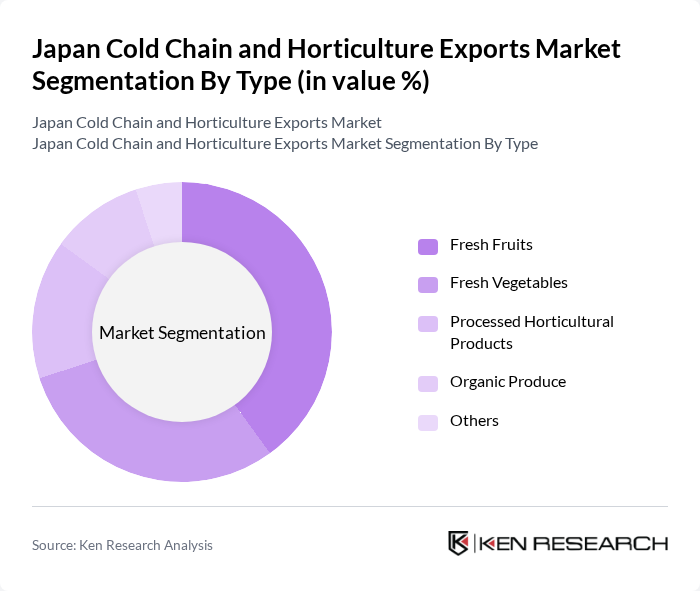

By Type:The market is segmented into various types, including fresh fruits, fresh vegetables, processed horticultural products, organic produce, and others. Among these, fresh fruits and vegetables are the most significant contributors to market growth, driven by consumer preferences for healthy eating and the increasing popularity of organic options. The demand for processed horticultural products is also rising, as convenience and ready-to-eat options become more appealing to consumers.

By End-User:The end-user segmentation includes retail chains, food service providers, exporters, and wholesalers. Retail chains are the leading segment, driven by the increasing demand for fresh produce in supermarkets and grocery stores. Food service providers also play a significant role, as restaurants and catering services require a consistent supply of high-quality horticultural products. Exporters and wholesalers contribute to the market by facilitating the distribution of goods to international markets.

Japan Cold Chain and Horticulture Exports Market Competitive Landscape

The Japan Cold Chain and Horticulture Exports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marubeni Corporation, Mitsui & Co., Ltd., Sojitz Corporation, Sumitomo Corporation, Yamato Holdings Co., Ltd., Nippon Express Co., Ltd., Kintetsu World Express, Inc., Hitachi Transport System, Ltd., Seino Holdings Co., Ltd., Sagawa Express Co., Ltd., Daifuku Co., Ltd., Kuehne + Nagel Ltd., Daiseki Co., Ltd., Kato Sangyo Co., Ltd., Kanto Transportation Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Japan Cold Chain and Horticulture Exports Market Industry Analysis

Growth Drivers

- Increasing Demand for Fresh Produce:The demand for fresh produce in Japan is projected to reach 1.2 million tons in the future, driven by a growing health-conscious consumer base. The Japanese population increasingly prioritizes fresh fruits and vegetables, with organic produce sales alone expected to exceed ¥300 billion. This trend is supported by the World Bank's report indicating a 2.5% annual growth in food consumption, emphasizing the need for efficient cold chain logistics to maintain product quality during distribution.

- Expansion of E-commerce in Food Distribution:E-commerce sales in Japan's food sector are anticipated to surpass ¥1 trillion in the future, reflecting a significant shift in consumer purchasing behavior. The rise of online grocery shopping, accelerated by the COVID-19 pandemic, has necessitated robust cold chain solutions to ensure the freshness of perishable goods. According to the Ministry of Agriculture, Forestry and Fisheries, e-commerce now accounts for 15% of total food sales, highlighting the importance of efficient logistics in this growing segment.

- Technological Advancements in Cold Storage:The cold storage capacity in Japan is expected to increase by 10% in the future, driven by technological innovations such as IoT and automation. Investments in smart cold chain technologies are projected to reach ¥50 billion, enhancing temperature control and monitoring. The Japan Refrigeration and Air Conditioning Industry Association reports that these advancements can reduce spoilage rates by up to 30%, significantly improving the efficiency of horticulture exports and ensuring product quality.

Market Challenges

- High Operational Costs:The operational costs for cold chain logistics in Japan are among the highest globally, averaging ¥1,200 per cubic meter. This high cost is attributed to energy expenses, labor shortages, and the need for advanced technology. The Japan External Trade Organization indicates that these costs can reduce profit margins for exporters, making it challenging to compete with lower-cost international suppliers, particularly from Southeast Asia.

- Stringent Regulatory Requirements:Japan's cold chain and horticulture sectors face rigorous regulatory standards, including food safety and environmental regulations. Compliance costs can reach up to ¥100 million for small to medium-sized enterprises, as reported by the Ministry of Health, Labour and Welfare. These stringent requirements can hinder market entry for new players and increase operational complexities for existing businesses, limiting their growth potential in the export market.

Japan Cold Chain and Horticulture Exports Market Future Outlook

The future of Japan's cold chain and horticulture exports market appears promising, driven by increasing consumer demand for fresh and organic produce. As e-commerce continues to expand, the integration of advanced technologies in logistics will enhance operational efficiency. Furthermore, the government's commitment to supporting agricultural exports through subsidies and infrastructure development will likely bolster the sector. However, addressing high operational costs and regulatory challenges will be crucial for sustaining growth and competitiveness in the global market.

Market Opportunities

- Growth in Organic Horticulture Exports:The organic horticulture market in Japan is projected to grow to ¥400 billion in the future, driven by rising consumer awareness and demand for healthy food options. This growth presents significant opportunities for exporters to tap into international markets, particularly in regions with increasing health trends, such as North America and Europe.

- Development of Smart Cold Chain Solutions:The adoption of smart cold chain technologies is expected to create a market worth ¥30 billion in the future. Innovations such as real-time tracking and automated temperature control can enhance efficiency and reduce waste. This presents an opportunity for Japanese companies to lead in technology development and export these solutions globally, capitalizing on the growing demand for efficient logistics.