Region:Africa

Author(s):Rebecca

Product Code:KRAB1772

Pages:86

Published On:October 2025

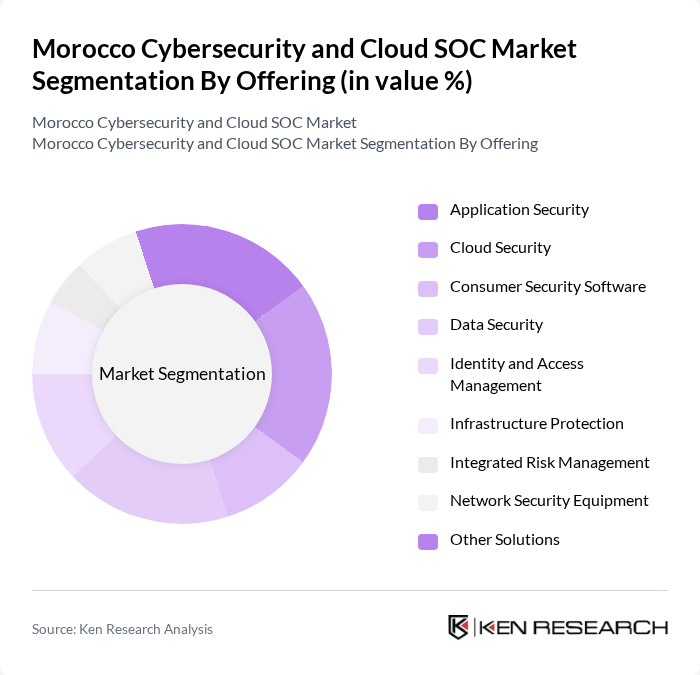

By Offering:The market is segmented into two main categories: Solutions and Services. The Solutions segment includes various subsegments such as Application Security, Cloud Security, Consumer Security Software, Data Security, Identity and Access Management, Infrastructure Protection, Integrated Risk Management, Network Security Equipment, and Other Solutions. The Services segment encompasses Professional Services and Managed Services. Each of these subsegments plays a crucial role in addressing the diverse cybersecurity needs of organizations, with AI-driven and machine learning-based systems offering real-time threat detection capabilities becoming increasingly important.

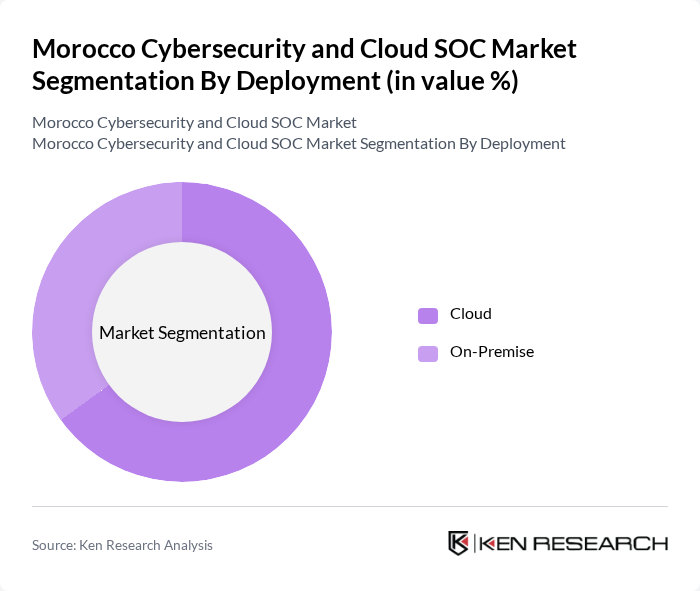

By Deployment:The market is also segmented based on deployment types, which include Cloud and On-Premise solutions. Cloud deployment is gaining traction due to its scalability and cost-effectiveness, while On-Premise solutions are preferred by organizations with stringent data security requirements. The choice of deployment often depends on the specific needs and regulatory obligations of the end-users, with cloud adoption among enterprises escalating and necessitating sophisticated cloud security measures.

By End-User:The market is segmented by end-users, which include IT and Telecom, BFSI, Retail and E-Commerce, Oil, Gas and Energy, Manufacturing, Government and Defence, and Other End-Users. Each sector has unique cybersecurity needs, with IT and Telecom being the largest segment due to the high volume of data and the critical nature of their services. The rapid digitization across sectors, including finance and healthcare, has further increased demand for robust cybersecurity solutions, while e-commerce growth is driving the need for securing payment gateways and customer data.

The Morocco Cybersecurity and Cloud SOC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Orange Cyberdefense, Atos SE (Morocco), IBM Security, Cisco Systems, Fortinet, Check Point Software Technologies, Trend Micro, Palo Alto Networks, Kaspersky Lab, McAfee, CyberArk, Treemium (Morocco), DATAPROTECT, Thales (Morocco), Involys contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Moroccan cybersecurity and cloud SOC market appears promising, driven by increasing government support and a growing awareness of cyber threats among businesses. As organizations continue to adopt cloud technologies, the demand for integrated cybersecurity solutions will rise. Additionally, the emergence of innovative technologies, such as AI and machine learning, will enhance threat detection capabilities, enabling organizations to respond more effectively to cyber incidents and safeguard their digital assets.

| Segment | Sub-Segments |

|---|---|

| By Offering | Solutions Application Security Cloud Security Consumer Security Software Data Security Identity and Access Management Infrastructure Protection Integrated Risk Management Network Security Equipment Other Solutions Services Professional Services Managed Services |

| By Deployment | Cloud On-Premise |

| By End-User | IT and Telecom BFSI Retail and E-Commerce Oil, Gas and Energy Manufacturing Government and Defence Other End-Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 60 | IT Security Managers, Compliance Officers |

| Healthcare Cloud Services | 50 | Healthcare IT Directors, Data Protection Officers |

| Government Cybersecurity Initiatives | 40 | Public Sector IT Managers, Cybersecurity Policy Makers |

| Telecommunications Security Solutions | 45 | Network Security Engineers, Operations Managers |

| SME Cybersecurity Adoption | 40 | Small Business Owners, IT Consultants |

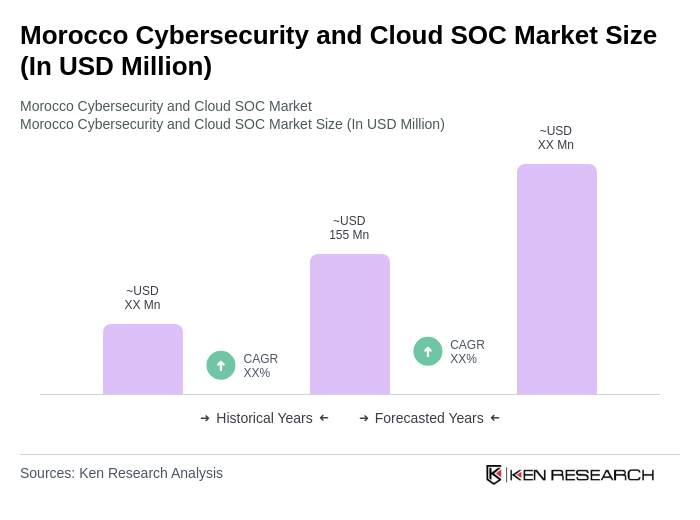

The Morocco Cybersecurity and Cloud SOC Market is valued at approximately USD 155 million, reflecting a significant growth driven by increasing cyber threats, cloud service adoption, and regulatory compliance needs among businesses.