Region:Africa

Author(s):Dev

Product Code:KRAA3516

Pages:84

Published On:September 2025

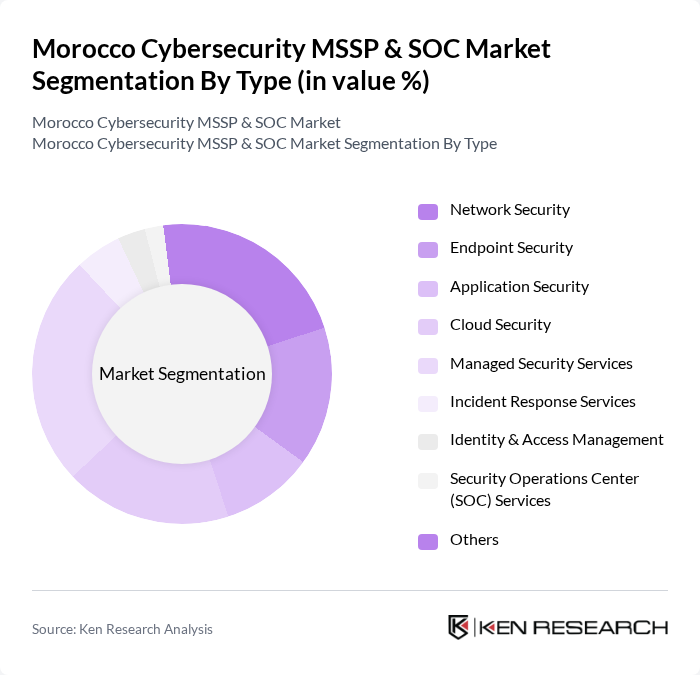

By Type:The market is segmented into various types of cybersecurity services, includingNetwork Security,Endpoint Security,Application Security,Cloud Security,Managed Security Services,Incident Response Services,Identity & Access Management,Security Operations Center (SOC) Services, andOthers. Each segment addresses specific security needs: Network Security focuses on protecting data in transit; Endpoint Security safeguards devices; Application Security ensures software integrity; Cloud Security addresses risks in cloud environments; Managed Security Services provide outsourced protection; Incident Response Services offer rapid breach mitigation; Identity & Access Management controls user privileges; SOC Services deliver real-time monitoring and response; and Others include specialized offerings such as vulnerability assessment and compliance management .

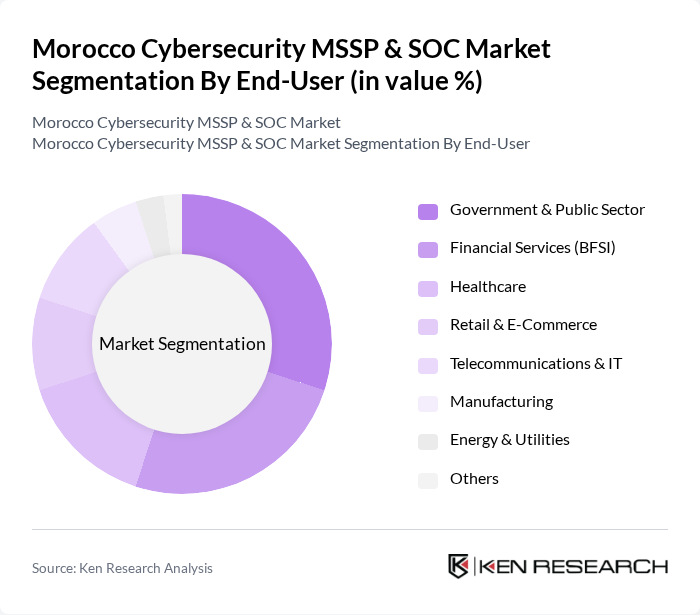

By End-User:The end-user segmentation includesGovernment & Public Sector,Financial Services (BFSI),Healthcare,Retail & E-Commerce,Telecommunications & IT,Manufacturing,Energy & Utilities, andOthers. Each sector has distinct cybersecurity requirements: Government & Public Sector focuses on national security and citizen data; BFSI prioritizes fraud prevention and regulatory compliance; Healthcare protects sensitive patient data; Retail & E-Commerce secures payment and customer information; Telecommunications & IT defends network infrastructure; Manufacturing addresses industrial control system risks; Energy & Utilities safeguard critical infrastructure; Others encompass education, transportation, and emerging sectors .

The Morocco Cybersecurity MSSP & SOC Market is characterized by a dynamic mix of regional and international players. Leading participants such as DATAPROTECT, Orange Cyberdefense Maroc, Atos Maroc, Thales Maroc, IBM Maroc, Cisco Systems Maroc, Fortinet, Kaspersky Lab, Trend Micro, Secureworks, S2M (Société Maghrébine de Monétique), Involys, GEMADEC, Paladion (an Atos company), and CyberForce Maroc contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Morocco cybersecurity MSSP and SOC market appears promising, driven by increasing investments in technology and a growing awareness of cybersecurity risks. As organizations continue to embrace digital transformation, the demand for advanced cybersecurity solutions will likely rise. Furthermore, collaboration between local firms and international cybersecurity companies is expected to enhance service offerings, leading to improved security measures and a more robust cybersecurity framework in the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Managed Security Services Incident Response Services Identity & Access Management Security Operations Center (SOC) Services Others |

| By End-User | Government & Public Sector Financial Services (BFSI) Healthcare Retail & E-Commerce Telecommunications & IT Manufacturing Energy & Utilities Others |

| By Service Model | On-Premises Cloud-Based Hybrid Others |

| By Deployment Type | Managed Services Professional Services Consulting & Advisory Services Others |

| By Industry Vertical | BFSI Government Healthcare IT & Telecom Energy & Utilities Retail & E-Commerce Manufacturing Others |

| By Security Type | Threat Intelligence Vulnerability Management Security Information and Event Management (SIEM) Managed Detection & Response (MDR) Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Outcome-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity Needs | 100 | CIOs, IT Security Managers |

| Healthcare Sector Cybersecurity Challenges | 80 | IT Directors, Compliance Officers |

| Telecommunications MSSP Utilization | 60 | Network Security Engineers, Operations Managers |

| Government Cybersecurity Initiatives | 50 | Policy Makers, Cybersecurity Advisors |

| SME Cybersecurity Awareness | 70 | Business Owners, IT Consultants |

The Morocco Cybersecurity MSSP & SOC Market is valued at approximately USD 150 million, reflecting a significant investment in managed security services driven by increasing cyber threats and the need for data protection across various sectors.