Region:Europe

Author(s):Shubham

Product Code:KRAB1149

Pages:98

Published On:October 2025

By Type:The market is segmented into Executive MBA Programs, Leadership Development Programs, Professional Certifications, Short Courses and Workshops, Online Learning Modules, Coaching and Mentoring Services, Corporate Academies, Custom In-Company Programs, and Others. Professional Certifications are experiencing the highest demand, driven by their direct impact on employability, alignment with industry standards, and the need for specialized skills in fields such as digital transformation, sustainability, and leadership .

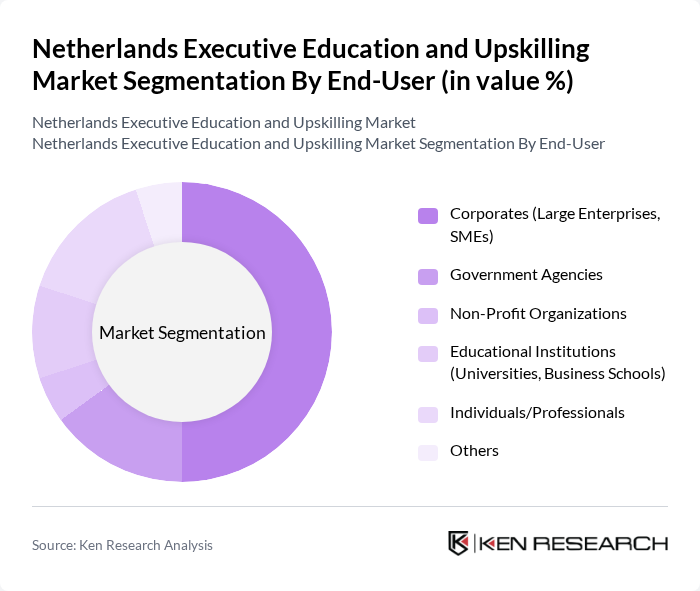

By End-User:The end-users of executive education and upskilling programs include Corporates (Large Enterprises, SMEs), Government Agencies, Non-Profit Organizations, Educational Institutions (Universities, Business Schools), Individuals/Professionals, and Others. Corporates remain the largest end-user segment, reflecting the strategic importance of continuous workforce development, talent retention, and adaptation to evolving business needs in the Netherlands .

The Netherlands Executive Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nyenrode Business Universiteit, Rotterdam School of Management, Erasmus University, TIAS School for Business and Society, Amsterdam Business School (University of Amsterdam), INSEAD, Open Universiteit Nederland, NCOI Opleidingen, LOI (Leidse Onderwijsinstellingen), ISBW (Instituut voor Sociale en Bedrijfskundige Wetenschappen), Academie voor Management, Schouten & Nelissen, Universiteit van Amsterdam, Vrije Universiteit Amsterdam, Universiteit Twente, Universiteit Utrecht, Avans Hogeschool, Saxion University of Applied Sciences, Digital Bricks contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands executive education and upskilling market appears promising, driven by the increasing emphasis on digital transformation and the need for a skilled workforce. As organizations adapt to evolving market demands, the focus on personalized and flexible learning solutions will intensify. Additionally, the integration of AI and data analytics in educational programs is expected to enhance learning outcomes, making training more effective and relevant. This evolution will likely create new avenues for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Leadership Development Programs Professional Certifications Short Courses and Workshops Online Learning Modules Coaching and Mentoring Services Corporate Academies Custom In-Company Programs Others |

| By End-User | Corporates (Large Enterprises, SMEs) Government Agencies Non-Profit Organizations Educational Institutions (Universities, Business Schools) Individuals/Professionals Others |

| By Delivery Mode | In-Person Training Online Learning (Synchronous, Asynchronous) Hybrid Learning Blended Learning Mobile Learning Others |

| By Duration | Short-Term Programs (Less than 3 months) Medium-Term Programs (3 to 6 months) Long-Term Programs (More than 6 months) Modular/Stackable Programs Others |

| By Industry Focus | Technology Finance & Banking Healthcare & Life Sciences Manufacturing & Engineering Retail & Consumer Goods Public Sector Energy & Sustainability Others |

| By Certification Type | Accredited Certifications (NVAO, EQF, etc.) Non-Accredited Certifications Professional Development Certificates Micro-Credentials Others |

| By Pricing Tier | Premium Tier Mid-Tier Budget Tier Free/Open Access Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 100 | HR Managers, Learning & Development Managers |

| Executive MBA Participants | 60 | Current Students, Alumni |

| Online Upskilling Courses | 80 | Course Participants, Educational Administrators |

| Industry-Specific Workshops | 50 | Workshop Facilitators, Industry Experts |

| Government Upskilling Initiatives | 40 | Policy Makers, Program Coordinators |

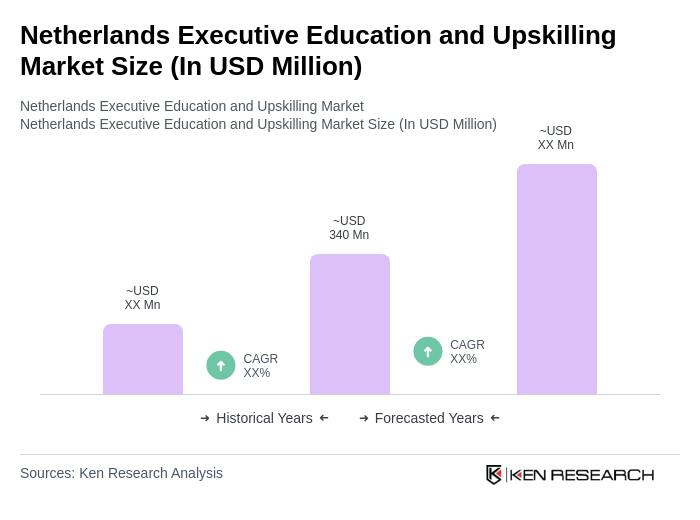

The Netherlands Executive Education and Upskilling Market is valued at approximately USD 340 million, reflecting a growing demand for skilled professionals in sectors such as technology, sustainability, and management, alongside the rise of digital learning platforms.