Region:Africa

Author(s):Geetanshi

Product Code:KRAE7601

Pages:93

Published On:December 2025

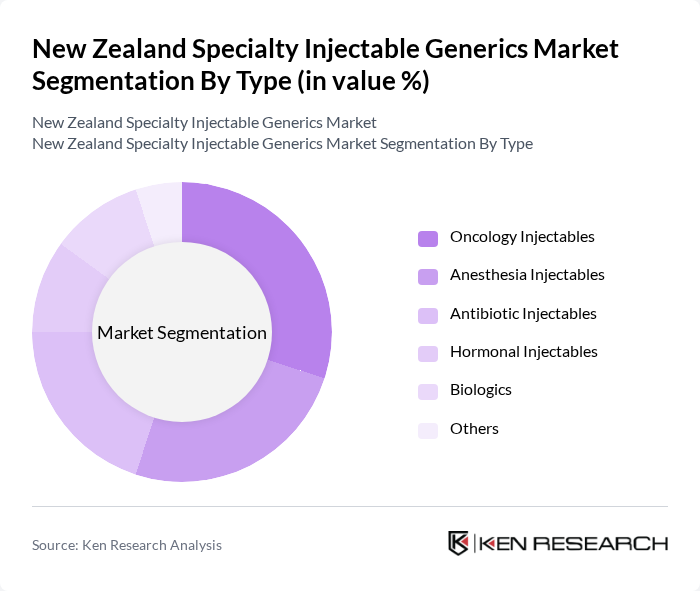

By Type:The market is segmented into various types of specialty injectable generics, including Oncology Injectables, Anesthesia Injectables, Antibiotic Injectables, Hormonal Injectables, Biologics, and Others. Each of these subsegments caters to specific therapeutic needs and patient demographics, with varying levels of demand based on clinical requirements and treatment protocols. Injectables remain the dominant formulation type globally due to their rapid absorption, long-lasting effects, and enhanced bioavailability, which improve patient compliance and acceptance.

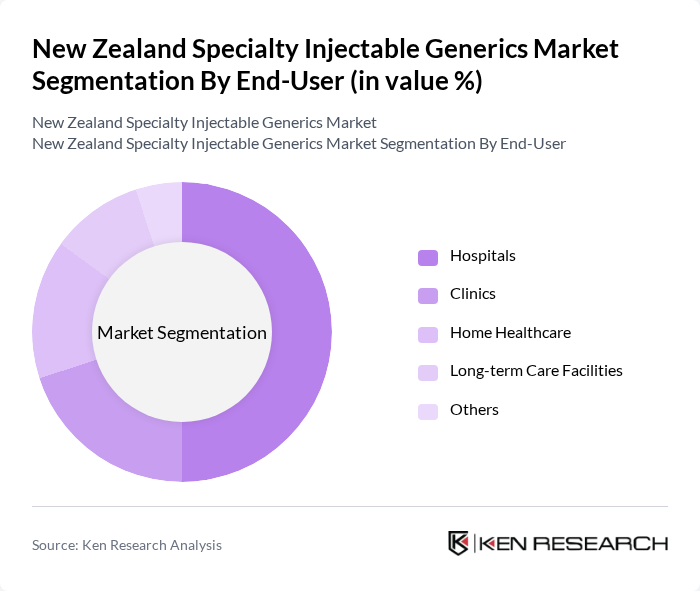

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare, Long-term Care Facilities, and Others. Each segment reflects the diverse settings in which specialty injectable generics are utilized, with hospitals being the primary consumers due to their extensive patient care services and specialized treatment protocols, with hospital pharmacy segments registering the fastest growth supported by rising adoption of specialty generics in inpatient settings for critical care treatments.

The New Zealand Specialty Injectable Generics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer New Zealand, Fresenius Kabi, Mylan, Sandoz, Teva Pharmaceuticals, Baxter International, Hikma Pharmaceuticals, Amgen, B. Braun, Ebewe Pharma, Accord Healthcare, Aurobindo Pharma, Apotex, Sun Pharmaceutical Industries, and Cipla contribute to innovation, geographic expansion, and service delivery in this space.

The future of the specialty injectable generics market in New Zealand appears promising, driven by increasing healthcare demands and technological advancements. As the population ages and chronic diseases become more prevalent, the need for affordable treatment options will intensify. Additionally, the ongoing shift towards value-based healthcare will encourage the adoption of generics. Companies that invest in innovative drug formulations and strategic collaborations with healthcare providers are likely to thrive in this evolving landscape, ensuring better patient access to essential medications.

| Segment | Sub-Segments |

|---|---|

| By Type | Oncology Injectables Anesthesia Injectables Antibiotic Injectables Hormonal Injectables Biologics Others |

| By End-User | Hospitals Clinics Home Healthcare Long-term Care Facilities Others |

| By Therapeutic Area | Cardiovascular Neurology Infectious Diseases Endocrinology Others |

| By Distribution Channel | Direct Sales Wholesalers Retail Pharmacies Online Pharmacies Others |

| By Packaging Type | Vials Ampoules Pre-filled Syringes Others |

| By Route of Administration | Intravenous Intramuscular Subcutaneous Others |

| By Region | North Island South Island Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Pharmacy Management | 100 | Pharmacy Directors, Clinical Pharmacists |

| Oncology Specialty Clinics | 80 | Oncologists, Nurse Practitioners |

| Rheumatology Practices | 70 | Rheumatologists, Physician Assistants |

| Patient Advocacy Groups | 60 | Patient Representatives, Healthcare Advocates |

| Health Insurance Providers | 90 | Policy Analysts, Claims Managers |

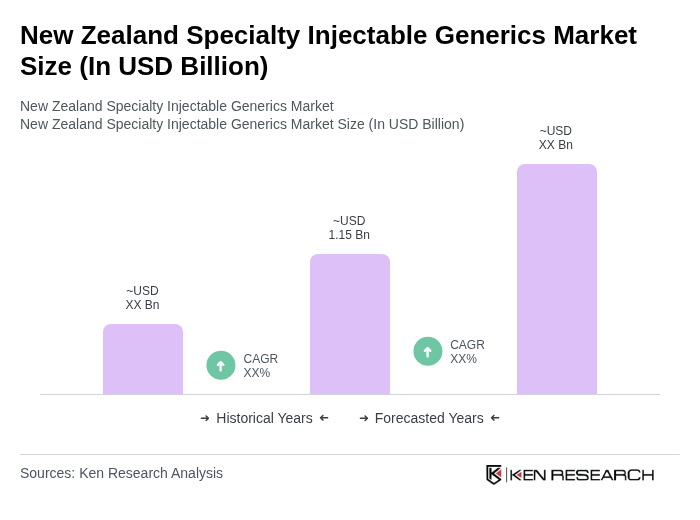

The New Zealand Specialty Injectable Generics Market is valued at approximately USD 1.15 billion, driven by the increasing prevalence of chronic diseases, demand for cost-effective treatments, and advancements in pharmaceutical technologies.