Region:Middle East

Author(s):Shubham

Product Code:KRAA8559

Pages:87

Published On:November 2025

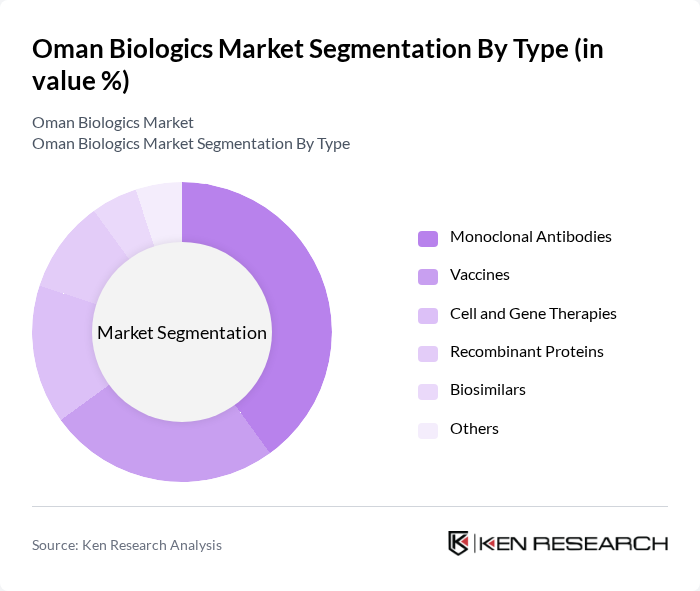

By Type:The biologics market can be segmented into various types, including Monoclonal Antibodies, Vaccines, Cell and Gene Therapies, Recombinant Proteins, Biosimilars, and Others. Among these, Monoclonal Antibodies have emerged as the leading sub-segment due to their effectiveness in treating various cancers and autoimmune diseases. The increasing investment in research and development, coupled with a growing number of approvals for new monoclonal antibody therapies, has significantly contributed to their dominance in the market. Biosimilars are also gaining traction as cost-effective alternatives, especially in oncology and immunology .

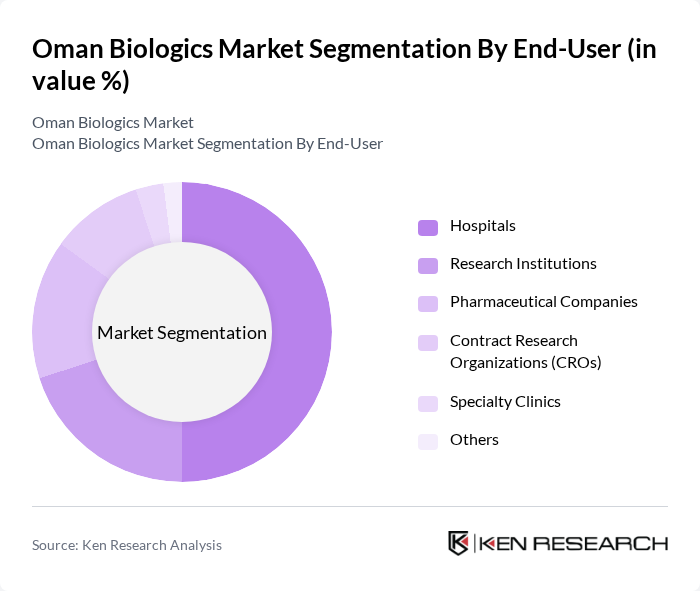

By End-User:The end-user segmentation includes Hospitals, Research Institutions, Pharmaceutical Companies, Contract Research Organizations (CROs), Specialty Clinics, and Others. Hospitals are the dominant end-user segment, driven by the increasing number of patients requiring biologic treatments and the growing adoption of advanced therapies in clinical settings. The expansion of healthcare facilities and the rising demand for specialized treatments further bolster the market share of hospitals in the biologics sector. Research institutions and CROs are also witnessing growth due to increased clinical trial activity and partnerships with global biopharma companies .

The Oman Biologics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Biotech LLC, Dhofar Pharmaceuticals LLC, Muscat Pharmaceuticals LLC, Al Jazeera Pharmaceutical Industries LLC, Gulf Pharmaceutical Industries (Julphar), Oman Medical Products Co. LLC, Al Nahda Pharmaceuticals LLC, Oman Biologics Company LLC, Al Batinah Pharmaceuticals LLC, Aster DM Healthcare Oman, Novartis Pharma Services AG Oman, Pfizer Oman LLC, Roche Middle East FZ-LLC Oman, Merck Sharp & Dohme (MSD) Oman, Sanofi S.A. Oman contribute to innovation, geographic expansion, and service delivery in this space.

The Oman biologics market is poised for significant transformation, driven by technological advancements and a growing emphasis on personalized healthcare. As the healthcare infrastructure expands, the integration of artificial intelligence in drug development is expected to streamline processes and enhance efficiency. Furthermore, the increasing focus on sustainable practices will likely shape the future of biologics production, encouraging eco-friendly innovations. These trends indicate a robust future for the biologics sector, with potential for improved patient outcomes and market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoclonal Antibodies Vaccines Cell and Gene Therapies Recombinant Proteins Biosimilars Others |

| By End-User | Hospitals Research Institutions Pharmaceutical Companies Contract Research Organizations (CROs) Specialty Clinics Others |

| By Application | Oncology Infectious Diseases Autoimmune Disorders Cardiovascular Diseases Rare Diseases Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Hospital Pharmacies Retail Pharmacies Others |

| By Region | Muscat Salalah Sohar Nizwa Sur Others |

| By Investment Source | Private Investments Government Funding International Grants Public-Private Partnerships Others |

| By Policy Support | Tax Incentives Research Grants Regulatory Support Fast-track Approval Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Biologics | 50 | Oncologists, Pharmacists, Hospital Administrators |

| Autoimmune Disease Treatments | 40 | Rheumatologists, Immunologists, Patient Advocacy Representatives |

| Diabetes Management Solutions | 45 | Endocrinologists, Diabetes Educators, Healthcare Policy Makers |

| Cardiovascular Biologics | 40 | Cardiologists, Clinical Researchers, Health Economists |

| Regenerative Medicine Applications | 40 | Surgeons, Biotech Researchers, Regulatory Affairs Specialists |

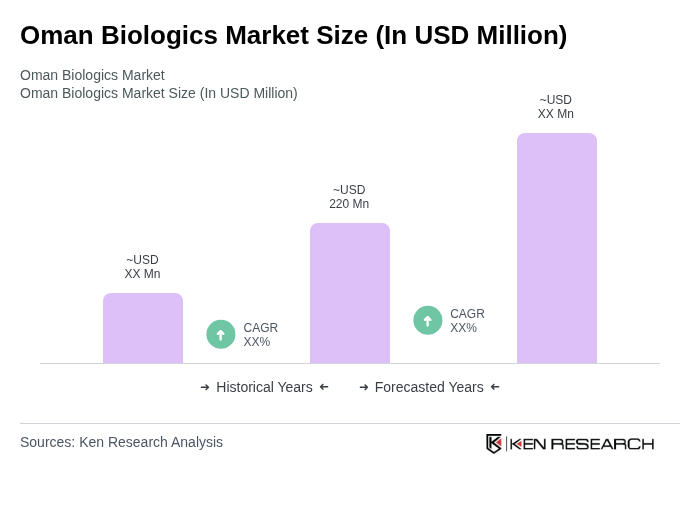

The Oman Biologics Market is valued at approximately USD 220 million, driven by increasing healthcare expenditure, a rise in chronic diseases, and advancements in biopharmaceutical technologies, particularly in oncology and autoimmune disorders.