Region:Africa

Author(s):Rebecca

Product Code:KRAA0342

Pages:87

Published On:August 2025

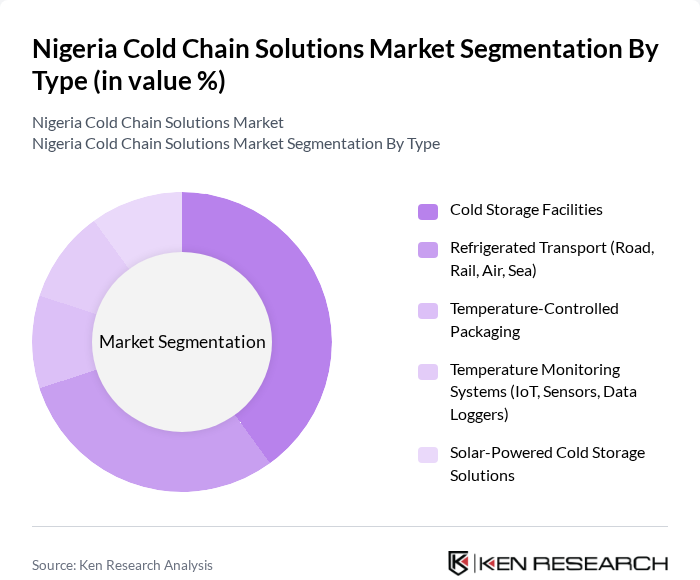

By Type:The cold chain solutions market is segmented into cold storage facilities, refrigerated transport, temperature-controlled packaging, temperature monitoring systems, and solar-powered cold storage solutions. Cold storage facilities are essential for maintaining the quality and shelf life of perishable food and pharmaceutical products. Refrigerated transport, encompassing road, rail, air, and sea, ensures safe delivery of temperature-sensitive goods. Temperature-controlled packaging and monitoring systems (including IoT, sensors, and data loggers) are increasingly adopted to ensure product integrity and real-time tracking. Solar-powered cold storage solutions are gaining traction, particularly in off-grid and rural areas, to address power supply challenges and reduce spoilage .

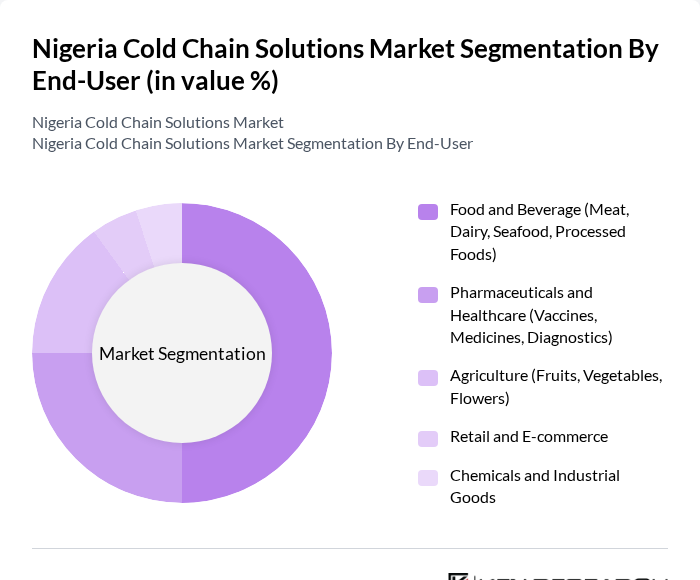

By End-User:The end-user segmentation includes food and beverage, pharmaceuticals and healthcare, agriculture, retail and e-commerce, and chemicals and industrial goods. The food and beverage sector is the largest consumer of cold chain solutions, driven by the need to preserve meat, dairy, seafood, and processed foods. The pharmaceutical and healthcare sector is a significant contributor, especially for the distribution of vaccines, medicines, and diagnostics that require strict temperature control. Agriculture leverages cold chain solutions to minimize post-harvest losses of fruits, vegetables, and flowers. Retail and e-commerce, along with chemicals and industrial goods, are emerging segments as demand for reliable cold logistics grows .

The Nigeria Cold Chain Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as ColdHubs, Koolboks, Ifrige Logistics, ABC Transport, DHL Global Forwarding Nigeria, Maersk Nigeria, Jumia Logistics, Integrated Cold Chain Solutions Ltd, TSL Logistics, Nagode Industries, Red Star Express, GPC Energy & Logistics, Swift Cold Chain Solutions, Chisco Transport, and Sifax Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's cold chain solutions market appears promising, driven by technological advancements and increasing consumer demand for quality perishable goods. The integration of IoT technologies is expected to enhance supply chain visibility and efficiency, while sustainability initiatives will likely shape operational practices. As the government continues to invest in infrastructure, the market is poised for significant growth, with a focus on improving logistics and reducing food waste, ultimately benefiting both consumers and businesses.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Storage Facilities Refrigerated Transport (Road, Rail, Air, Sea) Temperature-Controlled Packaging Temperature Monitoring Systems (IoT, Sensors, Data Loggers) Solar-Powered Cold Storage Solutions |

| By End-User | Food and Beverage (Meat, Dairy, Seafood, Processed Foods) Pharmaceuticals and Healthcare (Vaccines, Medicines, Diagnostics) Agriculture (Fruits, Vegetables, Flowers) Retail and E-commerce Chemicals and Industrial Goods |

| By Region | Lagos & South West Kano & North West Abuja & North Central Eastern Nigeria Other Regions |

| By Technology | Refrigeration Technology (Mechanical, Absorption, Solar) Insulation Technology IoT and Real-Time Monitoring Energy-Efficient Solutions Blockchain for Traceability |

| By Application | Food Preservation Vaccine and Pharmaceutical Distribution Fresh Produce Handling Logistics and Transportation Export/Import of Perishables |

| By Investment Source | Private Investments Government Funding International Aid and Development Agencies Public-Private Partnerships Venture Capital/Impact Investors |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for Cold Storage Facilities Grants for Technology Adoption Regulatory Support for Compliance Import Duty Exemptions for Cold Chain Equipment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Cold Storage Facilities | 100 | Facility Managers, Operations Directors |

| Pharmaceutical Cold Chain Logistics | 60 | Supply Chain Managers, Quality Assurance Officers |

| Food Distribution Networks | 110 | Logistics Coordinators, Distribution Managers |

| Retail Cold Chain Solutions | 80 | Retail Managers, Procurement Specialists |

| Transport Service Providers | 50 | Fleet Managers, Business Development Executives |

The Nigeria Cold Chain Solutions Market is valued at approximately USD 1.2 billion, driven by urbanization, consumer demand for perishable goods, and advancements in refrigeration technology, particularly in the food and pharmaceutical sectors.