Region:Middle East

Author(s):Rebecca

Product Code:KRAA0354

Pages:81

Published On:August 2025

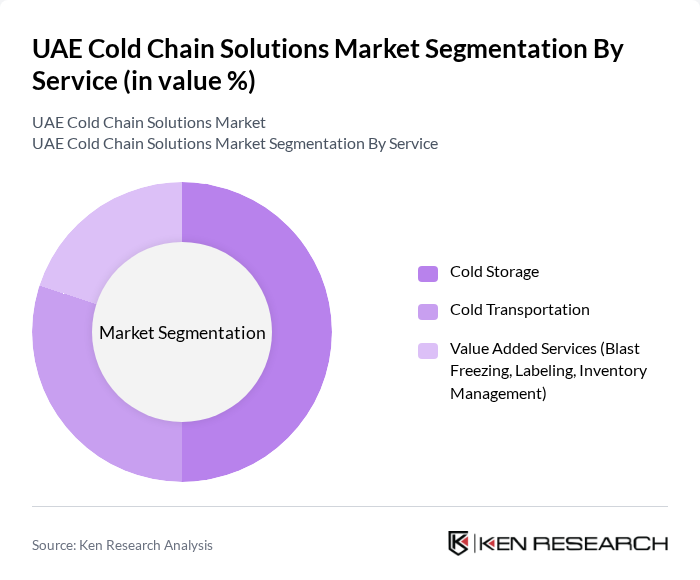

By Service:The service segment includes various offerings such as cold storage, cold transportation, and value-added services like blast freezing, labeling, and inventory management. Cold storage is crucial for maintaining the quality and safety of perishable goods, especially given the UAE’s reliance on imported food and pharmaceuticals. Cold transportation ensures timely and safe delivery, supported by real-time tracking and temperature monitoring technologies. Value-added services, including specialized packaging and inventory management, enhance operational efficiency and customer satisfaction .

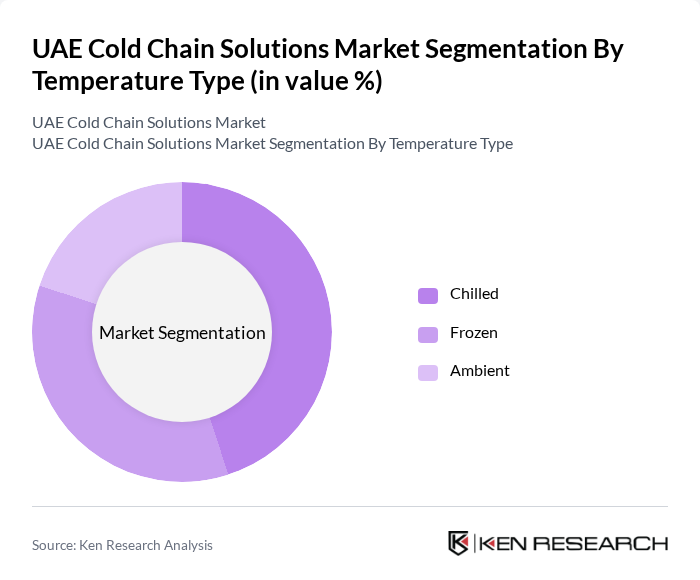

By Temperature Type:This segmentation includes chilled, frozen, and ambient temperature types. Chilled products are essential for maintaining freshness of items such as dairy, fresh produce, and beverages. Frozen products are critical for long-term storage and transport of seafood, meat, and pharmaceuticals. Ambient temperature solutions cater to products that do not require refrigeration but benefit from controlled environments, thus broadening the market's scope and supporting a diverse range of goods .

The UAE Cold Chain Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Logistics, Al-Futtaim Logistics, Agility Logistics, GWC (Gulf Warehousing Company), RSA Cold Chain, Al Watania Logistics, Al Jazeera Cold Storage, Gulf Cold Storage, Al Mufeed Cold Storage, Al Maktoum Cold Storage, Al Ghurair Foods, National Food Products Company, Al Ain Farms, Al Marai, Emirates National Oil Company (ENOC) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE cold chain solutions market is poised for significant transformation driven by technological advancements and evolving consumer preferences. In future, the integration of IoT technologies is expected to enhance monitoring and efficiency in cold chain operations. Additionally, sustainability initiatives will likely shape logistics practices, with a focus on reducing carbon footprints. As the market adapts to these trends, companies that embrace innovation and sustainability will be better positioned to capture emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Service | Cold Storage Cold Transportation Value Added Services (Blast Freezing, Labeling, Inventory Management) |

| By Temperature Type | Chilled Frozen Ambient |

| By End-User Sector | Food and Beverage Pharmaceuticals and Life Sciences Horticulture (Fresh Fruits and Vegetables) Dairy Products Meats, Fish, and Poultry Processed Food Products Chemicals Others |

| By Distribution Channel | Direct Sales Distributors Online Platforms Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Management | 60 | Supply Chain Managers, Quality Assurance Officers |

| Food & Beverage Cold Storage Solutions | 70 | Operations Managers, Logistics Coordinators |

| Temperature-Controlled Transportation | 50 | Fleet Managers, Distribution Supervisors |

| Cold Chain Technology Providers | 40 | Product Development Managers, Technical Sales Representatives |

| Retail Cold Chain Operations | 45 | Store Managers, Supply Chain Analysts |

The UAE Cold Chain Solutions Market is valued at approximately USD 1.4 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the growth of e-commerce and online grocery services.