Region:Europe

Author(s):Shubham

Product Code:KRAA1152

Pages:96

Published On:August 2025

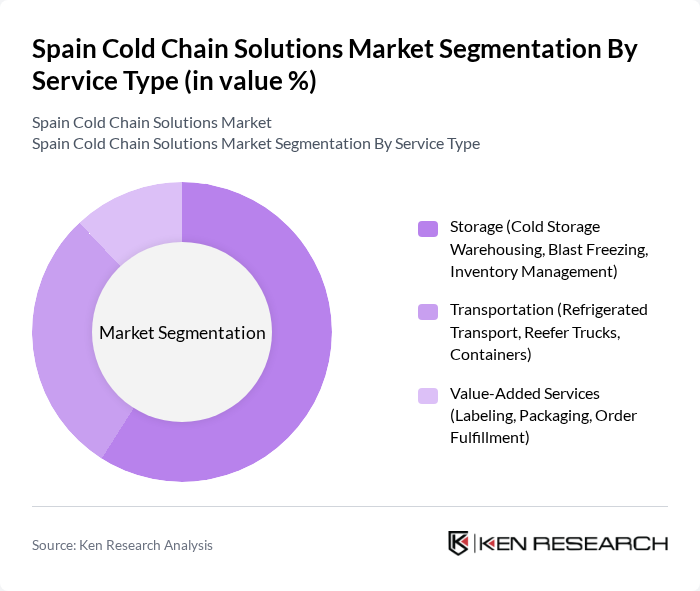

By Service Type:

The service type segmentation includes Storage, Transportation, and Value-Added Services. Among these, Storage is the leading sub-segment, driven by the increasing need for cold storage facilities to accommodate the growing volume of perishable goods. The demand for efficient inventory management and blast freezing services is also on the rise, as businesses seek to minimize spoilage and optimize their supply chains. Transportation services, particularly refrigerated transport, are crucial for maintaining product integrity during distribution, while value-added services like labeling and packaging enhance operational efficiency. Storage accounted for the largest share of the market, reflecting the critical role of warehousing in preserving product quality .

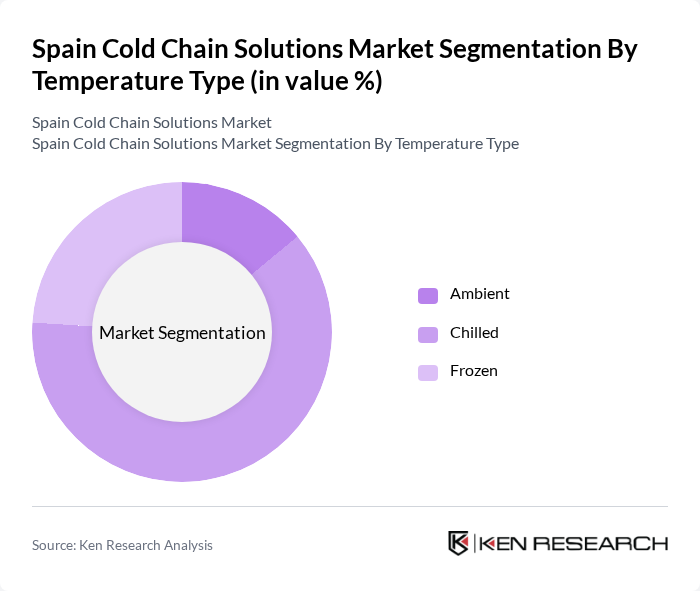

By Temperature Type:

This segmentation includes Ambient, Chilled, and Frozen categories. The Chilled segment dominates the market, driven by the high demand for fresh produce, dairy products, and ready-to-eat meals. The Frozen segment is also significant, particularly for meat and seafood products, as consumers increasingly prefer frozen options for their convenience and longer shelf life. The Ambient segment, while smaller, is essential for products that do not require refrigeration, such as certain packaged foods. Chilled and frozen categories together account for the majority of market demand .

The Spain Cold Chain Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Iberia, STEF Iberia, Logista, Carreras Grupo Logístico, Grupo Sesé, Transportes Caudete, Frigicoll, Lineage Logistics, XPO Logistics Spain, DB Schenker Spain, Kuehne + Nagel Spain, Agility Logistics Spain, CEVA Logistics Spain, Maersk Spain, and STEF Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain solutions market in Spain appears promising, driven by technological advancements and increasing consumer expectations. The integration of IoT and AI technologies is expected to enhance operational efficiency and provide real-time monitoring capabilities. Additionally, the focus on sustainability will likely lead to the adoption of eco-friendly refrigerants and energy-efficient systems, aligning with global environmental goals. As the market evolves, companies that prioritize innovation and compliance will be well-positioned for growth.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Storage (Cold Storage Warehousing, Blast Freezing, Inventory Management) Transportation (Refrigerated Transport, Reefer Trucks, Containers) Value-Added Services (Labeling, Packaging, Order Fulfillment) |

| By Temperature Type | Ambient Chilled Frozen |

| By Application | Horticulture (Fresh Fruits and Vegetables) Dairy Products (Milk, Ice Cream, Butter, etc.) Meat and Fish Processed Food Products Pharmaceuticals, Life Sciences, and Chemicals Other Applications |

| By End-User | Food and Beverage Pharmaceuticals and Healthcare Agriculture Retail Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Region | Northern Spain Central Spain Southern Spain Eastern Spain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Cold Chain | 120 | Supply Chain Managers, Quality Assurance Officers |

| Pharmaceutical Cold Storage | 90 | Logistics Coordinators, Compliance Managers |

| Temperature-Controlled Transport | 60 | Fleet Managers, Operations Directors |

| Retail Cold Chain Solutions | 50 | Retail Operations Managers, Procurement Specialists |

| Cold Chain Technology Providers | 40 | Product Managers, Business Development Executives |

The Spain Cold Chain Solutions Market is valued at approximately USD 4.7 billion, reflecting a significant growth driven by the increasing demand for temperature-sensitive products across various sectors, including food, dairy, meat, seafood, and pharmaceuticals.