Region:Africa

Author(s):Geetanshi

Product Code:KRAA5035

Pages:87

Published On:September 2025

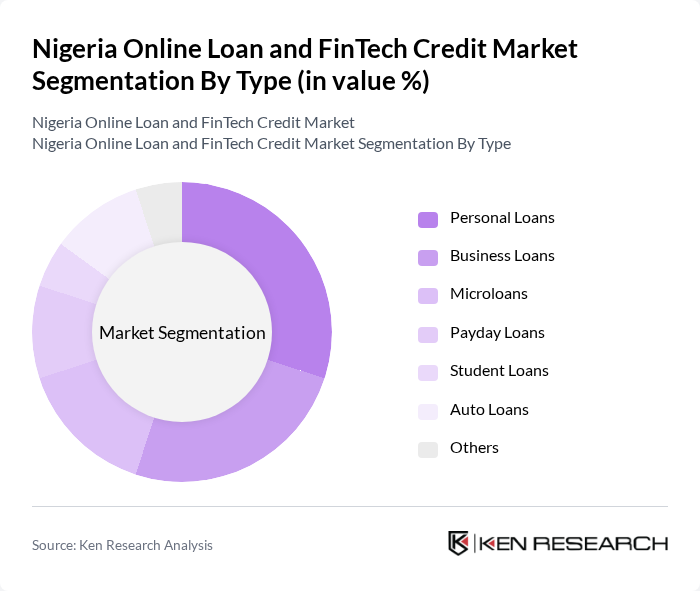

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Microloans, Payday Loans, Student Loans, Auto Loans, and Others. Personal Loans are particularly popular due to their flexibility and ease of access, catering to individuals' immediate financial needs. Business Loans are essential for small and medium enterprises (SMEs) seeking capital for growth. Microloans have gained traction among low-income individuals and entrepreneurs, while Payday Loans offer quick cash solutions for urgent expenses. Student Loans support educational financing, Auto Loans facilitate vehicle purchases, and the 'Others' category encompasses various niche lending products.

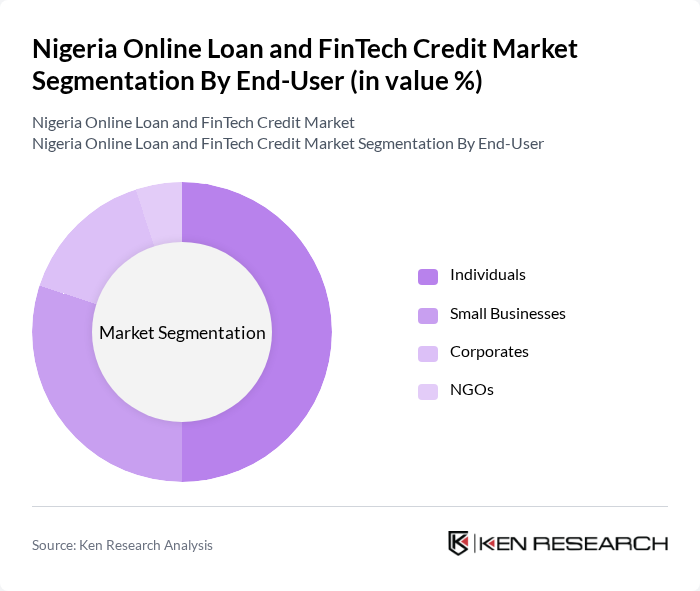

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, and NGOs. Individuals represent a significant portion of the market, driven by the need for personal financing solutions. Small Businesses are increasingly turning to online loans for operational capital, while Corporates utilize these services for expansion and project financing. NGOs also leverage these financial products for funding their initiatives, contributing to the overall growth of the market.

The Nigeria Online Loan and FinTech Credit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Paylater, Carbon, Branch, FairMoney, Renmoney, Kuda Bank, PalmPay, Aella Credit, Lendigo, QuickCheck, Migo, Zedvance, CredPal, Thrive Agric, GetCash contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's online loan and FinTech credit market appears promising, driven by technological advancements and increasing financial literacy among consumers. As more individuals gain access to smartphones and digital payment systems, the market is likely to see a surge in user engagement. Additionally, the integration of artificial intelligence in credit scoring will enhance risk assessment, allowing lenders to offer more personalized loan products. This evolution will foster a more inclusive financial ecosystem, benefiting both consumers and lenders alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Microloans Payday Loans Student Loans Auto Loans Others |

| By End-User | Individuals Small Businesses Corporates NGOs |

| By Loan Amount | Below ?50,000 ?50,000 - ?200,000 ?200,000 - ?1,000,000 Above ?1,000,000 |

| By Loan Duration | Short-term (up to 6 months) Medium-term (6 months to 2 years) Long-term (over 2 years) |

| By Interest Rate Type | Fixed Rate Variable Rate Hybrid Rate |

| By Distribution Channel | Online Platforms Mobile Apps Bank Branches Agents |

| By Customer Segment | First-time Borrowers Repeat Borrowers High-risk Borrowers Low-risk Borrowers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Online Loan Usage | 150 | Individual Borrowers, First-time Loan Users |

| Small Business Loan Applications | 100 | Small Business Owners, Entrepreneurs |

| FinTech Service Providers | 80 | Product Managers, Business Development Executives |

| Regulatory Impact Assessment | 60 | Regulatory Officials, Compliance Officers |

| Consumer Financial Literacy | 90 | Financial Advisors, Educators in Finance |

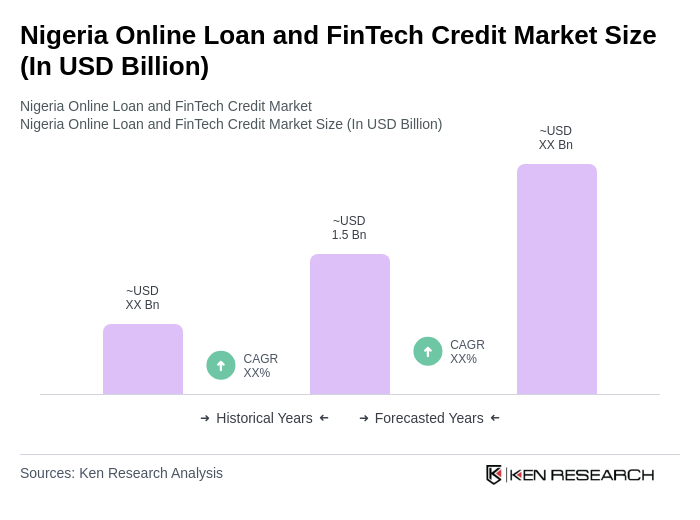

The Nigeria Online Loan and FinTech Credit Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital financial services and the demand for quick and accessible credit solutions.